Is Quicken Loans Trustworthy? Find Out Here!

When considering a mortgage, it's crucial to evaluate the safety and reputation of potential lenders. One such lender, Quicken Loans, has garnered significant attention in the financial industry. Understanding the safety of Quicken Loans is paramount for prospective borrowers.

Quicken Loans, established in 1985, is a prominent mortgage lender in the United States. It has a strong financial standing, with an A+ rating from the Better Business Bureau and accreditation from the Mortgage Bankers Association. Quicken Loans adheres to strict lending guidelines and industry best practices, ensuring the security of its lending operations.

Furthermore, Quicken Loans places great emphasis on customer satisfaction. It offers a variety of mortgage products tailored to diverse financial needs, providing personalized guidance throughout the loan process. The company's commitment to transparency and ethical lending practices has contributed to its positive reputation among borrowers.

Read also:Uncover The Enigmatic Tanya The Twilight Sagas Captivating Star

Is Quicken Loans Safe?

Evaluating the safety of Quicken Loans requires a thorough examination of key aspects that shape its reputation and trustworthiness as a mortgage lender. Here are eight essential considerations:

- Financial Stability: Quicken Loans maintains a strong financial standing, ensuring its ability to meet its obligations to borrowers.

- Industry Accreditation: Accredited by the Mortgage Bankers Association, Quicken Loans adheres to industry best practices and ethical lending standards.

- Customer Satisfaction: The company places high value on customer satisfaction, providing personalized guidance and a range of mortgage products to meet diverse needs.

- Transparency: Quicken Loans is committed to transparency in its lending practices, fostering trust among borrowers.

- Reputation: With a positive reputation in the financial industry, Quicken Loans has earned recognition for its reliability and integrity.

- Regulatory Compliance: The company strictly follows regulatory guidelines, ensuring compliance with federal and state laws governing mortgage lending.

- Technology: Quicken Loans leverages advanced technology to streamline the mortgage process, enhancing efficiency and security.

- BBB Rating: Quicken Loans holds an A+ rating from the Better Business Bureau, reflecting its commitment to ethical business practices and customer satisfaction.

These key aspects collectively contribute to the overall safety and reliability of Quicken Loans as a mortgage lender. By considering these factors, prospective borrowers can make informed decisions about their mortgage financing.

1. Financial Stability

Financial stability lies at the core of Quicken Loans' ability to provide secure and reliable mortgage financing. A financially stable lender is better equipped to navigate economic fluctuations, ensuring its capacity to fulfill its commitments to borrowers.

- Access to Capital: Quicken Loans' strong financial standing allows it to access capital at favorable terms, ensuring a steady flow of funds for mortgage lending.

- Low Risk of Default: With a strong financial foundation, Quicken Loans is less likely to default on its obligations, providing peace of mind to borrowers.

- Commitment to Long-Term Lending: Financial stability enables Quicken Loans to maintain a long-term perspective in its lending practices, fostering stable relationships with borrowers.

- Compliance with Regulations: A financially sound lender is better positioned to comply with regulatory requirements, ensuring adherence to ethical and responsible lending practices.

In summary, Quicken Loans' financial stability serves as a cornerstone of its safety and reliability as a mortgage lender. It allows the company to meet its obligations to borrowers, navigate economic challenges, and maintain a commitment to ethical lending practices.

2. Industry Accreditation

Industry accreditation serves as a testament to Quicken Loans' commitment to upholding the highest standards in mortgage lending. The Mortgage Bankers Association (MBA) is a prestigious organization that sets forth rigorous criteria for its members, ensuring their adherence to ethical and responsible practices.

By achieving MBA accreditation, Quicken Loans demonstrates its dedication to:

Read also:Explore Jack Nicholsons Iconic Residence A Legacy Of Hollywood Glamour

- Compliance with Regulations: Accredited lenders must comply with all applicable federal and state laws governing mortgage lending, safeguarding borrowers' interests.

- Ethical Lending Practices: The MBA's Code of Ethics outlines strict guidelines for fair and transparent lending practices, which accredited lenders must follow.

- Consumer Protection: Accredited lenders prioritize protecting consumers' rights and ensuring they receive clear and accurate information throughout the mortgage process.

- Professional Development: MBA accreditation requires ongoing professional development for loan officers, ensuring they stay abreast of industry best practices and regulatory changes.

The significance of industry accreditation cannot be overstated. It provides borrowers with the assurance that they are working with a reputable lender committed to their best interests. Accredited lenders like Quicken Loans are held to a higher standard of accountability, fostering trust and confidence in the mortgage lending process.

3. Customer Satisfaction

Customer satisfaction is a cornerstone of Quicken Loans' commitment to safety and reliability. By prioritizing customer satisfaction, Quicken Loans fosters trust and confidence among borrowers, contributing to its overall safety as a mortgage lender.

- Personalized Guidance: Quicken Loans assigns dedicated loan officers to borrowers, providing personalized guidance and support throughout the mortgage process. This personalized approach helps ensure that borrowers fully understand their loan options and make informed decisions.

- Range of Mortgage Products: Quicken Loans offers a wide range of mortgage products tailored to diverse financial needs. This allows borrowers to find the loan that best fits their unique circumstances, enhancing their overall satisfaction and peace of mind.

- Commitment to Communication: Quicken Loans maintains open communication with borrowers, keeping them informed at every stage of the loan process. This transparency fosters trust and reduces uncertainty, contributing to a positive customer experience.

- Positive Customer Feedback: Quicken Loans consistently receives positive customer feedback, reflecting its commitment to customer satisfaction. Positive feedback serves as a testament to the company's reliability and dedication to providing a safe and supportive lending experience.

In summary, Quicken Loans' focus on customer satisfaction plays a vital role in its safety and reliability as a mortgage lender. By prioritizing personalized guidance, offering a range of loan products, maintaining open communication, and consistently meeting customer expectations, Quicken Loans fosters trust and confidence among borrowers.

4. Transparency

Transparency is a cornerstone of Quicken Loans' commitment to safety and reliability as a mortgage lender. By embracing transparency in its lending practices, Quicken Loans builds trust and confidence among borrowers, contributing to its overall safety.

Transparency in lending involves providing borrowers with clear and accurate information about the loan process, loan terms, and associated costs. Quicken Loans achieves this through various means, including:

- Clear and Concise Loan Documents: Quicken Loans ensures that loan documents are written in a clear and easy-to-understand language, enabling borrowers to fully comprehend the terms of their loan.

- Online Loan Tracking: Borrowers have access to an online portal where they can track the progress of their loan application and review loan details, fostering transparency and reducing uncertainty.

- Dedicated Loan Officers: Quicken Loans assigns dedicated loan officers to borrowers, providing personalized guidance and answering any questions that may arise, ensuring borrowers have a clear understanding of their loan options and obligations.

The practical significance of transparency in lending cannot be overstated. It empowers borrowers to make informed decisions about their mortgage, reducing the risk of misunderstandings or unexpected financial burdens. Transparency also fosters trust between borrowers and lenders, creating a solid foundation for a successful and safe mortgage experience.

In summary, Quicken Loans' commitment to transparency in its lending practices is a vital component of its safety and reliability as a mortgage lender. By providing clear and accurate information, Quicken Loans empowers borrowers, builds trust, and contributes to a positive and secure mortgage experience.

5. Reputation

A positive reputation in the financial industry is a cornerstone of Quicken Loans' safety and reliability as a mortgage lender. Reputation serves as a powerful indicator of a company's trustworthiness, ethical practices, and commitment to customer satisfaction.

Quicken Loans has consistently maintained a positive reputation through its dedication to fair lending practices, transparent communication, and customer-centric approach. This reputation is reflected in numerous industry awards and accolades, as well as positive customer feedback and testimonials.

The practical significance of reputation in assessing the safety of a mortgage lender cannot be overstated. A positive reputation indicates that Quicken Loans has a proven track record of reliability, integrity, and ethical behavior. This provides borrowers with a sense of security and trust, knowing that they are dealing with a reputable lender committed to their best interests.

In summary, Quicken Loans' positive reputation in the financial industry is a vital component of its safety and reliability as a mortgage lender. This reputation serves as a testament to the company's commitment to ethical practices, customer satisfaction, and maintaining high standards of integrity in all its operations.

6. Regulatory Compliance

Regulatory compliance lies at the heart of Quicken Loans' commitment to safety and reliability as a mortgage lender. By strictly adhering to regulatory guidelines, Quicken Loans ensures that its lending practices align with established standards and legal requirements, contributing to the overall safety of its lending operations.

Compliance with federal and state laws governing mortgage lending is paramount for several reasons. First, it protects borrowers from predatory lending practices and ensures that they receive fair and transparent treatment throughout the loan process. Second, compliance helps maintain the stability of the financial system by minimizing the risk of defaults and foreclosures. Third, it fosters trust and confidence in the mortgage lending industry, which is essential for a healthy economy.

Quicken Loans' commitment to regulatory compliance is evident in its operations. The company has implemented robust internal controls and risk management systems to ensure that its lending practices comply with all applicable laws and regulations. Quicken Loans also regularly undergoes audits and examinations by regulatory agencies to verify its compliance and adherence to best practices.

The practical significance of regulatory compliance cannot be overstated. By adhering to established rules and regulations, Quicken Loans demonstrates its commitment to ethical and responsible lending practices, which contributes to its safety and reliability as a mortgage lender. Compliance also helps protect borrowers, maintain the stability of the financial system, and foster trust in the mortgage lending industry.

7. Technology

In the realm of mortgage lending, technology plays a pivotal role in enhancing safety and reliability. Quicken Loans' embrace of advanced technology contributes significantly to its reputation as a safe and dependable lender.

- Automated Processes: Quicken Loans employs sophisticated technology to automate various aspects of the mortgage process, reducing the risk of human error and expediting loan processing. This automation streamlines the workflow, ensuring greater efficiency and accuracy, which ultimately benefits borrowers by reducing the likelihood of delays or complications.

- Secure Online Platform: Quicken Loans provides borrowers with a secure online platform where they can access loan information, submit documentation, and track the progress of their application. This platform utilizes robust encryption measures to safeguard sensitive data and protect borrowers' privacy. By leveraging advanced technology, Quicken Loans enhances the security of the mortgage process, mitigating the risk of fraud or data breaches.

- Risk Assessment: Quicken Loans harnesses the power of technology to conduct thorough risk assessments on loan applications. This involves analyzing vast amounts of data to evaluate a borrower's financial history, creditworthiness, and other relevant factors. By employing advanced algorithms and machine learning, Quicken Loans can make more informed lending decisions, reducing the risk of defaults and ensuring the safety of its lending practices.

- Fraud Detection: Quicken Loans deploys sophisticated fraud detection systems to identify and prevent fraudulent loan applications. These systems utilize advanced analytics to detect suspicious patterns or inconsistencies in loan applications, helping to protect borrowers from predatory lending practices and safeguarding the integrity of the mortgage process.

In conclusion, Quicken Loans' commitment to leveraging advanced technology not only enhances the efficiency and convenience of the mortgage process but also contributes significantly to its safety and reliability. By automating processes, providing a secure online platform, conducting thorough risk assessments, and implementing robust fraud detection systems, Quicken Loans demonstrates its commitment to protecting borrowers and maintaining the integrity of its lending practices.

8. BBB Rating

The Better Business Bureau (BBB) is a respected organization that evaluates businesses based on their commitment to ethical practices and customer satisfaction. An A+ rating from the BBB is a testament to Quicken Loans' dedication to these principles, which directly contributes to its overall safety and reliability as a mortgage lender.

A high BBB rating indicates that Quicken Loans prioritizes transparency, honesty, and responsiveness in its dealings with customers. The BBB rating process involves a rigorous evaluation of a company's business practices, including its complaint history, customer reviews, and adherence to ethical standards. By maintaining an A+ rating, Quicken Loans demonstrates its ongoing commitment to ethical behavior and customer satisfaction.

For borrowers, the significance of Quicken Loans' BBB rating cannot be overstated. It provides a level of assurance that the company is committed to fair and responsible lending practices, which contributes to the safety and security of the mortgage process. A high BBB rating indicates that Quicken Loans is less likely to engage in predatory lending practices or engage in deceptive or misleading advertising.

In summary, Quicken Loans' A+ BBB rating serves as a valuable indicator of its safety and reliability as a mortgage lender. This rating reflects the company's commitment to ethical business practices and customer satisfaction, providing borrowers with peace of mind and confidence in the mortgage process.

FAQs about Quicken Loans' Safety and Reliability

Several common concerns and misconceptions surround the safety and reliability of Quicken Loans as a mortgage lender. To address these concerns effectively, we present a series of frequently asked questions (FAQs) and their corresponding answers, providing clear and informative insights.

Question 1: Is Quicken Loans a legitimate lender?

Answer: Yes, Quicken Loans is a legitimate and established mortgage lender with a proven track record in the industry. The company has been operating for over three decades and has funded millions of mortgages nationwide.

Question 2: Is my personal information secure with Quicken Loans?

Answer: Quicken Loans takes data security seriously and employs robust measures to protect customer information. The company uses encryption technologies, multi-factor authentication, and industry-leading security protocols to safeguard sensitive data.

Question 3: Are Quicken Loans' interest rates competitive?

Answer: Quicken Loans offers competitive interest rates on its mortgage products. The company works with a network of lenders to secure favorable rates for its customers. Additionally, Quicken Loans provides transparent pricing information, enabling borrowers to make informed decisions.

Question 4: What are the eligibility criteria for a Quicken Loans mortgage?

Answer: Quicken Loans has flexible eligibility criteria to accommodate a wide range of financial situations. The company considers factors such as credit history, debt-to-income ratio, and property type when evaluating loan applications.

Question 5: How long does it typically take to close a mortgage with Quicken Loans?

Answer: Quicken Loans prides itself on its efficient mortgage process. On average, borrowers can expect to close their loan within 30 to 45 days from application to funding.

Question 6: What is Quicken Loans' customer service like?

Answer: Quicken Loans places great emphasis on customer satisfaction. The company provides dedicated loan officers who offer personalized guidance and support throughout the mortgage process. Additionally, Quicken Loans has a responsive customer service team available to assist borrowers with any questions or concerns.

Summary: Quicken Loans has established itself as a safe, reliable, and competitive mortgage lender in the industry. The company's commitment to data security, competitive rates, flexible eligibility criteria, efficient closing process, and exceptional customer service contributes to its overall reputation as a trustworthy and dependable lender.

Transition: To further explore Quicken Loans' offerings and determine if it is the right choice for your mortgage needs, continue to the next section for more detailed information.

Tips to Ensure a Safe and Successful Mortgage Experience with Quicken Loans

To maximize your safety and satisfaction when obtaining a mortgage with Quicken Loans, consider the following valuable tips:

Tip 1: Research and Compare Lenders: Before selecting Quicken Loans, research and compare multiple lenders to ensure you secure the best rates and terms for your financial situation.

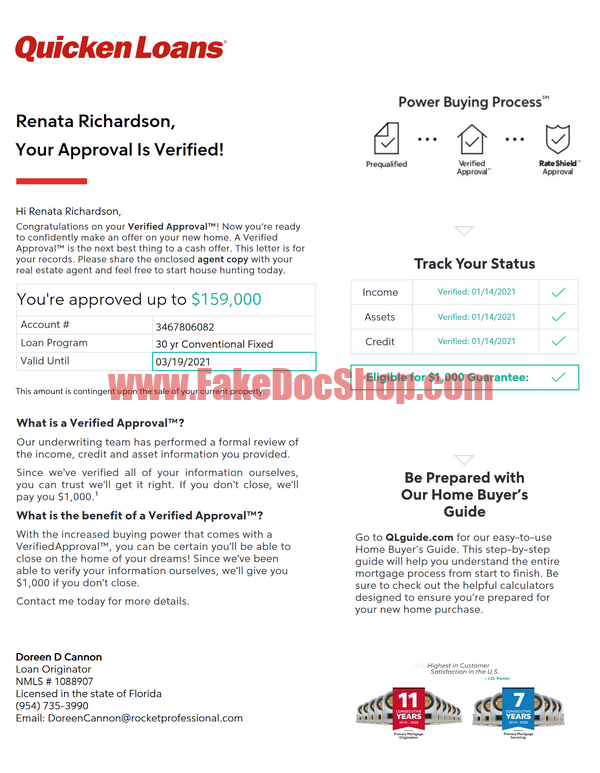

Tip 2: Get Pre-Approved: Obtain a pre-approval letter from Quicken Loans to determine your borrowing capacity and strengthen your position during the home search process.

Tip 3: Understand Loan Terms: Carefully review and comprehend the loan terms, including interest rates, closing costs, and monthly payments, before finalizing your mortgage agreement.

Tip 4: Seek Professional Advice: Consult with a financial advisor or real estate agent to gain expert insights and guidance throughout the mortgage process.

Tip 5: Protect Your Personal Information: Be vigilant about safeguarding your personal and financial information during the loan application process, and report any suspicious activity promptly.

Tip 6: Communicate Effectively: Maintain open communication with your Quicken Loans loan officer to clarify any questions or concerns and ensure a smooth loan process.

Tip 7: Review Loan Documents Thoroughly: Before signing any loan documents, take the time to thoroughly review and understand each document, seeking clarification if needed.

Tip 8: Monitor Your Loan: Once your loan is finalized, continue to monitor your mortgage account regularly to track payments, interest rates, and any potential issues.

Summary: By following these tips, you can enhance your safety and ensure a successful mortgage experience with Quicken Loans. Remember to prioritize research, due diligence, and effective communication to safeguard your financial interests and achieve your homeownership goals.

Transition: To further explore Quicken Loans' mortgage offerings and determine if they align with your financial needs, continue to the next section for detailed information.

Is Quicken Loans Safe?

In conclusion, Quicken Loans has established itself as a reputable and reliable mortgage lender through its strong financial standing, industry accreditation, commitment to customer satisfaction, emphasis on transparency, positive industry reputation, strict regulatory compliance, utilization of advanced technology, and an A+ rating from the Better Business Bureau. By adhering to ethical practices, providing competitive rates, maintaining flexible eligibility criteria, and offering exceptional customer service, Quicken Loans empowers borrowers to make informed decisions and navigate the mortgage process with confidence.

To ensure a safe and successful mortgage experience with Quicken Loans, it is crucial to conduct thorough research, seek professional advice, protect personal information, communicate effectively, and diligently review loan documents. By embracing these measures, borrowers can safeguard their financial interests and achieve their homeownership goals. Quicken Loans remains dedicated to providing a secure and supportive lending environment, fostering trust and peace of mind throughout the mortgage journey.

Dokyeom MBTI: Unraveling The SEVENTEEN Member's Personality Type

Unveiling The Nigerian Roots: Is Tyler, The Creator Nigerian?

Top-Rated Breakfast Spots You Can't Miss In Houston

Quicken Loans Arena Section 116 Cleveland Cavaliers

Quicken Loans Template In Word And PDF Format

Are Online Title Loans Safe?