Understanding The 2024 Tax Brackets: A Comprehensive Guide For Taxpayers

These changes reflect inflation adjustments and aim to ensure taxpayers are taxed fairly based on their earnings. Knowing how these brackets work can help you strategize your savings, investments, and spending patterns to maximize your financial health.

Every year, the IRS revises the federal tax brackets to account for inflation and economic shifts. For 2024, these updates bring new income thresholds that determine the percentage of your income subject to taxation. While the basic structure of the tax brackets remains consistent with previous years, even slight adjustments can lead to noticeable differences in your tax liability. Understanding these nuances can help you avoid surprises during tax season and potentially save money through strategic planning.

With the 2024 tax brackets now in place, it’s crucial to evaluate how your income aligns with these new thresholds. Taxpayers in higher income brackets may face increased obligations, while those in lower brackets could benefit from reduced rates. Regardless of your financial situation, familiarizing yourself with the updated brackets will empower you to make informed decisions and optimize your tax strategy.

Read also:Cavill New Bond Is Henry Cavill The Next James Bond

Table of Contents

- What Are the 2024 Tax Brackets?

- How Do the 2024 Tax Brackets Affect You?

- Why Are Tax Brackets Adjusted Every Year?

- Can You Reduce Your Tax Liability in 2024?

- How to Plan for the 2024 Tax Season?

- Key Changes in the 2024 Tax Brackets

- What Are the Standard Deductions for 2024?

- How Do Tax Brackets Work for Different Filing Statuses?

- What Should You Know About Tax Credits in 2024?

- Frequently Asked Questions About 2024 Tax Brackets

What Are the 2024 Tax Brackets?

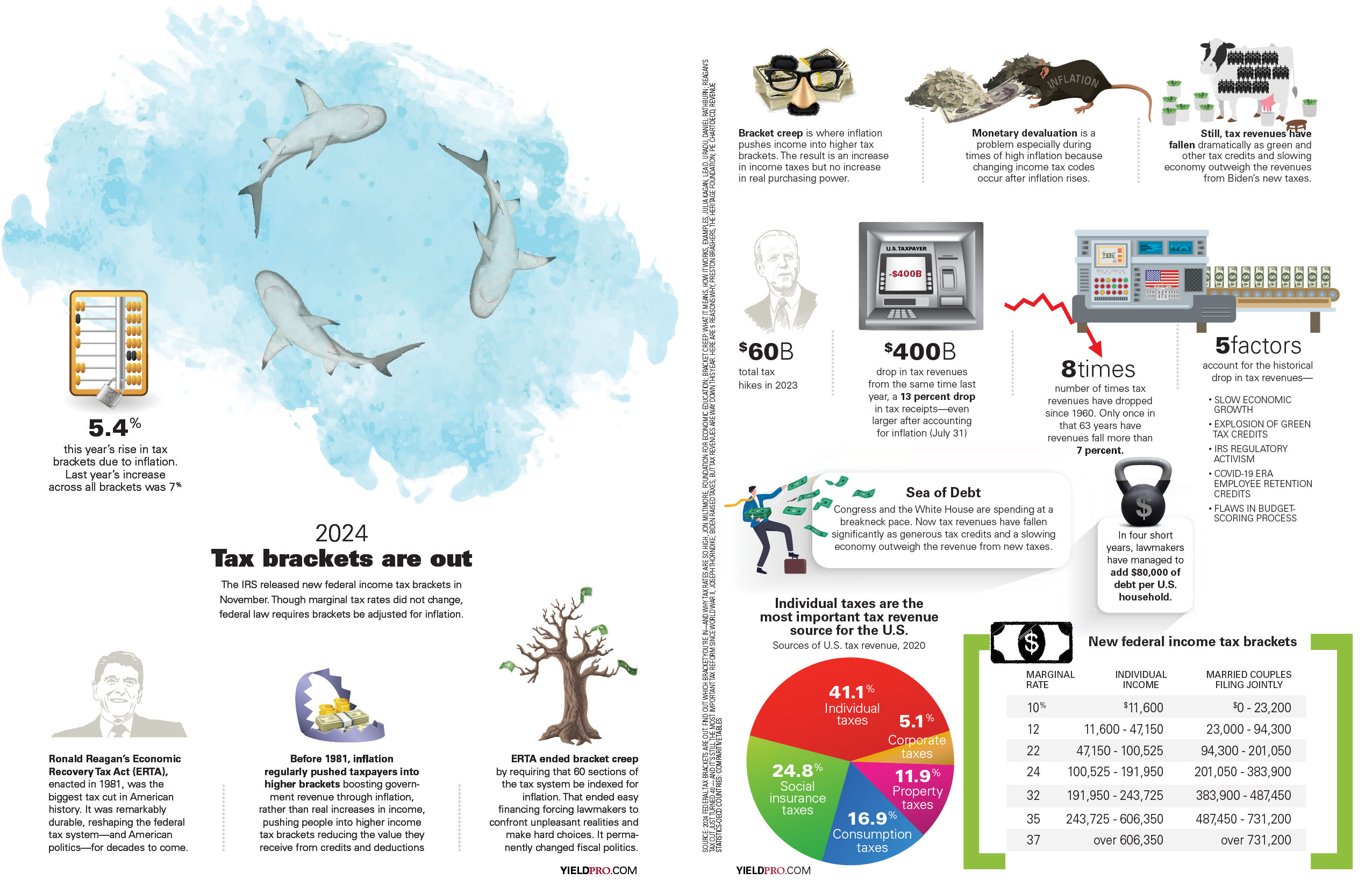

The 2024 tax brackets are divided into seven income levels, each taxed at a specific rate. These rates range from 10% to 37%, depending on your taxable income and filing status. For example, single filers earning up to $11,600 will fall into the 10% bracket, while those earning over $578,125 will be taxed at the highest rate of 37%. Similarly, married couples filing jointly will see different thresholds based on their combined income. Understanding where you fall within these brackets can help you estimate your tax liability and plan accordingly.

How Do the 2024 Tax Brackets Affect You?

The impact of the 2024 tax brackets depends on your income level and filing status. If you're a single filer earning $50,000 annually, you’ll be taxed at multiple rates. The first portion of your income will be taxed at 10%, the next at 12%, and so on, up to the highest applicable rate. This progressive system ensures that only a portion of your income is taxed at the highest rate. However, changes in the 2024 tax brackets could mean you’re pushed into a higher bracket, resulting in increased taxes owed.

Why Are Tax Brackets Adjusted Every Year?

Tax brackets are adjusted annually to account for inflation and cost-of-living increases. These adjustments prevent "bracket creep," a situation where taxpayers are pushed into higher tax brackets due to inflation rather than real income growth. For 2024, the IRS has implemented these changes to ensure fairness and accuracy in taxation. By understanding why these adjustments occur, you can better anticipate how they might affect your financial situation.

Can You Reduce Your Tax Liability in 2024?

Reducing your tax liability in 2024 is possible through strategic planning and leveraging available deductions and credits. Contributions to retirement accounts like IRAs or 401(k)s can lower your taxable income. Additionally, taking advantage of tax credits such as the Earned Income Tax Credit (EITC) or the Child Tax Credit can further reduce your tax bill. By understanding the 2024 tax brackets and how they apply to your situation, you can identify opportunities to minimize your tax burden.

How to Plan for the 2024 Tax Season?

Planning for the 2024 tax season involves reviewing your income, expenses, and potential deductions. Start by estimating your taxable income and determining which tax bracket you fall into. Next, explore ways to maximize deductions, such as itemizing expenses or claiming eligible credits. Consulting a tax professional can also provide valuable insights into navigating the 2024 tax brackets and optimizing your financial strategy.

Key Changes in the 2024 Tax Brackets

The 2024 tax brackets introduce several key changes compared to previous years. Income thresholds have been adjusted upward to reflect inflation, meaning taxpayers may need to earn more to reach higher tax brackets. For instance, the threshold for the 32% tax bracket for single filers has increased from $170,050 to $182,100. These adjustments aim to provide relief to taxpayers affected by rising living costs while maintaining a fair and progressive tax system.

Read also:Mia And Girthmaster Exploring The Dynamic Duo Of Online Content Creation

What Are the Standard Deductions for 2024?

The standard deduction for 2024 has also increased, providing taxpayers with greater opportunities to reduce their taxable income. For single filers, the standard deduction rises to $13,850, while married couples filing jointly can claim up to $27,700. These increases allow individuals and families to lower their taxable income without itemizing deductions, simplifying the tax filing process and potentially reducing their overall tax liability.

How Do Tax Brackets Work for Different Filing Statuses?

Tax brackets vary depending on your filing status, such as single, married filing jointly, or head of household. Each status has its own set of income thresholds and tax rates. For example, heads of household benefit from higher income limits before moving into higher tax brackets compared to single filers. Understanding how the 2024 tax brackets apply to your specific filing status is crucial for accurate tax planning and compliance.

What Should You Know About Tax Credits in 2024?

Tax credits offer a dollar-for-dollar reduction in your tax bill and can significantly lower your liability. In 2024, popular credits like the Child Tax Credit and the American Opportunity Credit remain available to eligible taxpayers. These credits are designed to support families, students, and low-income individuals by providing financial relief. By leveraging these credits alongside the 2024 tax brackets, you can achieve greater savings and improve your financial well-being.

Frequently Asked Questions About 2024 Tax Brackets

Here are answers to some common questions about the 2024 tax brackets:

- What happens if my income increases and I move into a higher tax bracket? Only the portion of your income that exceeds the threshold is taxed at the higher rate. Your entire income is not taxed at the new rate.

- Are the 2024 tax brackets the same for all states? No, state tax brackets may differ from federal brackets. It’s important to check your state’s specific tax rates and rules.

- How can I ensure I’m paying the correct amount of taxes? Keep accurate records of your income, deductions, and credits. Consulting a tax professional can also help ensure compliance and accuracy.

In conclusion, the 2024 tax brackets present both challenges and opportunities for taxpayers. By staying informed and proactive, you can navigate these changes effectively and make the most of your financial situation. Whether you’re planning for retirement, saving for education, or simply aiming to reduce your tax bill, understanding the 2024 tax brackets is a critical step toward achieving your goals.

Why Target Stock Should Be On Your Investment Radar

Fortnite Update Downtime: Everything You Need To Know

Chiara Ferragni: The Fashion Icon Redefining Influence And Entrepreneurship

Infographic 2024 Tax brackets are out Yield PRO

Tax Bracket Changes 2024 For Single, Household, Married Filling