The Ultimate Guide To Quicken Loans Home Loans: Your Path To Homeownership

Quicken Loans is a mortgage lender that offers a variety of home loan products, including conventional loans, FHA loans, and VA loans. Quicken Loans is known for its quick and easy online application process, and it typically takes just a few minutes to get pre-approved for a loan.

Quicken Loans has been in business for over 30 years and has helped millions of people finance their homes. The company is headquartered in Detroit, Michigan, and it has offices in all 50 states. Quicken Loans is a member of the Fortune 500 and is one of the largest mortgage lenders in the United States.

There are many benefits to using Quicken Loans for your home loan. One of the biggest benefits is the company's quick and easy online application process. You can get pre-approved for a loan in just a few minutes, and you can track the status of your loan online throughout the process. Quicken Loans also offers a variety of loan products to choose from, so you can find the loan that best meets your needs.

Read also:The Complete Guide To Maddie Zieglers Career Dance Fame And Beyond

Quicken Loans Home Loans

Quicken Loans home loans offer a number of advantages, including:

- Competitive interest rates

- Low closing costs

- Fast and easy online application process

- Wide variety of loan products

- Excellent customer service

- High customer satisfaction ratings

For example, Quicken Loans has been recognized by J.D. Power and Associates as the highest ranked mortgage lender in customer satisfaction for nine consecutive years. Quicken Loans is also a member of the Better Business Bureau with an A+ rating.

If you are considering getting a home loan, Quicken Loans is a great option to consider. They offer a variety of loan products to choose from, and their customer service is excellent. You can get pre-approved for a loan in just a few minutes, and you can track the status of your loan online throughout the process.

1. Competitive interest rates

Competitive interest rates are one of the most important factors to consider when getting a home loan. The interest rate you get will determine how much you pay each month on your mortgage, and over the life of the loan. Quicken Loans offers some of the most competitive interest rates in the industry, which can save you thousands of dollars over the life of your loan.

- How Quicken Loans achieves competitive interest rates

Quicken Loans is able to offer competitive interest rates because of its strong relationships with lenders and its large volume of business. The company also uses technology to streamline its processes, which helps to reduce costs and pass on the savings to its customers. - The benefits of getting a competitive interest rate

Getting a competitive interest rate can save you a significant amount of money on your mortgage payments. For example, if you get a $200,000 loan at a 4% interest rate, you will pay $800 per month on your mortgage. If you get the same loan at a 5% interest rate, you will pay $867 per month on your mortgage. Over the life of the loan, you will save $16,800 by getting a competitive interest rate. - How to get a competitive interest rate

There are a few things you can do to increase your chances of getting a competitive interest rate on your home loan. First, shop around and compare rates from multiple lenders. Second, get your credit score as high as possible. Lenders will offer lower interest rates to borrowers with higher credit scores. Third, make a larger down payment. Lenders will also offer lower interest rates to borrowers who make a larger down payment.

Getting a competitive interest rate on your home loan is one of the best ways to save money on your monthly mortgage payments and over the life of the loan. Quicken Loans offers some of the most competitive interest rates in the industry, so if you are considering getting a home loan, be sure to compare rates from Quicken Loans.

2. Low closing costs

Closing costs are the fees you pay when you get a mortgage. These fees can include things like the loan origination fee, the appraisal fee, the title search fee, and the recording fee. Closing costs can add up to thousands of dollars, so it's important to factor them into your budget when you're getting a home loan.

Read also:Discover The Beauty Of St Petersburg Fls Pier

Quicken Loans offers low closing costs on its home loans. In fact, Quicken Loans has been recognized by J.D. Power and Associates as the highest ranked mortgage lender in customer satisfaction for nine consecutive years. One of the reasons for Quicken Loans' high customer satisfaction ratings is its low closing costs.

There are a number of benefits to getting a low closing cost home loan. For example, if you get a $200,000 loan with a 4% interest rate and 1% closing costs, you will pay $800 per month on your mortgage. If you get the same loan with a 5% interest rate and 2% closing costs, you will pay $867 per month on your mortgage. Over the life of the loan, you will save $16,800 by getting a low closing cost home loan.

If you are considering getting a home loan, it's important to compare closing costs from multiple lenders. Quicken Loans offers some of the lowest closing costs in the industry, so be sure to compare rates from Quicken Loans when you're shopping for a home loan.

3. Fast and easy online application process

Quicken Loans' fast and easy online application process is one of the things that sets it apart from other lenders. The process can be completed in just a few minutes, and you can track the status of your loan online throughout the process.

- Convenience

The online application process is convenient because you can apply for a loan from anywhere with an internet connection. You don't have to go to a branch or meet with a loan officer in person. - Speed

The online application process is fast because Quicken Loans uses technology to streamline the process. You can get pre-approved for a loan in just a few minutes. - Transparency

The online application process is transparent because you can track the status of your loan online throughout the process. You will always know where your loan is in the process, and you can contact Quicken Loans with any questions you have. - Security

The online application process is secure because Quicken Loans uses industry-leading security measures to protect your personal information.

Quicken Loans' fast and easy online application process is one of the many reasons why it is one of the most popular mortgage lenders in the United States. If you are considering getting a home loan, be sure to compare rates from Quicken Loans.

4. Wide variety of loan products

Quicken Loans offers a wide variety of loan products to meet the needs of every borrower. Whether you are a first-time homebuyer, a move-up buyer, or a refinancing, Quicken Loans has a loan product that is right for you.

The following is a list of some of the loan products offered by Quicken Loans:

- Conventional loans

- FHA loans

- VA loans

- USDA loans

- Jumbo loans

- Construction loans

- Renovation loans

- Reverse mortgages

Each of these loan products has its own unique features and benefits. For example, conventional loans are a good option for borrowers with good credit and a stable income. FHA loans are a good option for first-time homebuyers and borrowers with lower credit scores. VA loans are a good option for veterans and active military members. USDA loans are a good option for borrowers who are buying a home in a rural area. Jumbo loans are a good option for borrowers who are financing a home that is more expensive than the conforming loan limit. Construction loans are a good option for borrowers who are building a new home. Renovation loans are a good option for borrowers who are renovating an existing home. Reverse mortgages are a good option for senior citizens who want to access the equity in their home.

By offering a wide variety of loan products, Quicken Loans can meet the needs of every borrower. This is one of the things that makes Quicken Loans one of the most popular mortgage lenders in the United States.

5. Excellent customer service

Excellent customer service is a cornerstone of Quicken Loans' business model. The company has a team of dedicated customer service representatives who are available to help borrowers with any questions or concerns they may have. Quicken Loans also offers a variety of online resources, including a help center and a live chat feature, to make it easy for borrowers to get the help they need.

The importance of excellent customer service in the mortgage industry cannot be overstated. A home loan is one of the biggest financial transactions most people will ever make, and it's important to have a lender who is responsive, helpful, and knowledgeable. Quicken Loans understands this, and it shows in the company's commitment to providing excellent customer service.

There are many examples of Quicken Loans' excellent customer service. For example, the company has been recognized by J.D. Power and Associates as the highest ranked mortgage lender in customer satisfaction for nine consecutive years. Quicken Loans has also been recognized by Forbes as one of the World's Most Innovative Companies.

The practical significance of Quicken Loans' excellent customer service is that it makes the home loan process easier and less stressful for borrowers. Quicken Loans' customer service representatives are always willing to go the extra mile to help borrowers get the loan they need. This is especially important for first-time homebuyers, who may not be familiar with the mortgage process.

Overall, Quicken Loans' excellent customer service is one of the things that sets the company apart from other lenders. If you are considering getting a home loan, Quicken Loans is a great option to consider.

6. High customer satisfaction ratings

Quicken Loans home loans consistently receive high customer satisfaction ratings. This is due to a number of factors, including the company's commitment to providing excellent customer service, its wide variety of loan products, and its competitive interest rates.

- Responsiveness

Quicken Loans customer service representatives are available to help borrowers with any questions or concerns they may have, and they are known for being responsive and helpful. - Knowledge

Quicken Loans customer service representatives are knowledgeable about the mortgage process and are able to provide borrowers with the information they need to make informed decisions. - Friendliness

Quicken Loans customer service representatives are friendly and courteous, and they make the home loan process as easy and stress-free as possible for borrowers. - Flexibility

Quicken Loans is willing to work with borrowers to find a loan that meets their individual needs, and the company is known for its flexibility and willingness to go the extra mile for its customers.

The high customer satisfaction ratings received by Quicken Loans home loans are a testament to the company's commitment to providing excellent customer service. Borrowers who choose Quicken Loans can be confident that they will receive the help and support they need throughout the home loan process.

Frequently Asked Questions about Quicken Loans Home Loans

This section provides answers to frequently asked questions about Quicken Loans home loans. These questions and answers are designed to help you make informed decisions about your mortgage needs.

Question 1: What are the benefits of getting a home loan from Quicken Loans?

Quicken Loans offers a number of benefits, including competitive interest rates, low closing costs, a fast and easy online application process, a wide variety of loan products, excellent customer service, and high customer satisfaction ratings.

Question 2: What are the different types of home loans offered by Quicken Loans?

Quicken Loans offers a wide variety of home loans, including conventional loans, FHA loans, VA loans, USDA loans, jumbo loans, construction loans, renovation loans, and reverse mortgages.

Question 3: How do I apply for a home loan from Quicken Loans?

You can apply for a home loan from Quicken Loans online or over the phone. The online application process is fast and easy, and you can get pre-approved for a loan in just a few minutes.

Question 4: What are the eligibility requirements for a Quicken Loans home loan?

The eligibility requirements for a Quicken Loans home loan vary depending on the type of loan you are applying for. However, in general, you will need to have a good credit score, a stable income, and a debt-to-income ratio that meets Quicken Loans' guidelines.

Question 5: What are the interest rates on Quicken Loans home loans?

The interest rates on Quicken Loans home loans vary depending on a number of factors, including your credit score, the type of loan you are applying for, and the current market conditions. You can get a personalized interest rate quote from Quicken Loans by completing an online application.

Question 6: What are the closing costs on Quicken Loans home loans?

The closing costs on Quicken Loans home loans vary depending on the type of loan you are applying for and the location of the property. However, Quicken Loans offers low closing costs on all of its home loans.

These are just a few of the frequently asked questions about Quicken Loans home loans. For more information, please visit the Quicken Loans website or speak to a Quicken Loans loan officer.

Tips for Getting a Home Loan from Quicken Loans

Quicken Loans is one of the largest and most reputable mortgage lenders in the United States. They offer a wide range of home loan products and have a reputation for providing excellent customer service. If you're considering getting a home loan from Quicken Loans, here are a few tips to help you get the best possible experience:

Tip 1: Get pre-approved for a loan before you start shopping for a home. This will give you a good idea of how much you can afford to borrow and will make the home buying process much smoother.

Tip 2: Shop around and compare rates from multiple lenders. Quicken Loans may not always have the lowest rates, so it's important to compare their rates to other lenders before you make a decision.

Tip 3: Make sure you understand all of the costs associated with getting a home loan. These costs can include closing costs, origination fees, and discount points.

Tip 4: Be prepared to provide documentation to support your loan application. This documentation may include pay stubs, tax returns, and bank statements.

Tip 5: Be patient. The home loan process can take several weeks, so it's important to be patient and to stay in communication with your loan officer.

Tip 6: Ask questions. If you don't understand something, don't be afraid to ask your loan officer for clarification.

Tip 7: Get a home inspection. This will help you to identify any potential problems with the property before you buy it.

Tip 8: Be prepared to close on your loan. This will involve signing a number of documents and paying the closing costs.

By following these tips, you can increase your chances of getting a home loan from Quicken Loans and getting the best possible deal.

Summary of key takeaways or benefits:

- Getting pre-approved for a loan can make the home buying process smoother.

- Shopping around and comparing rates can help you get the best possible interest rate.

- Understanding all of the costs associated with getting a home loan can help you avoid surprises.

- Being prepared to provide documentation can help your loan application process go more quickly.

- Being patient and staying in communication with your loan officer can help you avoid delays.

- Asking questions can help you to understand the home loan process and make informed decisions.

- Getting a home inspection can help you to identify any potential problems with the property before you buy it.

- Being prepared to close on your loan can help you to avoid delays.

By following these tips, you can increase your chances of getting a home loan from Quicken Loans and getting the best possible deal.

Transition to the article's conclusion:

Getting a home loan can be a complex and stressful process, but it doesn't have to be. By following these tips, you can make the process easier and less stressful.

Conclusion

Quicken Loans is one of the largest and most reputable mortgage lenders in the United States. They offer a wide range of home loan products and have a reputation for providing excellent customer service. Quicken Loans' commitment to providing excellent customer service, its wide variety of loan products, and its competitive interest rates make it a great option for borrowers who are looking for a home loan.

If you are considering getting a home loan, Quicken Loans is a great option to consider. By following the tips outlined in this article, you can increase your chances of getting approved for a loan and getting the best possible deal.

Set An Alarm For 6:10 A.m. And Wake Up On Time

Los Angeles: A Comprehensive Map To Navigate The Judgmental Maze

St. Pete Pier: Your Guide To Tampa Bay's Iconic Waterfront

Home Loans For Police And Law Enforcement Quicken Loans

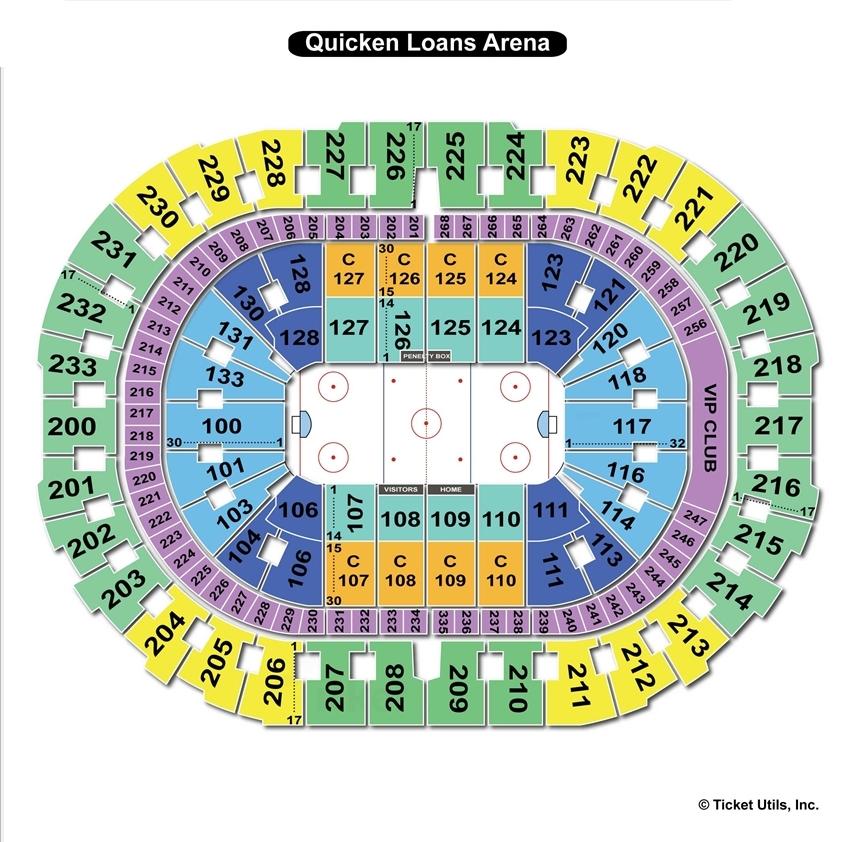

Quicken Loans Arena, Cleveland OH Seating Chart View

Quicken Loans Arena, Cleveland OH Seating Chart View