The Ultimate Guide To Quicken Loan Fees: Everything You Need To Know

Quicken Loans fees are charges associated with obtaining a mortgage loan from Quicken Loans, a prominent mortgage lender in the United States. These fees can vary depending on the loan amount, loan type, and borrower's credit profile.

Quicken Loans fees typically include origination fees, underwriting fees, appraisal fees, and title search fees. Origination fees are typically a percentage of the loan amount and cover the lender's costs of processing and underwriting the loan. Underwriting fees are charged to assess the borrower's creditworthiness and determine the risk of default. Appraisal fees are paid to an independent appraiser to determine the value of the property securing the loan. Title search fees are used to ensure that the property has a clear title and is free of any liens or encumbrances.

Understanding Quicken Loans fees is crucial for borrowers to make informed decisions about their mortgage financing. It is essential to compare fees from different lenders and factor these costs into the overall cost of the loan. By being aware of the fees associated with Quicken Loans, borrowers can budget accordingly and ensure a smooth and successful mortgage process.

Read also:Discover Your Credit Score With Quicken Loans

Quicken Loan Fees

Quicken Loans fees are an essential consideration when applying for a mortgage loan from Quicken Loans. Understanding these fees can help borrowers make informed decisions and budget accordingly.

- Origination Fee: A percentage of the loan amount, covering processing and underwriting costs.

- Underwriting Fee: Assesses the borrower's creditworthiness and risk of default.

- Appraisal Fee: Paid to an appraiser to determine the property's value.

- Title Search Fee: Ensures the property has a clear title, free of liens or encumbrances.

- Loan Application Fee: May be charged to cover the initial processing of the loan application.

- Credit Report Fee: Obtains the borrower's credit history for underwriting purposes.

- Flood Certification Fee: Determines if the property is located in a flood zone.

- Attorney Fee: May be required in some states to review and finalize the loan documents.

These fees vary depending on the loan amount, loan type, and borrower's profile. By understanding the different types of Quicken Loan fees, borrowers can factor these costs into their overall mortgage budget and make informed decisions about their financing options.

1. Origination Fee

The origination fee is a key component of Quicken Loan fees. It is a one-time charge that covers the lender's costs of processing and underwriting the loan. The origination fee is typically a percentage of the loan amount, ranging from 0.5% to 1%.

- Purpose: The origination fee covers the lender's administrative costs, such as reviewing the loan application, verifying the borrower's financial information, and underwriting the loan.

- Impact on Borrowers: The origination fee is a direct cost to the borrower and should be factored into the overall cost of the loan. A higher origination fee can increase the total cost of the loan, so it is important to compare fees from different lenders.

- Negotiation: In some cases, borrowers may be able to negotiate a lower origination fee with the lender. This is especially true for borrowers with good credit and a strong financial profile.

Understanding the origination fee and its impact on the overall cost of the loan is crucial for borrowers considering a mortgage from Quicken Loans. By carefully evaluating the fees associated with their loan, borrowers can make informed decisions and choose the financing option that best meets their needs.

2. Underwriting Fee

The underwriting fee is an integral part of Quicken Loan fees, playing a critical role in the loan application process. It is a one-time charge that covers the lender's costs of assessing the borrower's creditworthiness and determining the risk of default.

- Purpose: The underwriting fee compensates the lender for the time and resources spent reviewing the borrower's financial history, including their credit report, income, and assets. This in-depth analysis helps the lender determine the borrower's ability to repay the loan and the likelihood of default.

- Impact on Borrowers: The underwriting fee is a direct cost to the borrower and should be factored into the overall cost of the loan. A higher underwriting fee can increase the total cost of the loan, so it is important to compare fees from different lenders.

- Risk Assessment: The underwriting process helps lenders assess the risk associated with each loan application. Borrowers with a higher credit score and lower debt-to-income ratio are generally considered lower risk and may qualify for a lower underwriting fee.

- Conditional Approval: In some cases, the underwriting process may result in conditional approval of the loan. This means that the loan is approved subject to certain conditions, such as providing additional documentation or improving the borrower's credit score.

Understanding the underwriting fee and its role in the Quicken Loan fees process is crucial for borrowers. By carefully considering the underwriting fee and comparing it to fees from other lenders, borrowers can make informed decisions and choose the financing option that best meets their needs.

Read also:Is Tyler The Creator Nigerian Find Out The Truth

3. Appraisal Fee

The appraisal fee is an essential component of Quicken Loan fees and plays a critical role in the mortgage process. It is a one-time charge paid to an independent appraiser to determine the property's value. This valuation is crucial for several reasons:

- Loan Approval: The appraisal fee helps the lender assess the property's value to determine whether it meets their lending criteria. A property that is appraised at or above the purchase price provides assurance to the lender that the loan is adequately secured.

- Loan-to-Value Ratio (LTV): The appraisal fee helps determine the loan-to-value ratio (LTV), which is the percentage of the loan amount to the appraised value of the property. A higher LTV can impact the loan terms, such as the interest rate and the need for private mortgage insurance (PMI).

- PMI: If the LTV is above a certain threshold, typically 80%, the borrower may be required to pay PMI. PMI is an insurance premium that protects the lender in case of default. The appraisal fee helps determine if PMI is necessary.

- Property Taxes and Insurance: The appraised value is also used to calculate property taxes and insurance premiums. An accurate appraisal ensures that these costs are based on the property's fair market value.

Understanding the appraisal fee and its significance within Quicken Loan fees is crucial for borrowers. By being aware of the purpose and impact of the appraisal fee, borrowers can make informed decisions throughout the mortgage process.

4. Title Search Fee

The title search fee is an integral part of Quicken Loan fees, serving a critical role in safeguarding the lender's interests and ensuring a smooth closing process. This fee covers the costs associated with conducting a thorough title search to uncover any potential liens, judgments, or other encumbrances that may affect the property's ownership.

- Protection for the Lender: By conducting a title search, Quicken Loans can verify that the borrower has clear ownership of the property and that there are no outstanding claims or liens that could jeopardize the lender's security interest in the property.

- Peace of Mind for the Borrower: A clear title search provides peace of mind to the borrower, as it assures them that they are purchasing a property with a clean ownership history and that their investment is protected.

- Closing Delays Prevention: A title search helps to prevent costly closing delays by identifying any potential title issues early on. By addressing these issues before closing, the lender and borrower can ensure a smooth and timely closing process.

- Legal Compliance: Title searches are required by law in most jurisdictions to ensure that the property being purchased has a clear and marketable title. Quicken Loans adheres to these legal requirements to ensure compliance and protect the interests of both the lender and the borrower.

In summary, the title search fee associated with Quicken Loan fees plays a vital role in protecting the lender's investment, providing peace of mind to the borrower, preventing closing delays, and ensuring legal compliance. By conducting a thorough title search, Quicken Loans helps to ensure a secure and successful real estate transaction.

5. Loan Application Fee

The loan application fee is a common component of Quicken Loan fees. It is a one-time charge that covers the lender's costs of processing and reviewing the borrower's loan application. This fee can range from $0 to several hundred dollars, depending on the lender and the complexity of the loan application.

The loan application fee is important because it helps to cover the lender's costs of processing the loan application. These costs can include reviewing the borrower's credit history, verifying the borrower's income and assets, and underwriting the loan. By paying the loan application fee, the borrower is helping to ensure that their loan application is processed quickly and efficiently.

In some cases, the loan application fee may be refundable if the borrower is not approved for the loan. However, in most cases, the loan application fee is non-refundable. Therefore, it is important to factor the loan application fee into the overall cost of the loan when budgeting for a mortgage.

Understanding the loan application fee and its importance as a component of Quicken Loan fees can help borrowers make informed decisions about their mortgage financing. By carefully considering the loan application fee and comparing it to fees from other lenders, borrowers can choose the financing option that best meets their needs.

6. Credit Report Fee

The credit report fee is an essential component of Quicken Loan fees, playing a critical role in the loan underwriting process. This fee covers the lender's costs of obtaining the borrower's credit history from one or more credit bureaus.

- Assessing Creditworthiness: The credit report fee enables Quicken Loans to assess the borrower's creditworthiness by reviewing their credit history. This includes factors such as payment history, outstanding debts, and credit utilization ratio.

- Underwriting Decision: The information obtained from the credit report is crucial for the lender to make an informed underwriting decision. A strong credit history with high scores can increase the likelihood of loan approval and favorable loan terms.

- Pricing and Risk: The credit report fee contributes to the lender's ability to price the loan appropriately based on the borrower's risk profile. Borrowers with lower credit scores may face higher interest rates or additional fees due to the increased risk associated with their credit history.

- Compliance and Legal Requirements: Obtaining a credit report is a standard practice in the mortgage industry and is often required by law. The credit report fee ensures compliance with these regulations and protects the lender's interests.

Understanding the significance of the credit report fee within Quicken Loan fees is essential for borrowers. By considering the role of credit history in the loan approval process, borrowers can take steps to improve their credit scores and enhance their chances of obtaining favorable loan terms. Additionally, comparing credit report fees from different lenders can help borrowers make informed decisions and choose the financing option that best meets their needs.

7. Flood Certification Fee

The flood certification fee is an important component of Quicken Loan fees, as it plays a vital role in determining the flood risk associated with a property.

- Flood Insurance: In areas designated as high-risk flood zones, the lender may require the borrower to purchase flood insurance. The flood certification fee covers the cost of obtaining a flood certification, which is a document that verifies the property's flood risk.

- Loan Approval: The flood certification fee contributes to the lender's assessment of the property's flood risk. In some cases, a property located in a high-risk flood zone may not be eligible for a loan from Quicken Loans or may require additional flood mitigation measures.

- Property Value: The flood certification fee is indirectly related to the property's value. Properties located in flood zones may have lower values due to the increased risk of flooding and the potential costs associated with flood damage.

- Compliance and Legal Requirements: Obtaining a flood certification is often required by law in flood-prone areas. The flood certification fee ensures that Quicken Loans is compliant with these regulations and protects the interests of both the lender and the borrower.

Understanding the significance of the flood certification fee within Quicken Loan fees is essential for borrowers. By being aware of the potential flood risks and the implications for loan approval and property value, borrowers can make informed decisions about their mortgage financing and take appropriate steps to mitigate flood risks.

8. Attorney Fee

The attorney fee is a potential component of Quicken Loan fees, applicable in certain states where legal representation is required during the mortgage closing process. This fee covers the services of an attorney who reviews and explains the loan documents to the borrower, ensuring that they understand the terms and obligations associated with the loan.

The importance of the attorney fee as part of Quicken Loan fees lies in its role in protecting the borrower's interests. An attorney can provide valuable guidance and ensure that the borrower comprehends the legal implications of the loan documents before signing. This can help prevent misunderstandings, disputes, and potential legal issues in the future.

In states where an attorney fee is required, borrowers should factor this cost into their overall mortgage budget. The fee can vary depending on the complexity of the loan transaction and the attorney's experience. It is advisable to compare fees from different attorneys before making a decision.

Understanding the connection between the attorney fee and Quicken Loan fees is crucial for borrowers, particularly in states where legal representation is mandatory. By being aware of this potential expense, borrowers can make informed decisions, budget accordingly, and protect their interests throughout the mortgage process.

Quicken Loan Fees - FAQs

This section addresses frequently asked questions (FAQs) regarding Quicken Loan fees, providing concise and informative answers to assist borrowers in understanding these costs associated with obtaining a mortgage from Quicken Loans.

Question 1: What are the most common Quicken Loan fees?

The most common Quicken Loan fees include origination fees, underwriting fees, appraisal fees, title search fees, loan application fees, credit report fees, flood certification fees, and attorney fees (in certain states).

Question 2: How much do Quicken Loan fees typically cost?

Quicken Loan fees can vary depending on the loan amount, loan type, and borrower's profile. It is important to compare fees from different lenders and factor these costs into the overall cost of the loan.

Question 3: Can Quicken Loan fees be negotiated?

In some cases, borrowers may be able to negotiate lower fees with Quicken Loans, especially for borrowers with good credit and a strong financial profile.

Question 4: What is the purpose of the origination fee?

The origination fee covers the lender's costs of processing and underwriting the loan.

Question 5: Why is the appraisal fee important?

The appraisal fee helps the lender determine the property's value to ensure that it meets their lending criteria and to calculate the loan-to-value ratio (LTV).

Question 6: What does the title search fee cover?

The title search fee covers the costs of conducting a thorough title search to uncover any potential liens, judgments, or other encumbrances that may affect the property's ownership.

Understanding these FAQs can help borrowers make informed decisions about their mortgage financing and budget accordingly.

For further information or to explore specific Quicken Loan fees in more detail, please visit the lender's website or consult with a mortgage professional.

Tips Regarding Quicken Loan Fees

Understanding and managing Quicken Loan fees is essential for borrowers to make informed decisions and avoid unexpected costs. Here are several tips to consider:

Tip 1: Compare Fees from Multiple Lenders

Quicken Loan fees can vary significantly between different lenders. It is crucial to compare fees from multiple lenders to ensure you are getting the best deal. Consider not only the origination fee but also other associated costs such as underwriting fees, appraisal fees, and title search fees.

Tip 2: Negotiate Fees When Possible

In some cases, borrowers may be able to negotiate lower fees with Quicken Loans, particularly for those with good credit and a strong financial profile. Be prepared to provide documentation to support your request for a fee reduction.

Tip 3: Understand the Purpose of Each Fee

Each Quicken Loan fee serves a specific purpose. Familiarize yourself with the different fees and their significance to avoid confusion and ensure you are paying only for necessary services.

Tip 4: Factor Fees into Your Budget

Quicken Loan fees should be factored into your overall mortgage budget. Consider these costs when determining your affordability and monthly payments. Unexpected fees can strain your finances, so it is essential to plan accordingly.

Tip 5: Seek Professional Advice if Needed

If you are unsure about any Quicken Loan fees or have complex financial circumstances, consider seeking advice from a mortgage professional. They can provide personalized guidance and help you make informed decisions about your mortgage financing.

By following these tips, borrowers can navigate Quicken Loan fees effectively, minimize costs, and secure the best possible mortgage terms.

Conclusion

Quicken Loan fees are an integral part of the mortgage process, covering the costs associated with obtaining a loan from Quicken Loans. By understanding these fees, borrowers can make informed decisions and budget accordingly.

It is important to compare fees from multiple lenders, negotiate when possible, and factor these costs into your financial plan. Quicken Loan fees serve specific purposes, such as processing the loan application, assessing the property's value, and ensuring a clear title. Seeking professional advice can be beneficial for borrowers with complex financial circumstances or who need personalized guidance.

Understanding Quicken Loan fees empowers borrowers to navigate the mortgage process confidently and secure the best possible financing options for their needs.

Discover The Age Of Renowned Author Scott Presler

Stunning MGK PFPs: Enhance Your Social Media Presence

1959 Chinese Zodiac: Unraveling The Secrets Of The Pig Year

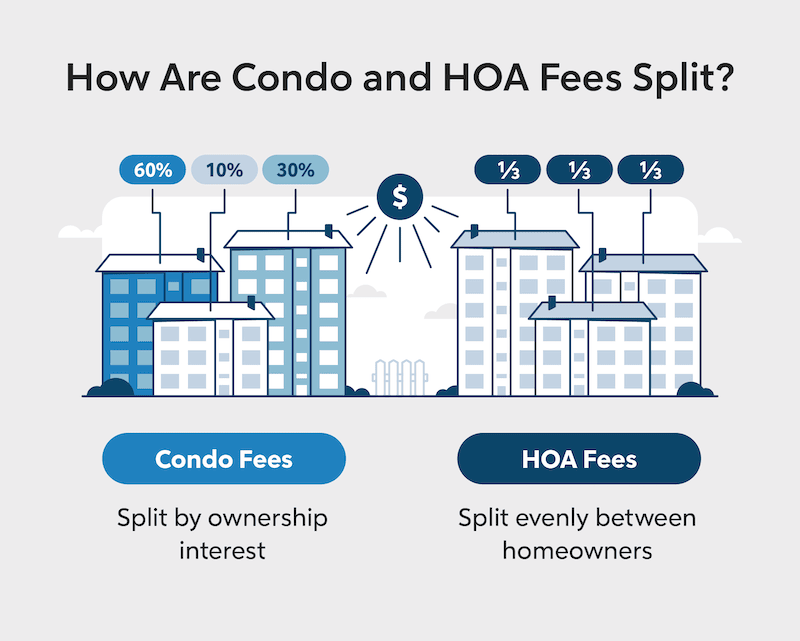

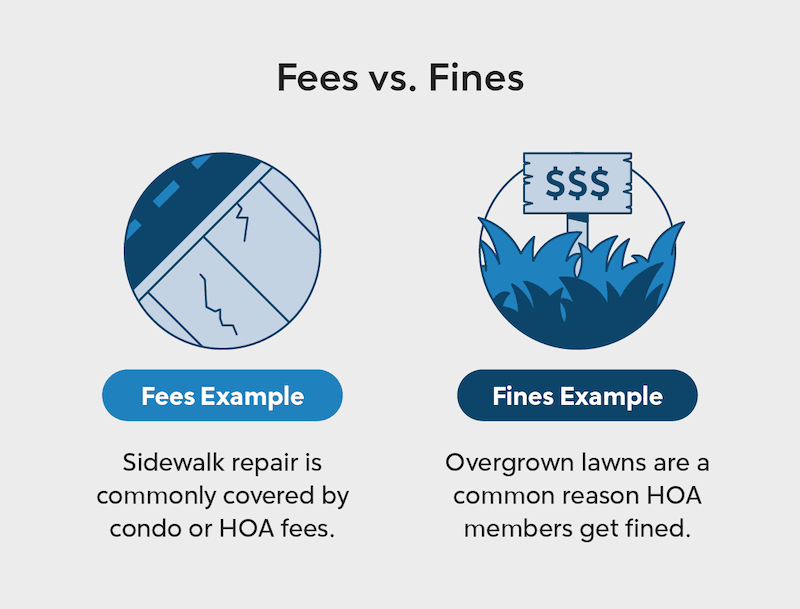

Understanding Condo Fees Vs. HOA Fees Quicken Loans

Understanding Condo Fees Vs. HOA Fees Quicken Loans

NMP Mortgage Professional of the Month Don Chiesa, Vice President of