Federal Reserve Interest Rates: What You Need To Know

The Federal Reserve interest rates play a pivotal role in shaping the U.S. economy and influencing global financial markets. These rates determine the cost of borrowing for banks, businesses, and consumers, making them a key factor in economic growth or contraction. When the Federal Reserve adjusts interest rates, it sends ripples through the economy, affecting everything from mortgage rates to savings accounts. Understanding how these rates work and their impact on your financial decisions is essential for anyone looking to navigate the complexities of the modern economy.

For decades, the Federal Reserve has used interest rates as a tool to maintain economic stability. By raising or lowering rates, the central bank aims to control inflation, encourage employment, and stabilize the currency. While the Federal Reserve's decisions are often technical, their effects are deeply personal, influencing everything from the cost of a new home to the returns on your retirement savings. Whether you're an investor, a homeowner, or simply someone trying to manage your finances, staying informed about federal reserve interest rates can help you make smarter financial choices.

With so much at stake, it's no surprise that the Federal Reserve's interest rate announcements are closely watched by economists, policymakers, and everyday citizens alike. From stock market fluctuations to shifts in consumer spending, the ripple effects of these decisions can be felt across the globe. This article will delve into the intricacies of federal reserve interest rates, exploring how they work, why they matter, and what they mean for your financial future. Let’s dive in and uncover everything you need to know about this critical economic tool.

Read also:Dara Tomlin Bill Hemmer Wife A Comprehensive Guide To Her Life Career And Influence

- What Are Federal Reserve Interest Rates?

- How Do Federal Reserve Interest Rates Affect the Economy?

- Why Does the Federal Reserve Change Interest Rates?

- What Happens When Federal Reserve Interest Rates Rise?

- What Happens When Federal Reserve Interest Rates Fall?

- How Can You Prepare for Interest Rate Changes?

- Is the Federal Reserve Independent?

- How Often Does the Federal Reserve Adjust Interest Rates?

- What Are the Current Federal Reserve Interest Rates?

- Federal Reserve Interest Rates and Your Financial Future

What Are Federal Reserve Interest Rates?

Federal Reserve interest rates refer to the benchmark rates set by the Federal Open Market Committee (FOMC), a branch of the Federal Reserve System. These rates serve as a guide for banks when lending to one another overnight. Known as the federal funds rate, this benchmark influences a wide range of other interest rates, including those for mortgages, credit cards, and auto loans. The Federal Reserve adjusts these rates to achieve its dual mandate of promoting maximum employment and maintaining stable prices.

When the Federal Reserve raises interest rates, borrowing becomes more expensive, which can slow down economic activity. Conversely, lowering interest rates makes borrowing cheaper, encouraging spending and investment. This delicate balancing act is crucial for managing inflation and ensuring sustainable economic growth. The Federal Reserve interest rates are a key tool in the central bank's arsenal for maintaining economic stability.

How Do Federal Reserve Interest Rates Affect the Economy?

The impact of federal reserve interest rates on the economy is both direct and far-reaching. When the Federal Reserve raises rates, businesses and consumers face higher borrowing costs. This can lead to reduced spending and investment, which may slow down economic growth. On the other hand, lower interest rates stimulate borrowing and spending, which can boost economic activity.

For example, higher federal reserve interest rates often result in increased mortgage rates, making home purchases more expensive. This can cool down a hot housing market but may also discourage first-time buyers. Similarly, higher rates can lead to lower returns on savings accounts, affecting individuals who rely on interest income. Understanding these dynamics is crucial for anyone looking to make informed financial decisions.

Why Does the Federal Reserve Change Interest Rates?

One of the most common questions about federal reserve interest rates is why the central bank changes them. The Federal Reserve adjusts interest rates to achieve its dual mandate: promoting maximum employment and maintaining price stability. When inflation is too high, the Federal Reserve may raise interest rates to cool down the economy. Conversely, during periods of economic slowdown, the Federal Reserve may lower rates to encourage spending and investment.

These decisions are based on a wide range of economic indicators, including inflation rates, unemployment levels, and GDP growth. By carefully analyzing these factors, the Federal Reserve aims to strike a balance between fostering economic growth and preventing runaway inflation. This delicate balancing act is why federal reserve interest rates are so closely watched by economists and investors alike.

Read also:Miaz And Girth Master A Comprehensive Guide To Enhancing Your Knowledge And Skills

What Happens When Federal Reserve Interest Rates Rise?

When federal reserve interest rates rise, the effects can be felt across the economy. Higher rates make borrowing more expensive, which can lead to reduced consumer spending and business investment. This can slow down economic growth but may also help control inflation. For savers, higher rates can mean better returns on savings accounts and certificates of deposit.

However, rising federal reserve interest rates can also have downsides. For example, higher mortgage rates can make homeownership less affordable, potentially cooling down the housing market. Additionally, businesses may delay expansion plans due to increased borrowing costs, which can lead to slower job creation. Understanding these dynamics is crucial for navigating the financial landscape during periods of rising rates.

What Happens When Federal Reserve Interest Rates Fall?

When federal reserve interest rates fall, borrowing becomes cheaper, encouraging spending and investment. This can stimulate economic growth, as businesses expand and consumers make larger purchases. Lower rates can also lead to increased demand in the housing market, as mortgage rates decline.

However, falling federal reserve interest rates can also have drawbacks. For savers, lower rates mean reduced returns on savings accounts and fixed-income investments. Additionally, prolonged periods of low rates can lead to asset bubbles, as investors seek higher returns in riskier markets. While lower rates can boost economic activity, they must be managed carefully to avoid unintended consequences.

How Can You Prepare for Interest Rate Changes?

Preparing for changes in federal reserve interest rates requires a proactive approach to financial planning. If you anticipate rising rates, consider locking in fixed-rate loans, such as mortgages or auto loans, to avoid higher costs in the future. For savers, rising rates can present opportunities to earn better returns on savings accounts and certificates of deposit.

On the other hand, if you expect federal reserve interest rates to fall, it may be a good time to refinance existing loans or take advantage of lower mortgage rates. Additionally, falling rates can create opportunities for investors to explore higher-yielding assets, such as dividend-paying stocks or real estate investment trusts (REITs). By staying informed and planning ahead, you can make the most of changing interest rate environments.

Is the Federal Reserve Independent?

One common question is whether the Federal Reserve is truly independent. The Federal Reserve operates independently of the federal government, allowing it to make decisions based on economic data rather than political pressures. This independence is crucial for maintaining credibility and ensuring that federal reserve interest rates are set in the best interest of the economy.

While the Federal Reserve is independent, it is still accountable to Congress and the public. The central bank must regularly report on its activities and decisions, providing transparency and fostering trust. This balance of independence and accountability is a cornerstone of the Federal Reserve's ability to manage federal reserve interest rates effectively.

How Often Does the Federal Reserve Adjust Interest Rates?

The Federal Reserve typically adjusts interest rates during its eight annual meetings of the Federal Open Market Committee (FOMC). However, the central bank can make adjustments more frequently if economic conditions warrant. These decisions are based on a careful analysis of economic indicators, including inflation, employment, and GDP growth.

While the Federal Reserve aims to maintain stability, it must remain flexible to respond to changing economic conditions. This is why federal reserve interest rates can fluctuate over time, reflecting the central bank's efforts to balance growth and inflation. Understanding the timing and rationale behind these adjustments can help you anticipate their impact on the economy and your finances.

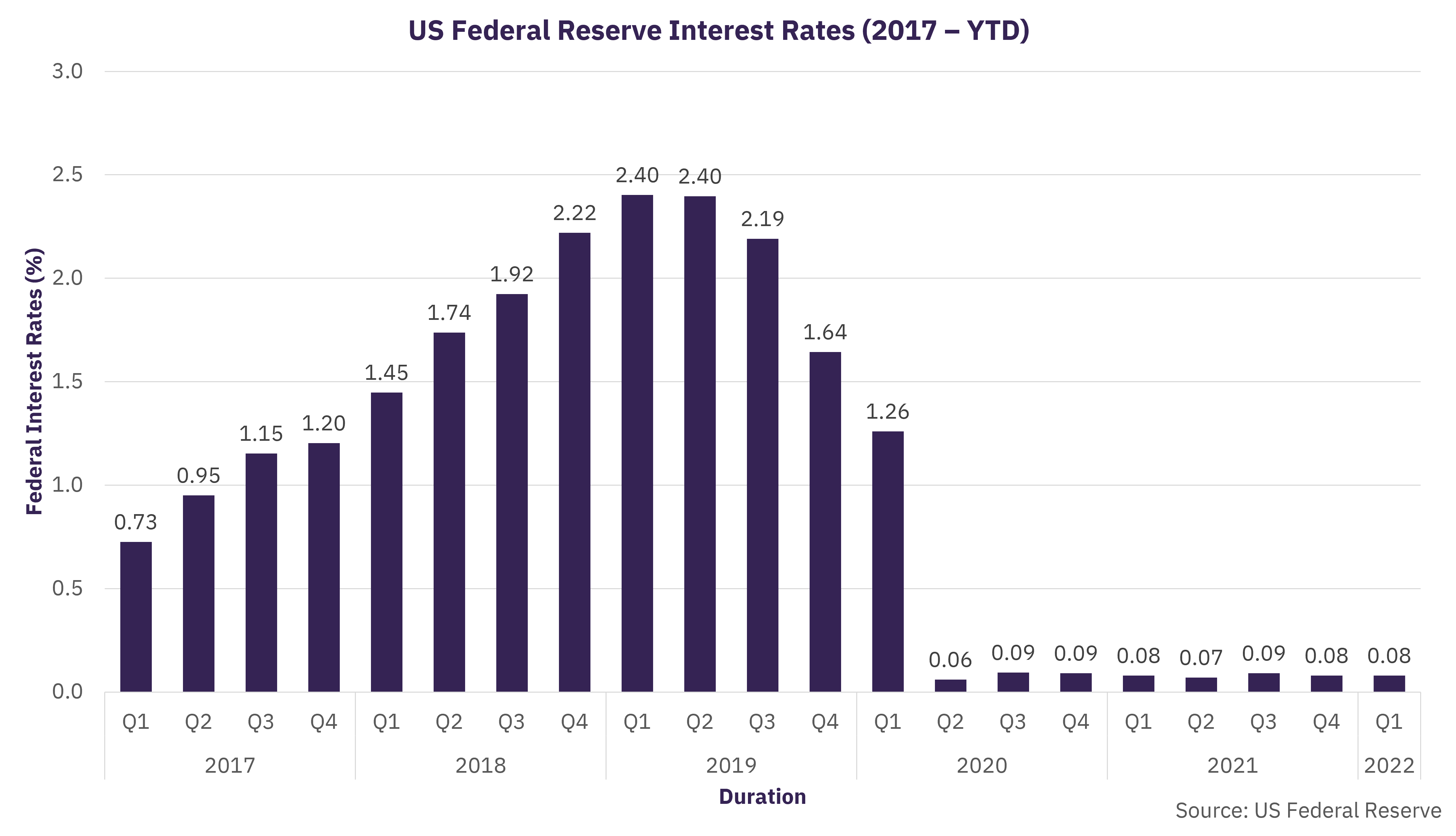

What Are the Current Federal Reserve Interest Rates?

To stay informed about federal reserve interest rates, it's important to monitor announcements from the Federal Open Market Committee (FOMC). The FOMC releases statements after each meeting, providing insights into its decisions and future outlook. These announcements are closely watched by economists, investors, and policymakers, as they provide valuable guidance on the direction of federal reserve interest rates.

For the most accurate and up-to-date information, you can visit the Federal Reserve's official website or consult financial news outlets. By staying informed about current rates and future expectations, you can make more informed decisions about your financial strategy.

Federal Reserve Interest Rates and Your Financial Future

Understanding federal reserve interest rates is essential for anyone looking to navigate the complexities of the modern economy. From influencing borrowing costs to shaping investment opportunities, these rates play a critical role in your financial future. By staying informed and planning ahead, you can make smarter decisions and achieve your financial goals.

Whether you're managing debt, saving for retirement, or investing in the stock market, federal reserve interest rates are a key factor to consider. By understanding how these rates work and their impact on the economy, you can position yourself for success in an ever-changing financial landscape. Remember, knowledge is power, and staying informed about federal reserve interest rates is one of the best ways to take control of your financial future.

Explore The Thrilling World Of Forza Horizon 5: Your Ultimate Guide

Steven Adams: The Unstoppable Force In Basketball

Discover The Legendary Journey Of Gene Hackman: A Hollywood Icon

Federal Reserve Interest Rates 2022 Get Halloween 2022 News Update

Federal Reserve Interest Rates 2022 Get Halloween 2022 News Update