Expert Sheffield Financial Advice | Plan Your Future Today

Sheffield financial advice refers to the professional guidance and services provided by financial advisors in Sheffield, UK. These advisors assist individuals and businesses in making informed financial decisions, managing their finances effectively, and achieving their financial goals.

Financial advice encompasses a wide range of services, including investment planning, retirement planning, tax planning, budgeting, and debt management. Qualified financial advisors in Sheffield possess specialized knowledge and expertise in these areas, enabling them to provide tailored advice that aligns with clients' unique financial situations and objectives.

The importance of seeking financial advice cannot be overstated, especially in today's complex and ever-changing financial landscape. A reputable financial advisor can help individuals and businesses navigate the intricacies of financial markets, make informed investment decisions, and develop comprehensive financial plans that optimize their financial well-being.

Read also:Unveiling The Nigerian Roots Is Tyler The Creator Nigerian

Sheffield Financial Advice

Sheffield financial advice encompasses various essential aspects that contribute to its importance and effectiveness. These key aspects include:

- Expertise: Financial advisors in Sheffield possess specialized knowledge and training in finance and financial planning.

- Tailored advice: They provide personalized guidance based on clients' unique financial situations and goals.

- Investment planning: Advisors assist in developing investment strategies to meet clients' risk tolerance and return expectations.

- Retirement planning: They help plan for a secure financial future during retirement.

- Tax planning: Advisors optimize tax strategies to minimize tax liabilities and maximize savings.

- Budgeting: They provide guidance on creating and managing budgets to achieve financial stability.

- Debt management: Advisors assist in developing strategies to reduce debt and improve financial well-being.

- Objectivity: Financial advisors offer unbiased advice, free from emotional or personal biases that may influence financial decisions.

These aspects collectively highlight the importance of seeking Sheffield financial advice. By leveraging the expertise and objectivity of financial advisors, individuals and businesses can make informed financial decisions, optimize their financial strategies, and achieve their long-term financial goals.

1. Expertise

The expertise of financial advisors in Sheffield is a cornerstone of the value they provide through their financial advice. Their specialized knowledge and training in finance and financial planning enable them to offer informed guidance and tailored solutions to clients.

Financial advisors in Sheffield undergo rigorous training and education to stay abreast of the latest financial trends, regulations, and investment strategies. They hold recognized certifications and qualifications, demonstrating their commitment to professional development and ethical conduct.

This expertise is crucial in navigating the complexities of financial markets and making sound financial decisions. Advisors can analyze clients' financial situations, assess their risk tolerance, and develop personalized financial plans that align with their unique goals and objectives.

Examples of how financial advisors leverage their expertise include:

Read also:The Ultimate Guide To Quicken Loans Home Loans Your Path To Homeownership

- Providing comprehensive investment advice, considering factors such as market trends, risk tolerance, and investment horizons.

- Developing retirement plans that optimize savings, minimize taxes, and ensure a secure financial future.

- Offering tax planning strategies to reduce tax liabilities and maximize wealth accumulation.

- Creating personalized budgets that align with clients' financial goals and spending habits.

- Guiding clients through complex financial decisions, such as buying a home or starting a business.

The expertise of financial advisors in Sheffield is essential for individuals and businesses seeking to make informed financial decisions and achieve their long-term financial objectives.

2. Tailored advice

The provision of tailored advice is a defining characteristic of sheffield financial advice. Financial advisors in Sheffield recognize that each client has unique financial circumstances, goals, and risk tolerance. They take the time to understand these individual factors and tailor their advice accordingly.

This personalized approach is crucial for effective financial planning. A one-size-fits-all strategy is unlikely to meet the specific needs of most clients. By considering each client's unique situation, financial advisors can develop customized recommendations that align with their financial objectives and aspirations.

For example, a financial advisor might recommend a different investment portfolio for a young professional with a high-risk tolerance than for a retiree seeking income and capital preservation. Similarly, retirement planning advice will vary depending on factors such as the client's age, income, savings, and desired retirement lifestyle.

The practical significance of this tailored approach is immense. It enables individuals and businesses to make informed financial decisions that are aligned with their unique circumstances and goals. This can lead to better investment outcomes, more effective retirement planning, and improved overall financial well-being.

3. Investment planning

Investment planning is a crucial component of sheffield financial advice. It involves developing and implementing investment strategies that align with clients' unique risk tolerance and return expectations. This is a critical aspect of financial planning, as it helps individuals and businesses achieve their long-term financial goals while managing potential risks.

Financial advisors in Sheffield play a vital role in providing tailored investment advice. They assess clients' financial situations, risk tolerance, and investment objectives to develop personalized investment portfolios. This process involves:

- Analyzing clients' financial goals and risk tolerance.

- Conducting thorough research on investment markets and asset classes.

- Creating diversified investment portfolios that align with clients' objectives.

- Monitoring and adjusting investment strategies over time.

The significance of effective investment planning cannot be overstated. It enables individuals and businesses to:

- Achieve their long-term financial goals, such as retirement, education funding, or wealth accumulation.

- Manage risk and protect their investments from market volatility.

- Maximize returns on their investments while aligning with their risk tolerance.

In conclusion, investment planning is an essential aspect of sheffield financial advice. By developing and implementing tailored investment strategies, financial advisors in Sheffield help their clients achieve their financial goals and secure their financial well-being.

4. Retirement planning

Retirement planning is an essential component of sheffield financial advice. It involves developing and implementing strategies to ensure a secure financial future during retirement. Financial advisors in Sheffield help clients navigate the complexities of retirement planning and make informed decisions to achieve their retirement goals.

- Investment planning: Retirement planning involves making investment decisions that align with clients' risk tolerance and return expectations. Financial advisors in Sheffield assess clients' financial situations and develop personalized investment portfolios designed to generate income and growth during retirement.

- Income planning: Financial advisors help clients plan for retirement income sources, including pensions, investments, and Social Security benefits. They analyze clients' income needs and develop strategies to ensure a sustainable income stream during retirement.

- Tax planning: Retirement planning also involves tax planning to minimize tax liabilities and maximize wealth accumulation. Financial advisors in Sheffield help clients understand the tax implications of different retirement savings and investment options.

- Estate planning: Retirement planning often includes estate planning to ensure that clients' assets are distributed according to their wishes and to minimize estate taxes. Financial advisors in Sheffield work with clients to develop estate plans that align with their goals and objectives.

Effective retirement planning is crucial for individuals to achieve a secure and comfortable financial future during retirement. Financial advisors in Sheffield provide the expertise and guidance necessary to navigate the complexities of retirement planning and make informed decisions that align with clients' unique circumstances and goals.

5. Tax planning

Tax planning is an integral component of sheffield financial advice. It involves utilizing strategies to reduce tax liabilities and maximize savings, ensuring that clients retain a larger portion of their hard-earned income.

Financial advisors in Sheffield play a crucial role in optimizing tax strategies for their clients. They possess in-depth knowledge of tax laws and regulations, enabling them to identify opportunities for tax savings and develop tailored strategies that align with clients' financial situations.

The practical significance of effective tax planning cannot be overstated. By reducing tax liabilities, individuals and businesses can:

- Increase their disposable income and savings

- Preserve and grow their wealth over the long term

- Avoid costly tax penalties and interest charges

For example, a financial advisor might recommend that a client utilize tax-advantaged retirement accounts, such as 401(k)s and IRAs, to reduce their current tax liability while saving for the future. Additionally, they might advise clients on strategies to minimize capital gains taxes when selling investments or to optimize deductions and credits to lower their overall tax burden.

In conclusion, tax planning is a vital aspect of sheffield financial advice. By leveraging their expertise in tax laws and regulations, financial advisors in Sheffield help clients minimize tax liabilities and maximize savings, contributing to their overall financial well-being and long-term financial success.

6. Budgeting

Budgeting is a fundamental aspect of financial management, and it plays a vital role in sheffield financial advice. By creating and adhering to a budget, individuals and businesses can gain control over their finances, prioritize their spending, and achieve their financial goals.

- Creating a Realistic Budget: Financial advisors in Sheffield assist clients in developing realistic and sustainable budgets that align with their income and expenses. This involves analyzing clients' cash flow, identifying areas for potential savings, and setting realistic spending limits.

- Tracking Expenses: Effective budgeting requires diligent expense tracking. Financial advisors guide clients in implementing systems for recording and categorizing expenses, providing valuable insights into their spending habits and identifying opportunities for optimization.

- Managing Debt: For clients with existing debt obligations, financial advisors incorporate debt management strategies into their budgets. This may involve consolidating debts, negotiating lower interest rates, or creating a plan to pay down debt faster.

- Planning for the Future: A well-crafted budget considers not only current expenses but also future financial goals, such as saving for retirement or a down payment on a house. Financial advisors help clients allocate funds towards these long-term objectives.

In conclusion, budgeting is an essential component of sheffield financial advice. By providing guidance on creating and managing budgets, financial advisors in Sheffield empower their clients to take control of their finances, achieve financial stability, and work towards their long-term financial aspirations.

7. Debt management

Debt management is a crucial aspect of sheffield financial advice, as it empowers individuals and businesses to overcome the burden of excessive debt and regain control of their financial lives.

- Debt Consolidation:

Financial advisors in Sheffield may recommend debt consolidation strategies to combine multiple high-interest debts into a single, lower-interest loan. This can simplify debt repayment, reduce monthly payments, and save money on interest charges.

- Negotiating Lower Interest Rates:

Advisors can assist clients in negotiating lower interest rates on existing debts. By leveraging their industry knowledge and relationships with lenders, they may be able to secure more favorable terms, resulting in significant savings over the life of the loan.

- Creating Debt Repayment Plans:

Financial advisors develop personalized debt repayment plans that align with clients' financial situations and goals. These plans prioritize high-interest debts and establish realistic timelines for debt elimination.

- Managing Debt-to-Income Ratio:

Advisors monitor clients' debt-to-income ratio, which measures the percentage of monthly income dedicated to debt repayment. By optimizing this ratio, clients can improve their creditworthiness and qualify for better loan terms in the future.

Effective debt management can lead to numerous benefits for clients, including reduced financial stress, improved credit scores, increased savings, and greater financial freedom. By providing comprehensive debt management guidance, financial advisors in Sheffield contribute significantly to the overall financial well-being of their clients.

8. Objectivity

Objectivity is a cornerstone of sheffield financial advice, distinguishing it from generic financial advice. Financial advisors in Sheffield prioritize clients' best interests, offering impartial guidance that steers clear of personal biases or emotional influences.

- Unbiased Financial Recommendations: Sheffield financial advisors provide objective recommendations tailored to clients' unique circumstances and goals. They avoid promoting specific products or services that may benefit the advisor financially, ensuring that clients receive advice that aligns solely with their interests.

- Evidence-Based Decision-Making: Advisors rely on data, research, and market analysis to inform their recommendations. They avoid making impulsive or emotionally driven decisions, ensuring that clients' financial plans are grounded in sound judgment and empirical evidence.

- Fiduciary Duty: Financial advisors in Sheffield are bound by a fiduciary duty to act in the best interests of their clients. This legal obligation reinforces their commitment to objectivity and ethical conduct.

- Regulatory Oversight: The financial industry in the United Kingdom is subject to strict regulations, which further promote objectivity and protect clients from biased advice. Financial advisors must adhere to these regulations to maintain their licenses and avoid potential legal repercussions.

Objectivity is paramount in financial advice, as it ensures that clients receive impartial guidance that prioritizes their financial well-being. The combination of unbiased recommendations, evidence-based decision-making, and regulatory oversight sets sheffield financial advice apart, empowering clients to make informed financial choices with confidence.

Frequently Asked Questions about Sheffield Financial Advice

This section addresses common questions and misconceptions surrounding Sheffield financial advice, providing concise and informative answers to guide individuals and businesses seeking financial guidance.

Question 1: What sets Sheffield financial advice apart from general financial advice?

Sheffield financial advice stands out due to its focus on objectivity, personalized guidance, and expertise. Advisors prioritize clients' best interests, offering unbiased recommendations based on in-depth knowledge and market analysis.

Question 2: How can I identify a reputable financial advisor in Sheffield?

Look for advisors who are certified by recognized bodies, have a proven track record, and adhere to ethical guidelines. Seek recommendations from trusted sources, read online reviews, and conduct thorough research before selecting an advisor.

Question 3: What are the benefits of seeking financial advice in Sheffield?

Professional financial advice can help individuals and businesses achieve their financial goals, navigate complex financial markets, optimize investment strategies, plan for retirement, manage debt effectively, and make informed financial decisions.

Question 4: How much does financial advice in Sheffield typically cost?

The cost of financial advice varies depending on the complexity of the services required and the advisor's fee structure. Some advisors charge a flat fee, while others may charge a percentage of assets under management or an hourly rate.

Question 5: Is it necessary to have a high income or significant assets to benefit from financial advice?

Financial advice is valuable for individuals and businesses at all income levels and stages of life. Advisors can assist with budgeting, saving, debt management, and long-term financial planning.

Question 6: How often should I review my financial plan with my advisor?

It is recommended to review your financial plan with your advisor regularly, typically once a year or as life circumstances change. This ensures that your plan remains aligned with your evolving goals and financial situation.

In conclusion, Sheffield financial advice offers a range of benefits and can be tailored to meet the needs of individuals and businesses seeking professional guidance. By seeking advice from reputable and experienced advisors, you can make informed financial decisions and work towards achieving your financial aspirations.

Transition to the next article section: Exploring the Role of Financial Advisors in Sheffield

Sheffield Financial Advice Tips

Seeking professional financial advice can empower you to make informed financial decisions and achieve your financial goals. Here are five essential tips to consider when seeking Sheffield financial advice:

Tip 1: Define Your Financial Goals and Objectives

Clearly outlining your financial goals and objectives is crucial. These goals may include saving for retirement, purchasing a home, funding your children's education, or managing debt. Identifying your goals will guide your financial advisor in developing a tailored plan that aligns with your aspirations.

Tip 2: Choose a Reputable and Experienced Advisor

Selecting a reputable and experienced financial advisor is essential. Look for advisors who are certified by recognized bodies, have a proven track record, and adhere to ethical guidelines. Conduct thorough research, read online reviews, and seek recommendations from trusted sources to identify a qualified advisor.

Tip 3: Be Transparent and Open with Your Advisor

Open and honest communication is key. Share complete information about your financial situation, including your income, expenses, assets, and liabilities. This transparency will enable your advisor to fully understand your financial circumstances and provide tailored advice that meets your specific needs and goals.

Tip 4: Regularly Review and Adjust Your Financial Plan

Your financial plan should be a living document that is regularly reviewed and adjusted as your circumstances and goals evolve. Life events such as marriage, childbirth, career changes, or retirement may necessitate revisions to your plan. Schedule regular meetings with your advisor to ensure your plan remains aligned with your changing needs.

Tip 5: Seek Advice Throughout Your Financial Journey

Financial advice is not a one-time event. As you progress through different life stages and face new financial challenges, seek ongoing guidance from your financial advisor. They can provide valuable insights, help you navigate complex financial decisions, and keep you on track towards achieving your long-term financial aspirations.

In conclusion, following these tips will help you maximize the benefits of Sheffield financial advice. Remember to clearly define your goals, choose a reputable advisor, communicate openly, regularly review your plan, and seek ongoing guidance throughout your financial journey.

Sheffield Financial Advice

Throughout this article, we have explored the multifaceted world of Sheffield financial advice, highlighting its importance, benefits, and key aspects. We have emphasized the crucial role that reputable and experienced financial advisors play in guiding individuals and businesses towards achieving their financial goals.

Seeking financial advice in Sheffield is not merely a transaction but an investment in your financial well-being. By embracing the tips outlined in this article, you can maximize the benefits of professional guidance and make informed financial decisions that align with your unique circumstances and aspirations. Sheffield financial advice empowers you to navigate the complexities of financial markets, plan for the future, and secure your financial future.

As you embark on your financial journey, remember that professional guidance is invaluable. Embrace the expertise, objectivity, and personalized advice offered by Sheffield financial advisors. Together, you can unlock your financial potential and achieve lasting financial success.

Discover All The Fallout 76 Microscopes

Discover The Future Of Energy: Renewable Energy In El Paso

The Ultimate Guide To Bradford Exchange Company: Your Source For Collectibles

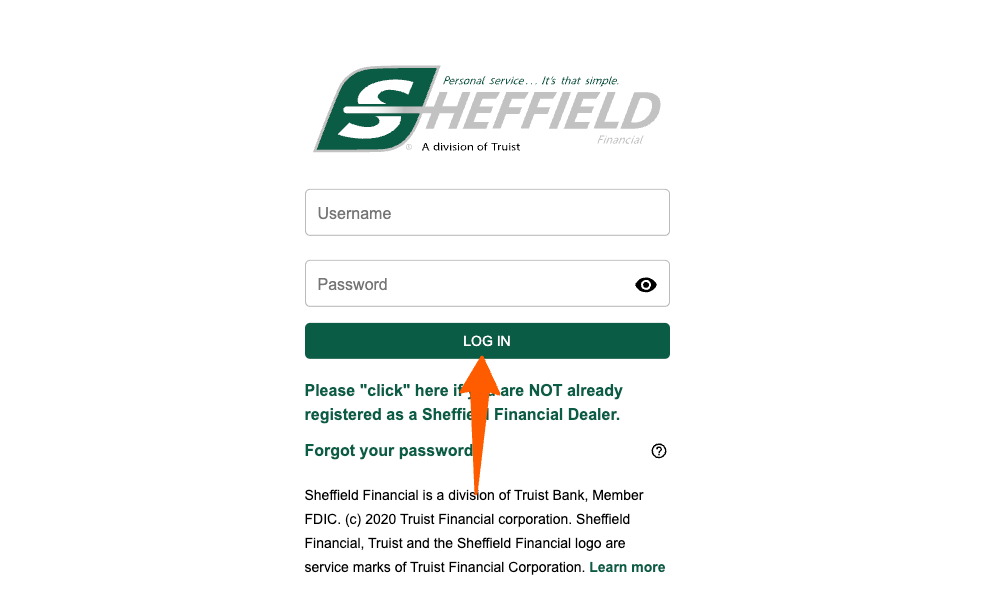

Apply here for Sheffield Financial

Sheffield Financial Dealer Login

Sheffield Financial loan application