Get Quicken Home Loans: Your Guide To Fast And Easy Home Financing

Quicken Home Loans is a leading mortgage lender that offers a wide range of home loan products, including conventional loans, FHA loans, VA loans, and jumbo loans. Quicken Loans was founded in 1985 and is headquartered in Detroit, Michigan. The company has a long history of innovation in the mortgage industry, and it was one of the first lenders to offer online mortgage applications. Quicken Loans is also known for its fast and easy loan approval process.

Quicken Home Loans offers a variety of benefits to borrowers, including competitive interest rates, low closing costs, and a variety of loan programs to choose from. Quicken Loans also offers a variety of online tools and resources to help borrowers throughout the mortgage process.

If you are considering getting a mortgage, Quicken Home Loans is a great option to consider. The company has a long history of providing excellent customer service and has a wide range of loan products to choose from.

Read also:Discover The Power Of Quicken Loans Your Ultimate Home Financing Solution

Quicken Home Loans

Quicken Home Loans is a leading mortgage lender that offers a wide range of home loan products, including conventional loans, FHA loans, VA loans, and jumbo loans. Quicken Loans was founded in 1985 and is headquartered in Detroit, Michigan.

- Competitive interest rates: Quicken Home Loans offers some of the most competitive interest rates in the industry.

- Low closing costs: Quicken Home Loans also offers low closing costs, which can save you thousands of dollars.

- Fast and easy loan approval process: Quicken Home Loans has a fast and easy loan approval process that can get you pre-approved for a loan in minutes.

- Variety of loan programs: Quicken Home Loans offers a variety of loan programs to choose from, so you can find the right loan for your needs.

- Excellent customer service: Quicken Home Loans is known for its excellent customer service, and its loan officers are always available to answer your questions.

- Online tools and resources: Quicken Home Loans offers a variety of online tools and resources to help you throughout the mortgage process.

Quicken Home Loans is a great option for anyone who is considering getting a mortgage. The company offers competitive interest rates, low closing costs, a fast and easy loan approval process, and a variety of loan programs to choose from. Quicken Home Loans also has excellent customer service and offers a variety of online tools and resources to help you throughout the mortgage process.

1. Competitive interest rates: Quicken Home Loans offers some of the most competitive interest rates in the industry

Competitive interest rates are a key component of Quicken Home Loans' value proposition. By offering some of the most competitive interest rates in the industry, Quicken Home Loans is able to attract and retain customers who are looking for the best possible deal on their mortgage. Low interest rates can save borrowers thousands of dollars over the life of their loan, so it is important to shop around and compare rates from multiple lenders before choosing a mortgage.

Quicken Home Loans' competitive interest rates are a result of several factors, including its strong relationships with investors, its efficient lending process, and its large volume of loans. Quicken Home Loans is able to pass these savings on to its customers in the form of lower interest rates.

For example, a borrower who takes out a $200,000 loan at a 4% interest rate will pay $8,000 in interest over the life of the loan. However, if the same borrower takes out a loan at a 3% interest rate, they will only pay $6,000 in interest over the life of the loan. This is a savings of $2,000.

Conclusion

Read also:Remy Lacroix Retired The End Of An Era In Adult Entertainment

Quicken Home Loans' competitive interest rates are a key reason why it is one of the leading mortgage lenders in the industry. By offering some of the most competitive interest rates in the industry, Quicken Home Loans is able to save its customers thousands of dollars over the life of their loan.

2. Low closing costs: Quicken Home Loans also offers low closing costs, which can save you thousands of dollars.

In addition to competitive interest rates, Quicken Home Loans also offers low closing costs. Closing costs are the fees that you pay when you close on your mortgage loan. These fees can include things like the origination fee, the underwriting fee, the appraisal fee, and the title insurance premium. The average closing costs for a conventional loan are around $3,000. However, Quicken Home Loans offers closing costs as low as $1,000.

- Transparency: Quicken Home Loans is upfront about its closing costs, and it provides a detailed Loan Estimate that outlines all of the fees that you will be responsible for. This transparency helps borrowers to budget for closing costs and avoid any surprises.

- Efficiency: Quicken Home Loans' efficient lending process helps to reduce closing costs. The company's streamlined process means that there is less paperwork and fewer delays, which can save borrowers money on closing costs.

- Volume: Quicken Home Loans' large volume of loans gives it bargaining power with vendors. This bargaining power allows Quicken Home Loans to negotiate lower closing costs on behalf of its customers.

- Technology: Quicken Home Loans uses technology to streamline the closing process. This technology helps to reduce the amount of time and paperwork that is required to close on a loan, which can save borrowers money on closing costs.

Quicken Home Loans' low closing costs are a key reason why it is one of the leading mortgage lenders in the industry. By offering some of the lowest closing costs in the industry, Quicken Home Loans is able to save its customers thousands of dollars.

3. Fast and easy loan approval process: Quicken Home Loans has a fast and easy loan approval process that can get you pre-approved for a loan in minutes.

In today's competitive mortgage market, getting pre-approved for a loan quickly and easily is essential. Quicken Home Loans' fast and easy loan approval process can give you a leg up on the competition and help you get the home you want.

- Online pre-approval: You can get pre-approved for a Quicken Home Loans mortgage online in just a few minutes. All you need to do is provide some basic information about yourself and your finances.

- No income or asset verification: Quicken Home Loans does not require you to provide income or asset verification when you get pre-approved. This can save you a lot of time and hassle.

- Pre-approval letter in minutes: Once you have been pre-approved, Quicken Home Loans will send you a pre-approval letter that you can use to show sellers that you are a serious buyer.

Quicken Home Loans' fast and easy loan approval process can give you a number of advantages in the home buying process. By getting pre-approved, you can:

- Show sellers that you are a serious buyer

- Get your offer accepted faster

- Negotiate a better price on your home

If you are thinking about buying a home, Quicken Home Loans' fast and easy loan approval process can help you get started on the right foot. Pre-approval can give you a number of advantages in the home buying process, and it can help you get the home you want.

4. Variety of loan programs: Quicken Home Loans offers a variety of loan programs to choose from, so you can find the right loan for your needs.

Quicken Home Loans offers a wide variety of loan programs to meet the needs of every borrower. Whether you are a first-time homebuyer, a move-up buyer, or a refinancing homeowner, Quicken Home Loans has a loan program that is right for you.

Some of the loan programs that Quicken Home Loans offers include:

- Conventional loans

- FHA loans

- VA loans

- Jumbo loans

- Refinancing loans

Each of these loan programs has its own unique benefits and drawbacks. For example, conventional loans typically have lower interest rates than FHA loans, but they also require a higher down payment. FHA loans are a good option for first-time homebuyers and borrowers with lower credit scores, but they have higher mortgage insurance premiums than conventional loans. VA loans are available to veterans and active-duty military members, and they offer competitive interest rates and no down payment requirement. Jumbo loans are for borrowers who need to borrow more than the conforming loan limit, which is $647,200 in most areas.

By offering a variety of loan programs, Quicken Home Loans can help you find the right loan for your needs. Whether you are looking for a low interest rate, a low down payment, or no mortgage insurance, Quicken Home Loans has a loan program that is right for you.

The variety of loan programs that Quicken Home Loans offers is a key component of its value proposition. By offering a wide range of loan programs, Quicken Home Loans is able to meet the needs of every borrower. This makes Quicken Home Loans a great option for anyone who is considering getting a mortgage.

5. Excellent customer service: Quicken Home Loans is known for its excellent customer service, and its loan officers are always available to answer your questions.

Excellent customer service is a key component of Quicken Home Loans' value proposition. Quicken Home Loans loan officers are knowledgeable, experienced, and always willing to go the extra mile to help borrowers. This commitment to customer service has helped Quicken Home Loans to become one of the leading mortgage lenders in the industry.

There are many examples of Quicken Home Loans' excellent customer service. For example, Quicken Home Loans has a dedicated team of loan officers who are available 24/7 to answer borrowers' questions. Quicken Home Loans also offers a variety of online tools and resources to help borrowers throughout the mortgage process. These tools and resources include a mortgage calculator, a loan application checklist, and a variety of educational articles and videos.

The practical significance of understanding the connection between Quicken Home Loans and its excellent customer service is that it can help borrowers to make informed decisions about their mortgage. By choosing a lender with a reputation for excellent customer service, borrowers can be confident that they will be treated fairly and that their questions will be answered promptly and professionally.

6. Online tools and resources: Quicken Home Loans offers a variety of online tools and resources to help you throughout the mortgage process.

Quicken Home Loans offers a variety of online tools and resources to help borrowers throughout the mortgage process. These tools and resources can help borrowers to get pre-approved for a loan, compare interest rates, and track the progress of their loan application. Quicken Home Loans' online tools and resources are easy to use and can save borrowers time and money.

- Mortgage calculator: Quicken Home Loans' mortgage calculator can help borrowers to estimate their monthly mortgage payments. This calculator takes into account the loan amount, interest rate, loan term, and property taxes and insurance.

- Loan application checklist: Quicken Home Loans' loan application checklist can help borrowers to gather all of the necessary documentation for their loan application. This checklist includes items such as pay stubs, bank statements, and tax returns.

- Educational articles and videos: Quicken Home Loans offers a variety of educational articles and videos that can help borrowers to learn about the mortgage process. These articles and videos cover topics such as how to get pre-approved for a loan, how to compare interest rates, and how to close on a loan.

Quicken Home Loans' online tools and resources are a valuable resource for borrowers. These tools and resources can help borrowers to get pre-approved for a loan, compare interest rates, and track the progress of their loan application. By using these tools and resources, borrowers can save time and money and make the mortgage process easier.

FAQs about Quicken Home Loans

Quicken Loans is one of the nation's largest mortgage lenders, and they offer a variety of home loan products to meet the needs of borrowers. If you're considering getting a mortgage from Quicken Loans, you may have some questions. Here are answers to some of the most frequently asked questions about Quicken Home Loans:

Question 1: What types of mortgage loans does Quicken Home Loans offer?

Quicken Home Loans offers a wide variety of mortgage loans, including conventional loans, FHA loans, VA loans, and jumbo loans. They also offer refinancing loans and home equity loans.

Question 2: What are the interest rates on Quicken Home Loans?

Quicken Home Loans offers competitive interest rates on all of their mortgage loans. The interest rate you qualify for will depend on a number of factors, including your credit score, debt-to-income ratio, and loan amount.

Question 3: What are the closing costs on Quicken Home Loans?

The closing costs on a Quicken Home Loans mortgage loan will vary depending on the loan amount, the location of the property, and other factors. However, Quicken Home Loans offers low closing costs compared to other lenders.

Question 4: How long does it take to get a mortgage from Quicken Home Loans?

Quicken Home Loans offers a fast and easy mortgage process. You can get pre-approved for a loan in minutes and close on your loan in as little as 21 days.

Question 5: What are the benefits of getting a mortgage from Quicken Home Loans?

There are many benefits to getting a mortgage from Quicken Home Loans, including competitive interest rates, low closing costs, a fast and easy loan process, and excellent customer service.

Question 6: How do I apply for a mortgage from Quicken Home Loans?

You can apply for a mortgage from Quicken Home Loans online, over the phone, or in person at one of their retail locations. The application process is quick and easy, and you can get pre-approved for a loan in minutes.

Summary

Quicken Home Loans is a leading mortgage lender that offers a variety of home loan products to meet the needs of borrowers. They offer competitive interest rates, low closing costs, and a fast and easy loan process. Quicken Home Loans also has a reputation for excellent customer service.

Transition to the next article section

If you are considering getting a mortgage, Quicken Home Loans is a great option to consider. They offer a variety of loan products, competitive interest rates, and low closing costs. Quicken Home Loans also has a fast and easy loan process and a reputation for excellent customer service.

Tips from Quicken Home Loans

Quicken Home Loans is a leading mortgage lender with a long history of providing excellent customer service. They offer a variety of home loan products and services to meet the needs of borrowers. Here are some tips from Quicken Home Loans to help you get the most out of your mortgage experience:

7. Get pre-approved for a loan before you start shopping for a home.

Getting pre-approved for a loan will give you a better idea of how much you can afford to borrow and will make the home buying process more efficient. Quicken Home Loans offers a fast and easy online pre-approval process that can get you pre-approved in minutes.

8. Shop around for the best interest rate.

Don't just accept the first interest rate that you're offered. Shop around and compare rates from multiple lenders to get the best possible deal. Quicken Home Loans offers competitive interest rates on all of their mortgage loans.

9. Consider all of your closing costs.

Closing costs can add up quickly, so it's important to factor them into your budget. Quicken Home Loans offers low closing costs compared to other lenders.

10. Lock in your interest rate.

Once you've found a loan that you're happy with, lock in your interest rate to protect yourself from rising interest rates. Quicken Home Loans offers a variety of interest rate lock options to meet your needs.

11. Make extra payments on your mortgage.

Making extra payments on your mortgage can help you pay off your loan faster and save money on interest. Quicken Home Loans offers a variety of flexible repayment options to help you make extra payments on your loan.

By following these tips, you can get the most out of your mortgage experience and save money on your home loan.

Summary

Getting a mortgage is a big decision, but it doesn't have to be stressful. By following these tips from Quicken Home Loans, you can get the best possible deal on your home loan and make the mortgage process easier.

Transition to the article's conclusion

If you're considering getting a mortgage, Quicken Home Loans is a great option to consider. They offer a variety of home loan products and services to meet the needs of borrowers, and they have a reputation for excellent customer service. Contact Quicken Home Loans today to learn more about their mortgage products and services.

Conclusion

Quicken Home Loans is a leading mortgage lender that offers a variety of home loan products and services to meet the needs of borrowers. They offer competitive interest rates, low closing costs, a fast and easy loan process, and excellent customer service.

If you are considering getting a mortgage, Quicken Home Loans is a great option to consider. They can help you get the best possible deal on your home loan and make the mortgage process easier.

Discover The Secrets Of Success With Dan Martell: The Ultimate Wiki Guide

Gaby Belt TS: The Complete Guide

Discover Bradford Collectibles: The Ultimate Collection

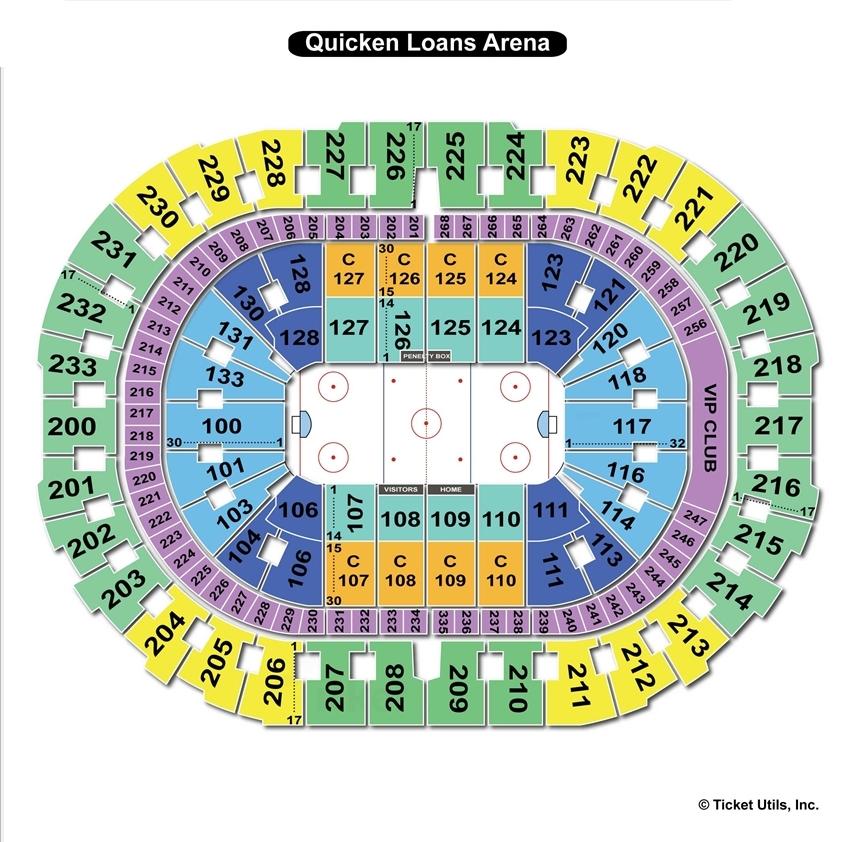

Quicken Loans Arena, Cleveland OH Seating Chart View

Quicken Loans Arena, Cleveland OH Seating Chart View

Quicken Loans