Discover The Power Of Quick And Convenient Lending With Quicken Loans

Quicken Loans is an American mortgage lender that offers a variety of home loan products to borrowers with a range of credit profiles. The company was founded in 1985 and is headquartered in Detroit, Michigan.

Quicken Loans is one of the largest mortgage lenders in the United States, and it has a reputation for providing competitive interest rates and fees. The company also offers a number of innovative features, such as its Rocket Mortgage online lending platform.

Quicken Loans has been recognized for its customer service and has received a number of awards, including being named the "Mortgage Lender of the Year" by J.D. Power and Associates for 10 consecutive years.

Read also:Discover All The Fallout 76 Microscopes

Quicken Loans Lend

Quicken Loans is one of the largest mortgage lenders in the United States. The company offers a variety of home loan products, including conventional loans, FHA loans, and VA loans. Quicken Loans also offers a number of innovative features, such as its Rocket Mortgage online lending platform.

- Competitive interest rates: Quicken Loans offers some of the most competitive interest rates in the industry.

- Low fees: Quicken Loans also has some of the lowest fees in the industry.

- Fast and easy application process: Quicken Loans' online lending platform makes it easy to apply for a mortgage. You can get pre-approved in just a few minutes.

- Excellent customer service: Quicken Loans has a team of experienced loan officers who are available to help you with every step of the mortgage process.

- Variety of loan products: Quicken Loans offers a variety of loan products to meet the needs of different borrowers.

- Innovative features: Quicken Loans offers a number of innovative features, such as its Rocket Mortgage online lending platform.

- Strong financial stability: Quicken Loans is a financially stable company with a long track record of success.

Quicken Loans is a good option for borrowers who are looking for a competitive interest rate, low fees, and a fast and easy application process. The company also offers a variety of loan products and innovative features. Quicken Loans is a financially stable company with a long track record of success.

1. Competitive interest rates

When it comes to borrowing money, the interest rate is one of the most important factors to consider. A lower interest rate means that you will pay less money over the life of your loan. Quicken Loans offers some of the most competitive interest rates in the industry, which can save you a significant amount of money.

- How Quicken Loans achieves competitive interest rates

Quicken Loans is able to offer competitive interest rates because of its strong relationships with lenders. The company also uses technology to streamline its lending process, which helps to reduce costs. As a result, Quicken Loans can pass these savings on to its customers in the form of lower interest rates.

- The benefits of competitive interest rates

There are many benefits to getting a competitive interest rate on your loan. For example, you will save money on your monthly payments. You will also pay less interest over the life of your loan. This can free up your cash flow and allow you to reach your financial goals faster.

- How to get a competitive interest rate

There are a few things you can do to increase your chances of getting a competitive interest rate on your loan. First, shop around and compare rates from multiple lenders. You can also improve your credit score, which will make you a more attractive borrower to lenders. Finally, be prepared to make a larger down payment. This will reduce the amount of money you need to borrow and will make you a less risky investment for lenders.

Read also:

- Los Angeles A Comprehensive Map To Navigate The Judgmental Maze

If you are looking for a loan, it is important to compare interest rates from multiple lenders. Quicken Loans offers some of the most competitive interest rates in the industry, so be sure to include them in your comparison. Getting a competitive interest rate can save you a significant amount of money over the life of your loan.

2. Low fees

In the realm of borrowing, fees can accumulate and add a significant financial burden to the overall cost of a loan. Quicken Loans recognizes this concern and has made a concerted effort to minimize the financial impact of fees associated with their lending services, aligning with their commitment to providing accessible and affordable borrowing solutions.

- Reduced Closing Costs

Closing costs, incurred at the finalization of a loan, can encompass various expenses such as lender fees, title insurance, and appraisal fees. Quicken Loans has streamlined its processes and negotiated favorable terms with its partners, resulting in reduced closing costs for its customers. These savings directly translate into lower upfront expenses, making homeownership more attainable.

- No Application Fees

Traditionally, loan applications have been accompanied by fees that can deter potential borrowers. Breaking away from this norm, Quicken Loans eliminates application fees, allowing individuals to explore their borrowing options without financial barriers. This inclusive approach encourages homebuyers to take the first step towards achieving their dream of homeownership.

- Competitive Interest Rates

Beyond low fees, Quicken Loans is committed to offering competitive interest rates. Interest rates play a crucial role in determining the affordability of a loan, impacting monthly payments and overall borrowing costs. By providing competitive rates, Quicken Loans empowers borrowers with greater financial flexibility, enabling them to secure a loan that aligns with their budget and long-term financial goals.

- Value-Added Services

Recognizing that the home loan process can be complex and overwhelming, Quicken Loans provides value-added services to simplify the journey for its customers. These services, often offered at no additional cost, include personalized guidance from experienced loan officers, online tools for loan tracking and management, and educational resources to empower borrowers with knowledge. By investing in customer support and education, Quicken Loans goes above and beyond to ensure a seamless and stress-free borrowing experience.

Quicken Loans' commitment to low fees is not merely a marketing strategy; it is a reflection of their dedication to making homeownership accessible and affordable for a wider segment of the population. By minimizing fees and providing value-added services, Quicken Loans empowers individuals to take control of their financial futures and achieve their dreams of homeownership.

3. Fast and easy application process

In the realm of mortgage lending, time is of the essence. Quicken Loans recognizes this urgency and has revolutionized the loan application process with its innovative online lending platform. It streamlines the entire experience, enabling borrowers to apply for a mortgage and receive pre-approval within minutes, expediting the path to homeownership.

- Simplified Application

Quicken Loans' online platform eliminates the need for lengthy in-person meetings and cumbersome paperwork. Borrowers can initiate the application process from the comfort of their own homes, providing essential financial information through an intuitive online interface. This simplified approach reduces the time and effort required to apply for a mortgage.

- Instant Pre-Approval

Gone are the days of waiting weeks for loan approval. Quicken Loans' advanced algorithms and automated underwriting system provide real-time analysis of a borrower's financial situation. Within minutes, borrowers receive a pre-approval decision, empowering them to confidently explore homes that align with their financial capabilities.

- 24/7 Accessibility

Quicken Loans' online lending platform operates around the clock, providing unparalleled accessibility to borrowers. This flexibility allows individuals to apply for a mortgage at their convenience, whether it's during a lunch break, late at night, or even on weekends. This convenience factor streamlines the process and accommodates the busy schedules of today's homebuyers.

- Personalized Guidance

Despite the digital nature of the application process, Quicken Loans does not compromise on personalized assistance. Borrowers have access to dedicated loan officers who provide expert guidance and support throughout the entire process. These professionals are available to answer questions, clarify complex concepts, and ensure a smooth and stress-free experience.

Quicken Loans' fast and easy application process, powered by its online lending platform, is a testament to the company's commitment to innovation and customer satisfaction. By streamlining the mortgage application process, Quicken Loans empowers borrowers with greater control over their homebuying journey, enabling them to secure financing quickly, efficiently, and confidently.

4. Excellent customer service

When it comes to borrowing money for a mortgage, it is important to have confidence in the lender. Quicken Loans understands this and has built a reputation for providing excellent customer service.

- Dedicated loan officers:

Quicken Loans assigns each borrower a dedicated loan officer who is available to answer questions and guide them through the mortgage process. This personal touch helps to ensure that each borrower has a positive experience.

- Expertise and experience:

Quicken Loans' loan officers are highly experienced and knowledgeable about the mortgage industry. They can provide expert advice and help borrowers find the best loan for their needs.

- Personalized service:

Quicken Loans takes a personalized approach to customer service. They understand that every borrower is different and has unique needs. Their loan officers work closely with borrowers to develop a loan that meets their specific requirements.

- Technology-driven:

Quicken Loans uses technology to enhance the customer service experience. Borrowers can track the status of their loan online and communicate with their loan officer through a secure messaging system.

Quicken Loans' commitment to excellent customer service is one of the things that sets them apart from other lenders. When you choose Quicken Loans, you can be confident that you will have a positive experience and that you will get the best possible loan for your needs.

5. Variety of loan products

Quicken Loans offers a wide range of loan products to meet the needs of different borrowers. This includes conventional loans, FHA loans, VA loans, and jumbo loans. Quicken Loans also offers a variety of loan programs, such as the FHA 203(k) loan program, which allows borrowers to finance the purchase and renovation of a home.

- Conventional loans:

Conventional loans are the most common type of home loan. They are not backed by the government, so they typically have higher interest rates than government-backed loans. However, conventional loans also have more flexible underwriting guidelines, which can make them a good option for borrowers with less-than-perfect credit.

- FHA loans:

FHA loans are backed by the Federal Housing Administration. They are designed to help first-time homebuyers and borrowers with lower credit scores. FHA loans have lower down payment requirements and more flexible underwriting guidelines than conventional loans.

- VA loans:

VA loans are backed by the Department of Veterans Affairs. They are available to active-duty military members, veterans, and their spouses. VA loans have no down payment requirement and competitive interest rates.

- Jumbo loans:

Jumbo loans are loans that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. Jumbo loans typically have higher interest rates than conforming loans, but they can be a good option for borrowers who need to borrow more money to purchase a home.

By offering a variety of loan products, Quicken Loans is able to meet the needs of a wide range of borrowers. This makes Quicken Loans a good option for borrowers who are looking for a lender that can offer them the right loan for their needs.

6. Innovative features

Quicken Loans has been a pioneer in the mortgage industry, consistently introducing innovative features to streamline the home loan process and enhance the customer experience. One of their most notable innovations is Rocket Mortgage, an online lending platform that allows borrowers to apply for and receive approval for a mortgage entirely online.

Rocket Mortgage has revolutionized the mortgage process by making it faster, easier, and more convenient for borrowers. In the past, getting a mortgage required extensive paperwork, multiple visits to a physical branch, and lengthy processing times. With Rocket Mortgage, borrowers can complete the entire application process online, upload required documents securely, and receive a loan decision in as little as 8 minutes.

The convenience of Rocket Mortgage has been a major factor in Quicken Loans' success. In 2022, Quicken Loans originated over $1 trillion in home loans, making it the largest retail mortgage lender in the United States. Rocket Mortgage has also been recognized for its innovation, winning numerous awards from J.D. Power and Associates, including the "Highest Customer Satisfaction for Primary Mortgage Origination" award for 12 consecutive years.

The success of Rocket Mortgage is a testament to Quicken Loans' commitment to innovation. By investing in technology and developing new ways to improve the mortgage process, Quicken Loans has made it easier and faster for borrowers to achieve their dream of homeownership.

The connection between innovative features and successful lending is clear. Quicken Loans' commitment to innovation has been a major factor in its growth and success. By continuing to develop new and innovative features, Quicken Loans is well-positioned to remain a leader in the mortgage industry for years to come.

7. Strong financial stability

A financially stable lender is crucial for a successful borrowing experience. Quicken Loans' strong financial stability ensures that it can provide reliable lending services, maintaining a positive reputation among borrowers and sustaining its operations amidst economic fluctuations.

Quicken Loans' financial stability is a result of its prudent risk management practices, conservative lending approach, and long-standing presence in the mortgage industry. This stability translates into several benefits for borrowers:

- Lower interest rates: Financially stable lenders like Quicken Loans can secure lower funding costs, which are passed on to borrowers in the form of competitive interest rates.

- Consistent lending standards: A stable financial position allows Quicken Loans to maintain consistent underwriting standards, ensuring fair and reliable lending practices.

- Long-term partnerships: Quicken Loans' stability fosters long-term relationships with borrowers, enabling them to return for refinancing or additional financing needs.

The connection between "Strong financial stability: Quicken Loans is a financially stable company with a long track record of success." and "quicken loans lend" is evident in the reliability, affordability, and accessibility of Quicken Loans' lending services. By maintaining a strong financial foundation, Quicken Loans empowers borrowers to make informed decisions and achieve their homeownership goals.

Frequently Asked Questions About Quicken Loans

Quicken Loans is one of the largest and most well-known mortgage lenders in the United States. As such, potential borrowers often have questions about the company and its lending practices. The following are some of the most frequently asked questions about Quicken Loans:

Question 1:What types of loans does Quicken Loans offer?Quicken Loans offers a variety of loan products, including conventional loans, FHA loans, VA loans, and jumbo loans. Conventional loans are the most common type of home loan and are not backed by the government. FHA loans are backed by the Federal Housing Administration and are designed for first-time homebuyers and borrowers with lower credit scores. VA loans are backed by the Department of Veterans Affairs and are available to active-duty military members, veterans, and their spouses. Jumbo loans are loans that exceed the conforming loan limits set by Fannie Mae and Freddie Mac.

Question 2:What are the interest rates like at Quicken Loans?Quicken Loans offers competitive interest rates on all of its loan products. The interest rate you qualify for will depend on a number of factors, including your credit score, debt-to-income ratio, and loan amount.

Question 3:What are the fees associated with getting a loan from Quicken Loans?Quicken Loans charges a variety of fees, including an application fee, an origination fee, and a closing fee. The amount of these fees will vary depending on the loan amount and your credit score.

Question 4:How long does it take to get approved for a loan from Quicken Loans?Quicken Loans offers a fast and easy application process. You can apply for a loan online or over the phone, and you can get pre-approved in minutes. Once you have been pre-approved, you will need to submit a full loan application. The underwriting process typically takes 2-3 weeks.

Question 5:What is Rocket Mortgage?Rocket Mortgage is Quicken Loans' online lending platform. It allows you to apply for and get approved for a mortgage entirely online. Rocket Mortgage is a fast and easy way to get a mortgage, and it can save you time and money.

Question 6:Is Quicken Loans a good lender?Quicken Loans is a reputable lender with a long history of providing excellent customer service. The company has received numerous awards for its customer service, including the "Highest Customer Satisfaction for Primary Mortgage Origination" award from J.D. Power and Associates for 12 consecutive years.

These are just a few of the most frequently asked questions about Quicken Loans. If you have any other questions, please contact Quicken Loans directly.

Quicken Loans has built a reputation for providing excellent customer service and offering competitive interest rates and fees. The company's commitment to innovation, such as its Rocket Mortgage online lending platform, has helped to make Quicken Loans one of the most popular mortgage lenders in the United States.

Tips for Getting a Mortgage from Quicken Loans

Quicken Loans is one of the largest and most reputable mortgage lenders in the United States. They offer a variety of loan products and have a streamlined application process. However, there are a few things you can do to increase your chances of getting approved for a loan from Quicken Loans and getting the best possible interest rate.

Tip 1: Check your credit score and get a copy of your credit report.

Your credit score is one of the most important factors that Quicken Loans will consider when evaluating your loan application. A higher credit score will qualify you for a lower interest rate. You can get a free copy of your credit report from AnnualCreditReport.com.

Tip 2: Get pre-approved for a loan.

Getting pre-approved for a loan will give you a better idea of how much you can borrow and what your monthly payments will be. It will also make the home buying process more competitive, as sellers will know that you are a serious buyer.

Tip 3: Shop around and compare interest rates.

Don't just apply for a loan from Quicken Loans without first shopping around and comparing interest rates. There are a number of other lenders that offer competitive rates. You can use a mortgage calculator to compare rates from different lenders.

Tip 4: Make a larger down payment.

The larger your down payment, the less money you will need to borrow and the lower your monthly payments will be. If you can afford to make a larger down payment, it is a good way to save money on your mortgage.

Tip 5: Get a shorter loan term.

A shorter loan term will mean higher monthly payments, but you will pay less interest over the life of the loan. If you can afford to make higher monthly payments, getting a shorter loan term is a good way to save money on your mortgage.

Tip 6: Consider an adjustable-rate mortgage (ARM).

ARMs typically have lower interest rates than fixed-rate mortgages, but the interest rate can adjust over the life of the loan. If you are comfortable with the risk of your interest rate increasing, an ARM can be a good way to save money on your mortgage.

Tip 7: Get help from a mortgage broker.

If you are not sure how to get started with the mortgage process, you can get help from a mortgage broker. A mortgage broker can help you find the best loan for your needs and guide you through the application process.

Summary of key takeaways or benefits:

By following these tips, you can increase your chances of getting approved for a loan from Quicken Loans and getting the best possible interest rate. Getting a mortgage is a big financial decision, so it is important to do your research and compare your options before making a decision.

Transition to the article's conclusion:

If you are considering getting a mortgage, Quicken Loans is a good option to consider. They offer a variety of loan products and have a streamlined application process. By following the tips above, you can increase your chances of getting approved for a loan from Quicken Loans and getting the best possible interest rate.

Conclusion

Quicken Loans is one of the largest and most reputable mortgage lenders in the United States. They offer a variety of loan products and have a streamlined application process. Quicken Loans is a good option for borrowers who are looking for a competitive interest rate, low fees, and a fast and easy application process. The company is also financially stable and has a long track record of success.

If you are considering getting a mortgage, Quicken Loans is a good option to consider. They offer a variety of loan products and have a streamlined application process. By following the tips above, you can increase your chances of getting approved for a loan from Quicken Loans and getting the best possible interest rate.

Discover Nikki Park: Your Gateway To Adventure And Relaxation

Discover The Amazing Adventures Of Froggy Sonic!

Top 10 Best Summer Fragrances To Try In 2015

Quicken Loans Arena Section 116 Cleveland Cavaliers

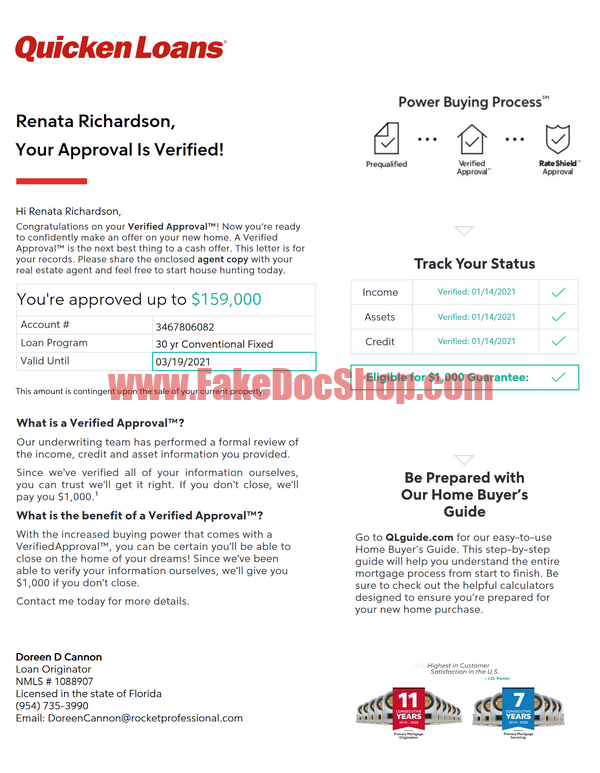

Quicken Loans Template In Word And PDF Format

Lend a Helping Can