Check Out Quicken Loans Borrower Reviews And Experiences

A Quicken Loans borrower is an individual or entity that has taken out a loan from Quicken Loans, a mortgage lender based in the United States. Quicken Loans offers a range of mortgage products, including conventional loans, FHA loans, VA loans, and jumbo loans. Borrowers can apply for a Quicken Loans mortgage online, over the phone, or through a local loan officer.

There are several benefits to being a Quicken Loans borrower. First, Quicken Loans offers competitive interest rates and fees. Second, Quicken Loans has a streamlined loan process that can help borrowers close on their loan quickly and easily. Third, Quicken Loans provides excellent customer service, with a dedicated team of loan officers and support staff available to help borrowers throughout the loan process.

If you are considering taking out a mortgage, Quicken Loans is a great option to consider. With its competitive rates, streamlined process, and excellent customer service, Quicken Loans can help you get the financing you need to purchase your dream home.

Read also:The Ultimate Guide To Stardust Bowl Merrillville History Causes And Impacts

Quicken Loans Borrower

When it comes to getting a mortgage, there are many different lenders to choose from. Quicken Loans is one of the largest and most well-known lenders in the United States. If you're considering taking out a mortgage with Quicken Loans, there are a few key things you should know.

- Competitive rates: Quicken Loans offers some of the most competitive interest rates in the industry.

- Streamlined process: Quicken Loans has a streamlined loan process that can help you close on your loan quickly and easily.

- Excellent customer service: Quicken Loans provides excellent customer service, with a dedicated team of loan officers and support staff available to help you throughout the loan process.

- Variety of loan products: Quicken Loans offers a variety of loan products, including conventional loans, FHA loans, VA loans, and jumbo loans.

- Online and offline options: You can apply for a Quicken Loans mortgage online, over the phone, or through a local loan officer.

- Pre-approval: Getting pre-approved for a Quicken Loans mortgage can help you get a better idea of how much you can afford to borrow and make the homebuying process smoother.

If you're considering taking out a mortgage, Quicken Loans is a great option to consider. With its competitive rates, streamlined process, and excellent customer service, Quicken Loans can help you get the financing you need to purchase your dream home.

1. Competitive rates

For borrowers, securing a mortgage with a competitive interest rate is crucial as it directly impacts their monthly mortgage payments and overall borrowing costs. Quicken Loans' commitment to offering some of the most competitive interest rates in the industry positions it as an attractive option for borrowers seeking to minimize their financial burden. By providing borrowers with lower interest rates, Quicken Loans enables them to qualify for larger loan amounts, purchase more expensive homes, or reduce their monthly payments, enhancing their financial flexibility and homeownership affordability.

For instance, a borrower who obtains a $200,000 mortgage with a 30-year term and an interest rate of 3.5% would have a monthly payment of approximately $955. If the same borrower were to secure a mortgage with a higher interest rate of 4%, their monthly payment would increase to around $1,006. Over the life of the loan, this difference in interest rate would result in the borrower paying thousands of dollars more in interest charges.

In conclusion, Quicken Loans' competitive rates play a pivotal role in making homeownership more accessible and affordable for borrowers. By offering lower interest rates, Quicken Loans empowers borrowers to make informed financial decisions, optimize their monthly cash flow, and achieve their homeownership aspirations.

2. Streamlined process

For Quicken Loans borrowers, the streamlined loan process offered by the lender provides numerous advantages that enhance their homebuying experience and expedite the path to homeownership.

Read also:Unique And Creative Nicknames For Morgan A Complete Guide

The streamlined process encompasses several key features that contribute to its efficiency and borrower-centric approach. Firstly, Quicken Loans utilizes an online platform that allows borrowers to complete their loan application and submit necessary documentation electronically. This eliminates the need for in-person visits to physical branches and streamlines the document collection process, saving borrowers valuable time and effort.

Additionally, Quicken Loans employs a team of experienced loan officers who are dedicated to guiding borrowers through each step of the loan process. These loan officers are readily available to answer questions, provide personalized advice, and ensure that borrowers understand all aspects of their loan. By providing personalized assistance, Quicken Loans empowers borrowers to make informed decisions and navigate the mortgage process with confidence.

The streamlined loan process offered by Quicken Loans has a profound impact on borrowers by reducing the time and effort required to secure a mortgage. This expedited process enables borrowers to close on their loans quickly and efficiently, often within 30 days or less. By minimizing the time it takes to complete the loan process, Quicken Loans helps borrowers seize time-sensitive opportunities, such as securing a favorable interest rate or purchasing a home in a competitive market.

In conclusion, Quicken Loans' streamlined loan process is an integral component of the borrower experience, providing numerous benefits that make the homebuying process smoother, faster, and more accessible. Its efficient online platform, experienced loan officers, and commitment to expediting the loan process empower borrowers to achieve their homeownership goals with greater ease and confidence.

3. Excellent customer service

Customer service is a crucial aspect of the mortgage borrowing experience. Quicken Loans recognizes this and places great emphasis on providing excellent customer service to its borrowers. A dedicated team of loan officers and support staff is available to assist borrowers throughout the loan process, from pre-approval to closing and beyond.

- Personalized guidance: Loan officers at Quicken Loans are knowledgeable and experienced professionals who provide personalized guidance to borrowers. They take the time to understand each borrower's unique financial situation and goals, and they work closely with them to find the best loan product and interest rate.

- Responsiveness: Quicken Loans' loan officers and support staff are highly responsive to borrowers' inquiries. They are available by phone, email, and chat, and they typically respond to inquiries within a short period of time. This responsiveness helps to ensure that borrowers' questions and concerns are addressed promptly.

- Problem-solving: Quicken Loans' loan officers and support staff are skilled at problem-solving. If a borrower encounters any issues during the loan process, they can work with the Quicken Loans team to find a solution. This problem-solving ability helps to ensure that borrowers have a smooth and stress-free experience.

- Commitment to satisfaction: Quicken Loans is committed to providing excellent customer service to its borrowers. The company's goal is to make the loan process as easy and stress-free as possible. This commitment to satisfaction is reflected in the company's high customer satisfaction ratings.

Excellent customer service is essential for Quicken Loans borrowers. It helps to ensure that borrowers have a positive experience throughout the loan process and that they are able to obtain the financing they need to purchase their dream home.

4. Variety of loan products

The variety of loan products offered by Quicken Loans is a significant advantage for borrowers, as it allows them to find the right loan for their individual needs and financial situation. This is especially important for borrowers who may not qualify for traditional conventional loans.

- Conventional loans: Conventional loans are the most common type of mortgage loan. They are not backed by the government, so they typically have stricter credit and income requirements than government-backed loans. However, conventional loans often have lower interest rates than government-backed loans.

- FHA loans: FHA loans are backed by the Federal Housing Administration. They are designed for borrowers with lower credit scores and down payments. FHA loans typically have lower interest rates than conventional loans, but they also have higher upfront costs.

- VA loans: VA loans are backed by the Department of Veterans Affairs. They are available to active-duty military members, veterans, and their spouses. VA loans have no down payment requirement and typically have lower interest rates than conventional loans.

- Jumbo loans: Jumbo loans are loans that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. They are typically used to finance high-priced homes. Jumbo loans typically have higher interest rates than conventional loans.

By offering a variety of loan products, Quicken Loans makes it possible for more borrowers to achieve their homeownership goals. This is especially important in today's competitive housing market, where it is more important than ever to find the right loan for your individual needs.

5. Online and offline options

The availability of both online and offline options for applying for a Quicken Loans mortgage provides several benefits to borrowers, enhancing their experience and accommodating diverse preferences.

Convenience and flexibility: Online applications offer unmatched convenience, allowing borrowers to initiate the loan process from anywhere with an internet connection. This flexibility is particularly valuable for borrowers with busy schedules or those who prefer the comfort and privacy of their own home. Additionally, the online platform enables borrowers to access loan information, track their application status, and upload necessary documents at their convenience.

Personalized guidance: While online applications offer convenience, some borrowers may prefer the personalized guidance and support of a local loan officer. Quicken Loans provides the option to connect with experienced loan officers who can provide expert advice, answer questions, and assist borrowers throughout the entire loan process. This face-to-face interaction can be invaluable for first-time homebuyers or borrowers with complex financial situations.

Tailored solutions: Whether borrowers choose to apply online or through a local loan officer, Quicken Loans is committed to finding the best loan solution for each individual's needs. The company's wide range of loan products, including conventional loans, FHA loans, VA loans, and jumbo loans, allows borrowers to explore various options and select the one that aligns with their financial goals and circumstances.

In conclusion, the combination of online and offline options empowers Quicken Loans borrowers with the flexibility and support they need to make informed decisions and navigate the mortgage process seamlessly. By providing both online convenience and personalized guidance, Quicken Loans caters to the diverse preferences and needs of borrowers, ultimately enhancing their homeownership journey.

6. Pre-approval

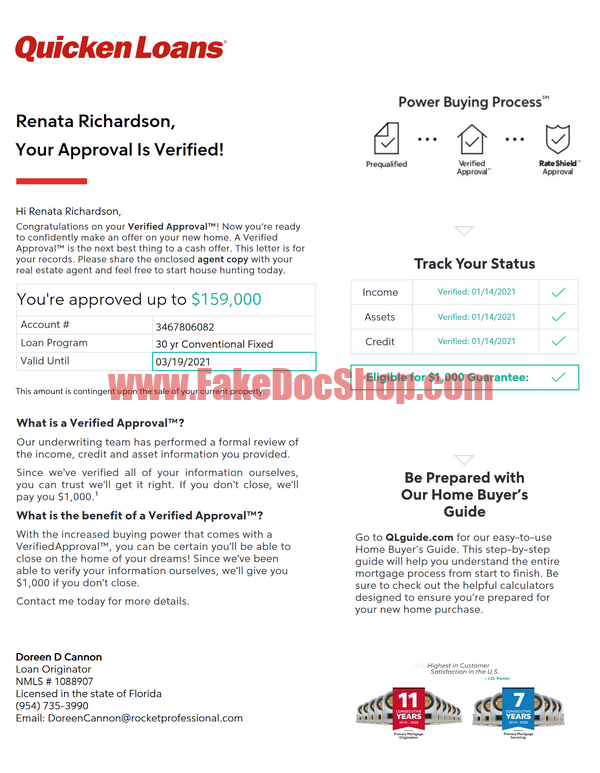

Pre-approval is an essential step in the homebuying process, and it can be especially beneficial for Quicken Loans borrowers. Getting pre-approved gives you a better understanding of your financial situation and how much you can afford to borrow. This can help you narrow your home search and make more informed decisions about your budget.

The pre-approval process is relatively simple and straightforward. You will need to provide Quicken Loans with some basic financial information, such as your income, debts, and assets. Quicken Loans will then use this information to determine how much you can afford to borrow. Once you are pre-approved, you will receive a letter from Quicken Loans that states the maximum amount you can borrow and the interest rate you qualify for.

Pre-approval can give you a number of advantages in the homebuying process. First, it can help you get your offer accepted. When you make an offer on a home, the seller will want to know that you are financially qualified to buy the home. A pre-approval letter from Quicken Loans can give the seller confidence that you are a serious buyer and that you have the financial means to purchase the home.

Second, pre-approval can help you save time. When you are pre-approved, you will have already completed a significant portion of the loan application process. This can save you time when you are ready to make an offer on a home. Quicken Loans can quickly and easily convert your pre-approval into a full loan application, which can help you close on your home faster.

Finally, pre-approval can help you get a better interest rate. When you are pre-approved, you lock in an interest rate for a certain period of time. This can protect you from rising interest rates, which can save you money on your mortgage.

If you are considering buying a home, getting pre-approved for a Quicken Loans mortgage is a smart move. Pre-approval can give you a number of advantages in the homebuying process, including a better understanding of your financial situation, a stronger offer, and a faster closing time.

Frequently Asked Questions by Quicken Loans Borrowers

This section will address frequently asked questions by Quicken Loans borrowers, providing clear and concise answers to common concerns and misconceptions. Each question and answer pair is designed to inform and empower borrowers throughout their homeownership journey.

Question 1: What are the benefits of getting pre-approved for a Quicken Loans mortgage?

Getting pre-approved for a Quicken Loans mortgage offers several advantages. It provides you with a clear understanding of your borrowing capacity, strengthens your offer when purchasing a home, expedites the loan application process, and potentially secures a favorable interest rate.

Question 2: How long does it take to get pre-approved for a Quicken Loans mortgage?

The pre-approval process at Quicken Loans is designed to be efficient and streamlined. Typically, you can complete the pre-approval process within a few business days by submitting the necessary financial information.

Question 3: What documents are required for a Quicken Loans mortgage application?

To apply for a Quicken Loans mortgage, you will need to provide documentation such as pay stubs, bank statements, tax returns, and a valid government-issued ID. The specific requirements may vary depending on your loan program and individual circumstances.

Question 4: Can I lock in my interest rate with Quicken Loans?

Yes, Quicken Loans allows borrowers to lock in their interest rate for a specified period. This protects you from potential interest rate fluctuations and ensures that you secure the quoted rate for your mortgage.

Question 5: What are the closing costs associated with a Quicken Loans mortgage?

Closing costs are fees paid at the closing of your mortgage loan. These costs may include lender fees, title insurance, appraisal fees, and other third-party charges. Quicken Loans provides a Loan Estimate that outlines the estimated closing costs associated with your loan.

Question 6: How can I track the progress of my Quicken Loans mortgage application?

Quicken Loans offers online tools that allow you to conveniently track the status of your mortgage application. You can access your loan information, upload required documents, and communicate with your loan officer through a secure online portal.

These frequently asked questions provide valuable insights into the Quicken Loans mortgage process, empowering borrowers with the knowledge they need to make informed decisions and navigate their homeownership journey with confidence.

For additional information and personalized assistance, Quicken Loans borrowers are encouraged to contact their dedicated loan officer or visit the Quicken Loans website.

Tips for Quicken Loans Borrowers

Navigating the homeownership journey with Quicken Loans can be a smooth and successful experience. By following these practical tips, borrowers can optimize their mortgage process and achieve their financial goals.

Tip 1: Get Pre-Approved for a MortgageObtain a clear understanding of your borrowing capacity and strengthen your offer when purchasing a home. Streamline the loan application process and secure a favorable interest rate.Tip 2: Gather Required DocumentsPrepare necessary financial documentation, including pay stubs, bank statements, tax returns, and a valid government-issued ID. Ensure timely submission to expedite the loan approval process.Tip 3: Explore Loan OptionsFamiliarize yourself with various loan programs offered by Quicken Loans, such as conventional, FHA, VA, and jumbo loans. Choose the loan product that best suits your financial situation and homeownership goals.Tip 4: Lock in Your Interest RateProtect yourself from interest rate fluctuations by locking in your rate for a specified period. Secure the quoted rate for your mortgage, providing stability and predictability.Tip 5: Monitor Your Application StatusUtilize Quicken Loans' online tools to conveniently track the progress of your mortgage application. Access loan information, upload required documents, and communicate with your loan officer through a secure online portal.Tip 6: Understand Closing CostsReview the Loan Estimate provided by Quicken Loans to identify the estimated closing costs associated with your loan. Prepare for these expenses, which may include lender fees, title insurance, appraisal fees, and other third-party charges.Tip 7: Communicate with Your Loan OfficerEstablish clear communication with your dedicated loan officer throughout the mortgage process. Seek guidance, ask questions, and stay informed about the status of your application.Tip 8: Prepare for Closing DayAttend the closing meeting well-prepared with the required documentation and funds. Review and sign the loan documents carefully to finalize your mortgage and take ownership of your new home.By implementing these tips, Quicken Loans borrowers can navigate the mortgage process with confidence, ensuring a smooth and successful homebuying experience.Remember to consult with your loan officer or visit the Quicken Loans website for additional information and personalized assistance.

Conclusion

Navigating the homeownership journey as a Quicken Loans borrower can be a financially rewarding and fulfilling experience. Throughout this exploration, we have highlighted key aspects of the Quicken Loans borrower experience, emphasizing the competitive rates, streamlined loan process, excellent customer service, variety of loan products, and convenient online and offline application options.

By leveraging these advantages and adhering to practical tips, Quicken Loans borrowers can make informed decisions, optimize their mortgage process, and achieve their homeownership aspirations. The commitment to providing exceptional service and innovative solutions positions Quicken Loans as a trusted partner in the homebuying journey. As the housing market continues to evolve, Quicken Loans remains dedicated to empowering borrowers with the knowledge, tools, and support they need to succeed in their financial endeavors.

Discover Mehar Bano Qureshi's Age: Unveiling The Truth

Outback Spotted Dog Sundae: The Ultimate Doggie Treat

The Ultimate Guide To Fisherman's Toast: From History To Recipe

CoBorrower Vs. CoSigner Their Differences Quicken Loans

Quicken Loans Arena Section 116 Cleveland Cavaliers

Quicken Loans Template In Word And PDF Format