NYSEARCA VOO: The Definitive Guide To Vanguard S&P 500 ETF

The NYSEARCA VOO, commonly known as the Vanguard S&P 500 ETF, is one of the most popular and widely recognized exchange-traded funds (ETFs) in the financial world. It is a go-to choice for investors seeking exposure to the S&P 500 Index, which tracks the performance of 500 of the largest publicly traded companies in the United States. With its low expense ratio, impressive historical returns, and diversified portfolio, NYSEARCA VOO has become synonymous with long-term wealth-building and passive investing strategies.

In this article, we'll dive into the key aspects of NYSEARCA VOO, exploring its features, benefits, and performance metrics. Whether you're a seasoned investor or someone just starting out, understanding how this ETF works can help you make informed decisions about your financial future. We'll also address common questions surrounding NYSEARCA VOO, provide a historical overview, and discuss how it compares to other investment options like mutual funds and individual stocks.

By the end of this comprehensive guide, you'll have a clear understanding of why NYSEARCA VOO is considered a cornerstone of many investment portfolios. This article aims to provide you with actionable insights, backed by data and expert analysis, to ensure you’re equipped to navigate the world of ETFs with confidence.

Read also:When To Apply Deodorant After The Shower Timing Is Everything

Table of Contents

- What is NYSEARCA VOO?

- How Does NYSEARCA VOO Work?

- History and Background

- Why is NYSEARCA VOO Popular?

- Performance and Returns

- Expense Ratio and Costs

- How to Invest in NYSEARCA VOO?

- Who Should Invest in NYSEARCA VOO?

- What Are the Risks?

- Tax Efficiency and Benefits

- NYSEARCA VOO vs. Other ETFs

- Frequently Asked Questions

- Conclusion

What is NYSEARCA VOO?

NYSEARCA VOO, or Vanguard S&P 500 ETF, is an ETF designed to mirror the performance of the S&P 500 Index. This index represents approximately 80% of the U.S. stock market's total value, making it a reliable indicator of the overall market's health. By investing in NYSEARCA VOO, you're essentially buying into a slice of the U.S. economy, gaining exposure to a mix of industries such as technology, healthcare, finance, and consumer goods.

Launched in 2010 by Vanguard, NYSEARCA VOO quickly gained popularity due to its low expense ratio and strong performance. It allows investors to diversify their portfolios without the need to purchase individual stocks, making it an accessible option for beginners and experienced investors alike.

Key Features of NYSEARCA VOO

- Low Expense Ratio: NYSEARCA VOO has one of the lowest expense ratios in the industry, making it cost-efficient for long-term investors.

- Broad Diversification: The ETF includes companies from various sectors, reducing the risk associated with investing in a single industry or stock.

- Liquidity: As one of the most traded ETFs, it offers high liquidity, allowing investors to buy and sell easily.

- Passive Management: NYSEARCA VOO is passively managed, which means it aims to replicate the S&P 500 Index rather than outperform it.

In essence, NYSEARCA VOO is a simple yet powerful tool for anyone looking to invest in the U.S. stock market with minimal effort and low costs.

How Does NYSEARCA VOO Work?

NYSEARCA VOO operates by tracking the S&P 500 Index, which is comprised of 500 of the largest publicly traded companies in the United States. The fund achieves this by holding the same stocks as the index in the same proportions. For example, if Apple constitutes 6% of the S&P 500, it will also make up 6% of NYSEARCA VOO's holdings.

What Makes It Different from Mutual Funds?

Unlike mutual funds, NYSEARCA VOO is traded on an exchange, much like individual stocks. This means you can buy and sell shares throughout the trading day at market prices. In contrast, mutual funds are priced only once per day, after the market closes.

Advantages of the ETF Structure

- Transparency: NYSEARCA VOO's holdings are disclosed daily, allowing investors to see exactly what they own.

- Tax Efficiency: ETFs like NYSEARCA VOO are generally more tax-efficient compared to mutual funds because of their unique creation and redemption process.

- Flexibility: The ability to trade throughout the day provides flexibility to investors looking to capitalize on market movements.

By understanding how NYSEARCA VOO operates, you can better appreciate its role in a diversified investment portfolio.

Read also:Outback Spotted Dog Sundae The Ultimate Doggie Treat

History and Background

NYSEARCA VOO was launched on September 7, 2010, by Vanguard, a pioneer in low-cost investing. The fund was designed to provide investors with an affordable way to gain exposure to the S&P 500 Index. Since its inception, NYSEARCA VOO has consistently delivered returns that closely match the index, making it a reliable choice for investors.

Vanguard’s Philosophy

Vanguard's investment philosophy revolves around low costs, long-term focus, and diversification. These principles are evident in NYSEARCA VOO, which has an expense ratio of just 0.03%, significantly lower than the industry average. This low-cost approach allows investors to keep more of their returns.

The fund's performance over the years has attracted a wide range of investors, from individuals saving for retirement to institutional investors managing large portfolios.

Why is NYSEARCA VOO Popular?

NYSEARCA VOO's popularity can be attributed to several factors, including its low costs, strong performance, and ease of access. Here's a closer look at why it's a favorite among investors:

Low Costs

With an expense ratio of just 0.03%, NYSEARCA VOO is one of the most cost-effective ways to invest in the S&P 500. Lower costs mean more of your money is working for you, compounding over time.

Strong Historical Performance

NYSEARCA VOO has a track record of delivering returns that closely mirror the S&P 500 Index. Over the long term, the S&P 500 has provided average annual returns of around 7-10%, making it a reliable choice for growth-oriented investors.

Accessibility

As an ETF, NYSEARCA VOO is easy to buy and sell through any brokerage account. There are no minimum investment requirements, unlike some mutual funds, making it accessible to a broader audience.

These features make NYSEARCA VOO an attractive option for anyone looking to invest in the stock market with minimal effort and maximum efficiency.

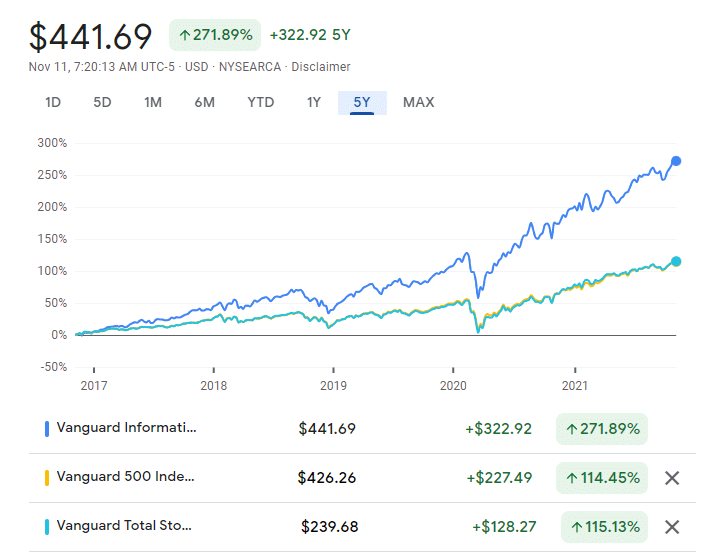

Performance and Returns

When evaluating any investment, performance and returns are critical factors. NYSEARCA VOO has consistently delivered strong returns that align closely with the S&P 500 Index. Here’s what you need to know:

Historical Returns

Over the past decade, NYSEARCA VOO has provided average annual returns of approximately 10%, depending on the specific time period. These returns are net of the fund's expense ratio, showcasing its cost-efficiency.

Dividend Yields

In addition to capital gains, NYSEARCA VOO also provides dividends, which are distributed quarterly. These dividends come from the earnings of the underlying companies in the S&P 500.

Investors who reinvest these dividends can benefit from compounding, further boosting their returns over time.

Frequently Asked Questions

1. Is NYSEARCA VOO a good investment?

Yes, NYSEARCA VOO is considered a good investment for those seeking long-term growth and diversification at a low cost. However, it’s essential to align it with your financial goals and risk tolerance.

2. How do I buy NYSEARCA VOO?

You can purchase NYSEARCA VOO through any brokerage account. Simply search for the ticker symbol "VOO" and place your order during market hours.

3. What is the minimum investment for NYSEARCA VOO?

There is no minimum investment for NYSEARCA VOO; you can buy as little as one share, making it accessible to all types of investors.

4. How does NYSEARCA VOO compare to SPY?

Both NYSEARCA VOO and SPY track the S&P 500 Index. However, VOO has a lower expense ratio, making it a cost-effective choice for long-term investors.

5. What are the risks of investing in NYSEARCA VOO?

While NYSEARCA VOO offers diversification, it is still subject to market risks, including economic downturns and volatility. Investors should be prepared for short-term fluctuations.

6. Can I hold NYSEARCA VOO in a retirement account?

Yes, NYSEARCA VOO is an excellent addition to retirement accounts like IRAs and 401(k)s due to its low costs and long-term growth potential.

Conclusion

NYSEARCA VOO stands out as a cornerstone investment for those looking to achieve long-term financial success. Its low costs, strong performance, and ease of access make it an ideal choice for investors of all levels. By understanding how NYSEARCA VOO works and aligning it with your financial goals, you can take a significant step toward building a diversified and resilient portfolio.

Whether you're a seasoned investor or just starting your journey, NYSEARCA VOO offers a simple, efficient, and reliable way to participate in the growth of the U.S. economy. With its proven track record and investor-friendly features, it's no surprise that NYSEARCA VOO remains a favorite among millions of investors worldwide.

Logan Lerman Selena Gomez: A Complete Look At Their Lives And Careers

What Does LPO Stand For In Cars? All You Need To Know

King Charles Is Reportedly Planning A Visit To Prince Harry: A Royal Reconciliation?

CategoryVOO Wikimedia Commons

VTI vs VOO vs VGT HeadtoHead Comparison projectfinance