Uncover The Secrets: The Ultimate Guide To Quicken Loans Borrowing

Quicken Loans, now known as Rocket Mortgage, is an American mortgage lender. Founded in 1985, it was the largest retail mortgage lender in the United States for several years. Quicken Loans offers a variety of mortgage products, including conventional loans, FHA loans, VA loans, and jumbo loans. The company also offers refinancing and home equity loans.

Quicken Loans has been praised for its innovative use of technology, which has helped to streamline the mortgage process. The company's website allows borrowers to apply for a mortgage online and track the progress of their loan application. Quicken Loans also offers a mobile app that allows borrowers to manage their mortgage account and make payments.

Quicken Loans has been recognized for its customer service. The company has received numerous awards from J.D. Power and Associates for its customer satisfaction. Quicken Loans has also been recognized by Forbes as one of the "World's Most Innovative Companies."

Read also:Top 10 Best Summer Fragrances To Try In 2015

Quicken Loans Borrowing

Quicken Loans, now known as Rocket Mortgage, is one of the largest mortgage lenders in the United States. The company offers a variety of mortgage products, including conventional loans, FHA loans, VA loans, and jumbo loans. Quicken Loans also offers refinancing and home equity loans.

- Online: Quicken Loans offers an easy-to-use website and mobile app that allows borrowers to apply for a mortgage online and track the progress of their loan application.

- Fast: Quicken Loans is known for its fast and efficient mortgage process. The company can often approve a loan in as little as 24 hours.

- Flexible: Quicken Loans offers a variety of mortgage products and loan programs to meet the needs of different borrowers.

- Customer service: Quicken Loans has a team of experienced loan officers who are available to answer questions and help borrowers through the mortgage process.

- Technology: Quicken Loans uses a variety of technology tools to streamline the mortgage process and make it easier for borrowers to get a loan.

- Rates: Quicken Loans offers competitive interest rates on its mortgage products.

Quicken Loans is a good option for borrowers who are looking for a fast, easy, and affordable mortgage. The company's online platform and mobile app make it easy to apply for a loan and track the progress of your application. Quicken Loans also offers a variety of mortgage products and loan programs to meet the needs of different borrowers.

1. Online

The internet has revolutionized the way we do many things, including the way we apply for loans. In the past, borrowers had to go to a bank or mortgage company in person to apply for a loan. This could be a time-consuming and inconvenient process. Today, thanks to online lenders like Quicken Loans, borrowers can apply for a mortgage from the comfort of their own home.

Quicken Loans' online platform is easy to use and navigate. Borrowers can apply for a mortgage in just a few minutes. Once they have submitted their application, they can track the progress of their loan online or through the Quicken Loans mobile app. This transparency gives borrowers peace of mind and allows them to stay informed about the status of their loan.

The ability to apply for a mortgage online has made the process much faster and easier for borrowers. In the past, it could take weeks or even months to get a mortgage approved. Today, thanks to online lenders like Quicken Loans, borrowers can get approved for a mortgage in as little as 24 hours.

2. Fast

One of the biggest advantages of using Quicken Loans is its fast and efficient mortgage process. The company uses a variety of technology tools to streamline the loan process, which allows it to approve loans quickly. In many cases, Quicken Loans can approve a loan in as little as 24 hours. This is much faster than the traditional mortgage process, which can take weeks or even months.

Read also:Why Are My Fingernails Dented And Cracked

The speed of Quicken Loans' mortgage process is a major benefit for borrowers. It allows them to get the money they need to buy a home quickly and easily. This can be especially important for borrowers who are in a hurry to close on a home or who need to get a loan quickly for other reasons.

Here are a few examples of how Quicken Loans' fast mortgage process has helped borrowers:

- One borrower was able to close on his home in just 21 days, thanks to Quicken Loans' fast mortgage process. This allowed him to move into his new home quickly and easily.

- Another borrower was able to get a loan approved in just 24 hours, thanks to Quicken Loans' streamlined process. This allowed her to get the money she needed to buy her dream home quickly and easily.

Quicken Loans' fast mortgage process is a major benefit for borrowers. It allows them to get the money they need to buy a home quickly and easily. This can be especially important for borrowers who are in a hurry to close on a home or who need to get a loan quickly for other reasons.

3. Flexible

Quicken Loans (now Rocket Mortgage) offers a diverse range of mortgage products and loan programs tailored to cater to the unique financial situations and homeownership goals of different borrowers. This flexibility aligns seamlessly with the overall concept of "quicken loans borrowing" by providing tailored solutions that address the diverse borrowing needs of individuals and families.

- Product Variety:

Quicken Loans offers an extensive portfolio of mortgage products, including conventional loans, FHA loans, VA loans, jumbo loans, and USDA loans. This variety empowers borrowers with options that suit their credit profiles, debt-to-income ratios, and down payment capabilities, ensuring they can secure financing that aligns with their specific requirements. - Program Customization:

Beyond product diversity, Quicken Loans provides customizable loan programs that cater to unique borrower circumstances. For instance, the company offers adjustable-rate mortgages (ARMs) with varying adjustment periods and interest rate caps, allowing borrowers to manage interest rate risk based on their financial projections. Additionally, Quicken Loans provides specialized programs for first-time homebuyers, offering down payment assistance and flexible credit guidelines to facilitate homeownership. - Flexible Underwriting:

Quicken Loans employs flexible underwriting practices that consider a holistic view of a borrower's financial profile, not solely relying on credit scores. This approach enables borrowers with non-traditional credit histories or income streams to qualify for mortgages, broadening access to homeownership opportunities. - Streamlined Process:

Quicken Loans' streamlined mortgage process complements its flexible product and program offerings. The company leverages technology to expedite loan approvals, reduce paperwork, and provide real-time updates on loan status. This efficiency empowers borrowers to navigate the borrowing process swiftly and conveniently, adapting to their busy schedules and preferences.

In conclusion, the flexibility of Quicken Loans' mortgage products, loan programs, underwriting practices, and process aligns with the concept of "quicken loans borrowing" by providing tailored solutions that meet the diverse needs of borrowers. This flexibility enhances accessibility, caters to unique financial situations, and simplifies the borrowing process, ultimately facilitating successful homeownership journeys for individuals and families.

4. Customer service

Excellent customer service is an integral component of "quicken loans borrowing" as it directly impacts the borrower's experience and satisfaction throughout the mortgage process. Quicken Loans' team of experienced loan officers plays a pivotal role in providing personalized assistance, addressing borrower inquiries, and guiding them through the complexities of securing a mortgage.

The availability of knowledgeable and responsive loan officers enhances the overall borrowing experience. Borrowers can confidently navigate the mortgage process, knowing they have access to professional guidance and support. This personalized approach fosters trust and empowers borrowers to make informed decisions, ultimately contributing to a smooth and successful borrowing journey.

Real-life examples showcase the practical significance of Quicken Loans' customer service in "quicken loans borrowing":

- A first-time homebuyer seeking guidance on mortgage options received comprehensive support from a loan officer, who explained different loan programs and helped them choose the one that best fit their financial situation.

- A borrower facing challenges with their credit history was assisted by a loan officer who explored alternative underwriting options, enabling them to qualify for a mortgage and achieve their homeownership goals.

- Throughout the mortgage process, borrowers have the peace of mind knowing they can reach out to their dedicated loan officer for timely updates, clarification of loan terms, and resolution of any issues that may arise.

In conclusion, the connection between "Customer service: Quicken Loans has a team of experienced loan officers who are available to answer questions and help borrowers through the mortgage process." and "quicken loans borrowing" is paramount. Exceptional customer service not only enhances the borrower's experience but also contributes to the overall success of the borrowing process. Quicken Loans' commitment to providing personalized assistance and guidance empowers borrowers, fosters trust, and ultimately facilitates a smooth and successful homeownership journey.

5. Technology

Technology plays a crucial role in "quicken loans borrowing" by transforming the mortgage process, enhancing convenience, and empowering borrowers. Quicken Loans' strategic utilization of technology tools streamlines the borrowing experience, making it more accessible and efficient.

One of the significant ways technology enhances "quicken loans borrowing" is through online loan applications. Quicken Loans' user-friendly website and mobile app allow borrowers to initiate and track their loan applications remotely. This eliminates the need for in-person visits to physical branches, saving borrowers valuable time and effort.

Moreover, Quicken Loans leverages technology to accelerate loan processing and approval. By employing automated underwriting systems and digital document verification, the company expedites the review and approval process, reducing the time it takes for borrowers to secure financing. This efficiency is particularly advantageous in competitive real estate markets, enabling borrowers to act quickly and confidently.

Technology also empowers borrowers with greater control and transparency throughout the "quicken loans borrowing" process. Quicken Loans' online platform provides borrowers with real-time updates on their loan status, allowing them to monitor their progress and make informed decisions. Additionally, borrowers can securely upload and share documents, reducing the need for physical paperwork and enhancing overall convenience.

In conclusion, the connection between "Technology: Quicken Loans uses a variety of technology tools to streamline the mortgage process and make it easier for borrowers to get a loan." and "quicken loans borrowing" is evident in the enhanced convenience, efficiency, and transparency that technology brings to the borrowing experience. Quicken Loans' commitment to innovation and technology adoption has revolutionized "quicken loans borrowing," making it more accessible, swift, and empowering for borrowers.

6. Rates

Interest rates play a crucial role in "quicken loans borrowing" as they directly impact the monthly mortgage payments and the overall cost of borrowing. Quicken Loans' commitment to offering competitive interest rates on its mortgage products aligns with its mission of providing affordable and accessible financing solutions to borrowers.

- Cost Savings:

Lower interest rates translate into lower monthly mortgage payments, allowing borrowers to save money on their housing expenses. This cost savings can have a significant impact on a borrower's financial situation, freeing up funds for other essential expenses or investments. - Affordability:

Competitive interest rates enhance the affordability of homeownership. By reducing the cost of borrowing, Quicken Loans makes it possible for more individuals and families to qualify for a mortgage and achieve their dream of homeownership. - Refinancing Opportunities:

Borrowers who have existing mortgages may benefit from refinancing their loans with Quicken Loans to take advantage of lower interest rates. Refinancing can result in lower monthly payments, shorter loan terms, or both, providing borrowers with greater financial flexibility and potential savings. - Market Competitiveness:

In a competitive mortgage market, borrowers are more likely to choose lenders who offer attractive interest rates. Quicken Loans' competitive rates ensure that it remains a top choice for borrowers seeking affordable and accessible financing options.

In conclusion, the connection between "Rates: Quicken Loans offers competitive interest rates on its mortgage products" and "quicken loans borrowing" is evident in the cost savings, affordability, refinancing opportunities, and market competitiveness that competitive interest rates provide. Quicken Loans' commitment to offering competitive rates aligns with its mission of empowering borrowers and making homeownership a reality for more individuals and families.

Frequently Asked Questions about "Quicken Loans Borrowing"

Quicken Loans, now known as Rocket Mortgage, is one of the largest mortgage lenders in the United States. The company offers a variety of mortgage products and loan programs to meet the needs of different borrowers.

Question 1: Is Quicken Loans a reputable lender?

Yes, Quicken Loans is a reputable lender with a long history of providing mortgages to borrowers. The company is licensed in all 50 states and is a member of the Mortgage Bankers Association. Quicken Loans has also received high ratings from consumer protection agencies, such as the Better Business Bureau and J.D. Power and Associates.

Question 2: What types of mortgage products does Quicken Loans offer?

Quicken Loans offers a variety of mortgage products, including conventional loans, FHA loans, VA loans, jumbo loans, and USDA loans. The company also offers refinancing and home equity loans.

Question 3: What are the benefits of using Quicken Loans?

There are many benefits to using Quicken Loans, including:

- Competitive interest rates

- Fast and efficient loan process

- Flexible underwriting guidelines

- Excellent customer service

Question 4: What are the drawbacks of using Quicken Loans?

There are a few potential drawbacks to using Quicken Loans, including:

- Higher fees than some other lenders

- Not all loan programs are available in all states

- Some borrowers may not qualify for the most competitive interest rates

Question 5: How do I apply for a mortgage with Quicken Loans?

You can apply for a mortgage with Quicken Loans online, over the phone, or in person at a local branch. The online application process is quick and easy, and you can track the progress of your loan application online or through the Quicken Loans mobile app.

Question 6: What are the closing costs associated with a Quicken Loans mortgage?

The closing costs associated with a Quicken Loans mortgage will vary depending on the loan amount, the loan program, and the location of the property. However, Quicken Loans provides a Loan Estimate that will provide you with an estimate of the closing costs before you close on your loan.

Summary of key takeaways or final thought:

Quicken Loans is a reputable lender that offers a variety of mortgage products and loan programs. The company has a fast and efficient loan process, flexible underwriting guidelines, and excellent customer service. However, Quicken Loans may have higher fees than some other lenders, and not all loan programs are available in all states.

Transition to the next article section:

If you are considering using Quicken Loans for your mortgage, it is important to compare the company's rates and fees with other lenders to find the best deal for your needs.

Tips for "Quicken Loans Borrowing"

Quicken Loans, now known as Rocket Mortgage, is one of the largest mortgage lenders in the United States. The company offers a variety of mortgage products and loan programs to meet the needs of different borrowers.

If you are considering using Quicken Loans for your mortgage, here are a few tips to help you get the best possible experience:

Tip 1: Compare Quicken Loans to other lenders.

Quicken Loans is a reputable lender, but it is important to compare the company's rates and fees with other lenders to find the best deal for your needs. There are many online mortgage marketplaces that allow you to compare rates from multiple lenders side-by-side.

Tip 2: Get pre-approved for a mortgage.

Getting pre-approved for a mortgage will give you a better idea of how much you can afford to borrow and will make the homebuying process more competitive. Quicken Loans offers a quick and easy online pre-approval process.

Tip 3: Have your financial documents ready.

When you apply for a mortgage, you will need to provide Quicken Loans with a variety of financial documents, such as your pay stubs, bank statements, and tax returns. Having these documents ready will help to speed up the loan process.

Tip 4: Be prepared to pay closing costs.

Closing costs are fees that are paid at the closing of your loan. These costs can include things like the loan origination fee, the appraisal fee, and the title insurance fee. Quicken Loans provides a Loan Estimate that will give you an estimate of the closing costs before you close on your loan.

Tip 5: Ask questions.

If you have any questions about the mortgage process or about Quicken Loans, don't be afraid to ask. Quicken Loans has a team of experienced loan officers who are available to answer your questions and help you through the process.

Summary of key takeaways or benefits:

By following these tips, you can help to ensure that you have a smooth and successful experience when borrowing from Quicken Loans.

Transition to the article's conclusion:

Quicken Loans is a reputable lender that offers a variety of mortgage products and loan programs. By comparing rates, getting pre-approved, and having your financial documents ready, you can get the best possible experience when borrowing from Quicken Loans.

Conclusion

Quicken Loans, now known as Rocket Mortgage, is one of the largest mortgage lenders in the United States. The company offers a variety of mortgage products and loan programs to meet the needs of different borrowers. Quicken Loans is known for its fast and efficient loan process, flexible underwriting guidelines, and excellent customer service.

If you are considering using Quicken Loans for your mortgage, it is important to compare the company's rates and fees with other lenders to find the best deal for your needs. You should also get pre-approved for a mortgage, have your financial documents ready, and be prepared to pay closing costs. By following these tips, you can help to ensure that you have a smooth and successful experience when borrowing from Quicken Loans.

Quicken Loans is a reputable lender that can provide you with the financing you need to purchase a home. By understanding the "quicken loans borrowing" process and by following the tips outlined in this article, you can make informed decisions and get the best possible mortgage for your needs.

Astonishing Revelation: Dev Patel's Pioneering Role As James Bond

Discover The Excellence Of Oakland County Community College

Discover Unforgettable Outdoor Entertainment Experiences In Hinsdale, IL

Quicken Loans Arena Section 116 Cleveland Cavaliers

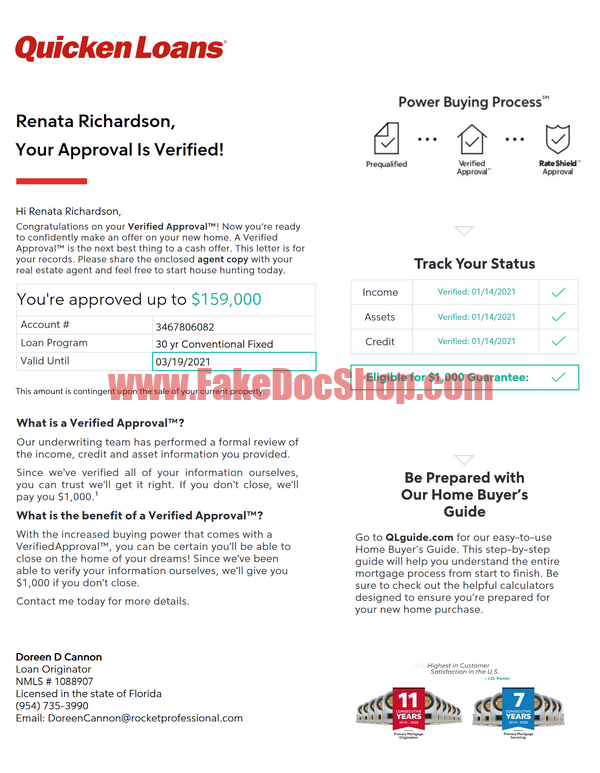

Quicken Loans Template In Word And PDF Format

Dynamic DoubleDigit Subtraction Worksheets (No Borrowing