Tesla Earnings: A Comprehensive Guide To Understanding The Company's Financial Performance

The company, led by CEO Elon Musk, has consistently demonstrated its ability to innovate and disrupt the automotive industry. With Tesla's rapid growth, its earnings releases provide deep insights into its financial health, operational efficiency, and future strategies. Whether you're an investor looking to make informed decisions or simply curious about Tesla's performance, understanding the intricacies of Tesla's financial results is essential. This article dives into the key aspects of Tesla earnings, answering critical questions and offering valuable insights.

Tesla's quarterly earnings reports are more than just numbers—they tell a story about the company's progress in achieving its ambitious goals. From revenue growth to profitability metrics, each report sheds light on Tesla's ability to scale production, expand its global footprint, and lead the transition to sustainable energy. These reports often include updates on vehicle deliveries, new product launches, and advancements in battery technology. Investors and industry watchers eagerly analyze Tesla's earnings to gauge the company's long-term potential and assess its competitive position in the electric vehicle market.

As Tesla continues to redefine the automotive landscape, its earnings reports have taken on even greater significance. They serve as a barometer for the broader EV industry, influencing stock prices, market sentiment, and consumer confidence. Understanding Tesla earnings requires a deep dive into the company's financial statements, management commentary, and industry trends. In this article, we'll explore everything you need to know about Tesla's earnings, including what drives their performance, how to interpret the data, and what to expect in the future.

Read also:When Did Rob Gronkowski Get Married Everything You Need To Know

Table of Contents

- What Are Tesla Earnings?

- Why Are Tesla Earnings Important?

- How Does Tesla Report Its Earnings?

- What Drives Tesla Earnings?

- Can Tesla Maintain Its Earnings Growth?

- How Do Tesla Earnings Impact Investors?

- What Are the Key Metrics in Tesla Earnings?

- How Does Tesla Compare to Competitors?

- What Can We Expect from Future Tesla Earnings?

- Frequently Asked Questions About Tesla Earnings

What Are Tesla Earnings?

Tesla earnings refer to the company's financial performance over a specific period, typically reported on a quarterly or annual basis. These reports include key metrics such as revenue, net income, earnings per share (EPS), and cash flow. Tesla's earnings are closely monitored because they provide a snapshot of the company's operational and financial health. Investors use these reports to assess Tesla's profitability, growth potential, and ability to execute its long-term strategy.

The earnings reports also include insights from Tesla's management team, who discuss the company's achievements, challenges, and future plans. This commentary is often delivered during earnings calls, where executives address questions from analysts and investors. These calls are a valuable resource for understanding Tesla's strategic priorities and the factors influencing its financial performance.

Why Are Tesla Earnings Important?

Tesla earnings are not just important for investors—they also have broader implications for the electric vehicle industry and the global transition to sustainable energy. Tesla's financial results provide insights into consumer demand for EVs, the company's production capabilities, and its ability to innovate. Strong Tesla earnings often boost investor confidence and drive the stock price higher, while disappointing results can lead to market volatility.

Additionally, Tesla's earnings reports serve as a benchmark for other companies in the EV space. As a market leader, Tesla's performance influences investor sentiment toward the entire industry. Analysts and industry experts closely scrutinize Tesla earnings to identify trends, opportunities, and potential risks in the EV market.

How Does Tesla Report Its Earnings?

Tesla follows a structured process for reporting its earnings, which includes filing financial statements with the Securities and Exchange Commission (SEC) and hosting earnings calls. The company releases its earnings reports after the market closes, providing detailed insights into its financial performance. These reports include an income statement, balance sheet, and cash flow statement, along with management's discussion and analysis.

During the earnings call, Tesla's executives discuss the company's performance, highlighting key achievements and addressing challenges. Analysts and investors have the opportunity to ask questions, gaining further clarity on Tesla's strategies and future outlook. This transparency helps build trust and credibility with stakeholders.

Read also:Retro Bowl Unblocked The Ultimate Guide To Playing The Classic Game Anytime Anywhere

What Drives Tesla Earnings?

Several factors contribute to Tesla's earnings, including vehicle sales, production efficiency, and cost management. The company's ability to scale production and meet delivery targets is a critical driver of its financial performance. Tesla's earnings are also influenced by its energy business, which includes solar panels and energy storage solutions.

Additionally, Tesla benefits from regulatory credits, which are sold to other automakers to help them meet emissions standards. These credits provide a significant revenue stream and contribute to Tesla's profitability. However, the company's long-term success depends on its ability to grow its core business and reduce reliance on regulatory credits.

Can Tesla Maintain Its Earnings Growth?

One of the most frequently asked questions about Tesla is whether the company can sustain its impressive earnings growth. Tesla has consistently delivered strong financial results, driven by increasing vehicle deliveries and operational improvements. However, maintaining this growth will require overcoming challenges such as supply chain disruptions, rising competition, and macroeconomic uncertainties.

Tesla's management has outlined several strategies to support continued growth, including expanding production capacity, launching new models, and investing in battery technology. These initiatives are designed to enhance Tesla's competitive advantage and ensure long-term profitability.

How Do Tesla Earnings Impact Investors?

Tesla earnings have a significant impact on investors, as they influence the company's stock price and market valuation. Strong earnings reports often lead to increased investor confidence and higher stock prices, while weak results can result in sell-offs and volatility. Investors closely analyze Tesla's earnings to assess its growth potential and make informed investment decisions.

In addition to financial metrics, investors also consider qualitative factors such as Tesla's strategic initiatives, competitive positioning, and market trends. Understanding the broader context of Tesla earnings is essential for evaluating the company's long-term prospects.

What Are the Key Metrics in Tesla Earnings?

When analyzing Tesla earnings, several key metrics stand out. These include revenue growth, gross margins, operating income, and free cash flow. Revenue growth reflects the company's ability to increase sales and expand its market share. Gross margins provide insights into Tesla's pricing power and cost efficiency, while operating income highlights its profitability.

Free cash flow is another critical metric, as it indicates Tesla's ability to generate cash from its operations and fund future growth. Investors also pay attention to vehicle delivery numbers, which are a leading indicator of Tesla's financial performance.

How Does Tesla Compare to Competitors?

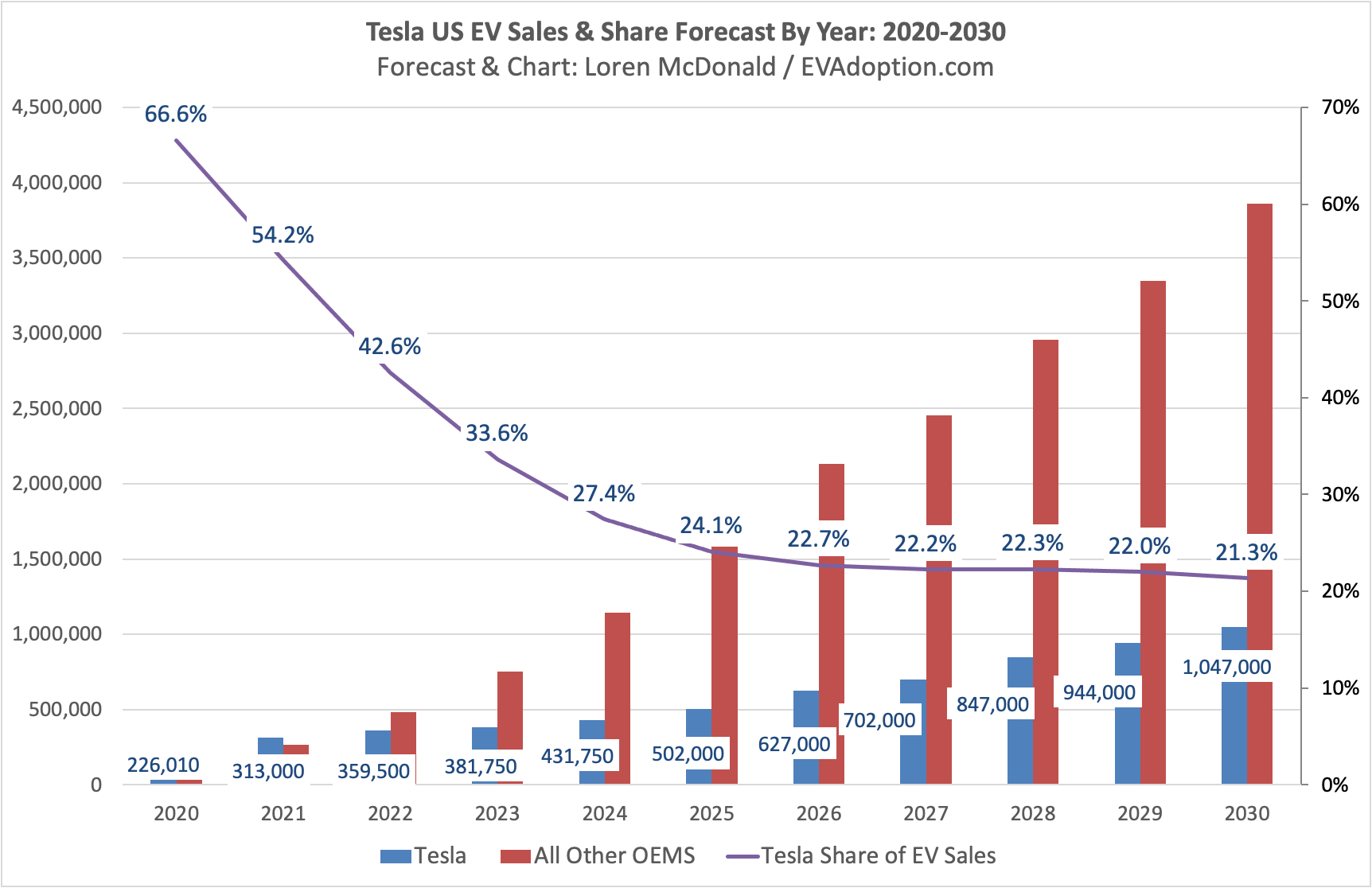

Tesla's earnings performance is often compared to that of its competitors in the EV space. Companies like Rivian, Lucid Motors, and traditional automakers such as Ford and General Motors are vying for market share in the rapidly growing EV industry. Tesla's ability to deliver consistent earnings growth sets it apart from many of its peers, who are still working to achieve profitability.

However, Tesla faces increasing competition as more automakers enter the EV market. To maintain its leadership position, Tesla must continue to innovate, improve efficiency, and expand its product lineup. Understanding how Tesla stacks up against its competitors is essential for assessing its long-term prospects.

What Can We Expect from Future Tesla Earnings?

Looking ahead, Tesla's future earnings will depend on its ability to execute its growth strategy and navigate challenges. The company is investing heavily in new factories, battery technology, and product development, which could drive future earnings growth. Tesla's focus on cost reduction and operational efficiency is also expected to enhance profitability.

However, external factors such as economic conditions, regulatory changes, and supply chain disruptions could impact Tesla's financial performance. Investors will need to monitor these factors closely to assess the company's earnings potential.

Frequently Asked Questions About Tesla Earnings

What Are the Biggest Risks to Tesla Earnings?

Several risks could impact Tesla earnings, including supply chain disruptions, rising raw material costs, and increased competition. Additionally, macroeconomic factors such as inflation and interest rates could affect consumer demand for EVs.

How Often Does Tesla Report Earnings?

Tesla reports earnings on a quarterly basis, typically after the market closes. The company also releases an annual report at the end of each fiscal year.

Where Can I Find Tesla Earnings Reports?

Tesla earnings reports are available on the company's investor relations website. They are also filed with the SEC and can be accessed through the EDGAR database.

What Role Do Regulatory Credits Play in Tesla Earnings?

Regulatory credits are an important revenue stream for Tesla, contributing to its profitability. However, the company is working to reduce its reliance on these credits by growing its core business.

Tesla earnings are a critical indicator of the company's financial health and growth potential. By understanding the factors driving Tesla's performance and analyzing its earnings reports, investors can make informed decisions and gain valuable insights into the EV industry.

Exploring The Significance Of Black History Month 2025: A Celebration Of Legacy And Progress

Discover The Vibrant World Of Grupo Frontera: A Musical Journey Like No Other

Mellody Hobson: A Trailblazer In Finance And Leadership

Tesla Earnings What to Expect

Tesla 2024 Earnings Lorri Renate