Uncover The Truth About Van Zandt County Appraisal

Van Zandt County Appraisal is the process of determining the value of real property for the purpose of taxation. It is typically conducted by a county appraisal district, which is a local government agency responsible for assessing the value of all real property within its jurisdiction. The appraisal district uses a variety of methods to determine the value of property, including comparable sales data, cost data, and income data.

Van Zandt County Appraisal is important because it determines the amount of property taxes that a property owner will owe. Property taxes are used to fund a variety of local government services, such as schools, roads, and libraries. Accurate appraisals are essential to ensure that property owners are paying their fair share of taxes.

The history of Van Zandt County Appraisal dates back to the early days of Texas. In 1846, the Texas Legislature created the first county appraisal districts. The appraisal districts were responsible for assessing the value of all real property within their respective counties. The appraisal process has changed over the years, but the basic principles remain the same.

Read also:The Ultimate Guide To Microtia Uncovering The Story Of Paul Stanleys Ear

Today, Van Zandt County Appraisal is a complex and sophisticated process. The appraisal district uses a variety of data and methods to determine the value of property. The appraisal process is also subject to a number of laws and regulations.

Van Zandt County Appraisal is an important part of the local government process. It helps to ensure that property owners are paying their fair share of taxes and that local government services are adequately funded.

Van Zandt County Appraisal

Van Zandt County Appraisal is the process of determining the value of real property for the purpose of taxation. It is typically conducted by a county appraisal district, which is a local government agency responsible for assessing the value of all real property within its jurisdiction. The appraisal district uses a variety of methods to determine the value of property, including comparable sales data, cost data, and income data.

- Property Taxes

- Local Government Services

- Fair Share

- Data and Methods

- Laws and Regulations

- History

- Importance

- Accuracy

These key aspects are all important to understanding Van Zandt County Appraisal. Property taxes are the primary source of revenue for local governments, and accurate appraisals are essential to ensure that property owners are paying their fair share. The appraisal process is also subject to a number of laws and regulations, which helps to ensure that appraisals are fair and accurate. Van Zandt County Appraisal is a complex and important process, and it is essential for property owners to understand the key aspects of the process.

1. Property Taxes

Property taxes are the primary source of revenue for local governments. They are used to fund a variety of essential services, such as schools, roads, libraries, and police and fire protection. Accurate appraisals are essential to ensure that property owners are paying their fair share of taxes and that local governments have the resources they need to provide these important services.

Van Zandt County Appraisal is the process of determining the value of real property for the purpose of taxation. The appraisal district uses a variety of methods to determine the value of property, including comparable sales data, cost data, and income data. Once the value of a property has been determined, the appraisal district will send a notice to the property owner. The property owner can then appeal the appraisal if they believe it is inaccurate.

Read also:Unleash Flawless Tech In Jackson Wy Technology Repair At Your Fingertips

Understanding the connection between property taxes and Van Zandt County Appraisal is important for several reasons. First, it helps property owners to understand how their property taxes are calculated. Second, it helps property owners to identify errors in their appraisals. Third, it helps property owners to make informed decisions about whether or not to appeal their appraisals.

Property taxes are an important part of the local government funding system. Accurate appraisals are essential to ensure that property owners are paying their fair share of taxes and that local governments have the resources they need to provide essential services.

2. Local Government Services

Local government services are those provided by local governments, such as cities, counties, and school districts. These services can include a wide range of activities, such as providing police and fire protection, maintaining roads and bridges, operating parks and libraries, and providing water and sewer services.

- Public Safety

Local governments play a vital role in providing public safety services, such as police and fire protection. These services help to keep communities safe and protect residents from crime and other threats.

- Infrastructure

Local governments are responsible for maintaining and improving infrastructure, such as roads, bridges, and water and sewer systems. This infrastructure is essential for the functioning of communities and businesses.

- Social Services

Local governments provide a variety of social services, such as operating parks and libraries and providing assistance to low-income residents. These services help to improve the quality of life for residents and make communities more livable.

- Economic Development

Local governments play a role in economic development by providing incentives to businesses and supporting job creation. These efforts help to create a strong local economy and improve the quality of life for residents.

Van Zandt County Appraisal is the process of determining the value of real property for the purpose of taxation. The revenue generated from property taxes is used to fund local government services. Therefore, accurate appraisals are essential to ensure that local governments have the resources they need to provide these important services.

3. Fair Share

In the context of property taxation, "fair share" refers to the principle that all property owners should pay their fair share of taxes. This means that properties of similar value should be taxed at the same rate, regardless of the owner's identity or financial situation.

Van Zandt County Appraisal plays a vital role in ensuring that property owners pay their fair share of taxes. The appraisal district uses a variety of methods to determine the value of property, including comparable sales data, cost data, and income data. This data is then used to calculate the property's taxable value.

Accurate appraisals are essential for ensuring that all property owners are paying their fair share of taxes. If a property is undervalued, the owner will pay less than their fair share of taxes. Conversely, if a property is overvalued, the owner will pay more than their fair share of taxes.

There are a number of challenges to ensuring that all property owners pay their fair share of taxes. One challenge is the difficulty of accurately valuing property. Another challenge is the fact that property values can change over time. However, the appraisal district uses a variety of methods to ensure that appraisals are as accurate and fair as possible.

Understanding the connection between "fair share" and "van zandt county appraisal" is important for several reasons. First, it helps property owners to understand how their property taxes are calculated. Second, it helps property owners to identify errors in their appraisals. Third, it helps property owners to make informed decisions about whether or not to appeal their appraisals.

4. Data and Methods

Data and methods are essential components of van zandt county appraisal, the process of determining the value of real property for the purpose of taxation. The accuracy of an appraisal depends on the quality of the data used and the methods employed to analyze that data.

- Data Sources

The appraisal district collects data from a variety of sources, including public records, MLS listings, and property inspections. This data is used to create a database of all taxable properties in the county.

- Valuation Methods

The appraisal district uses three primary methods to value properties: the sales comparison approach, the cost approach, and the income approach. The sales comparison approach compares the subject property to similar properties that have recently sold. The cost approach estimates the cost of reproducing or replacing the subject property. The income approach estimates the value of the property based on its potential income.

- Data Analysis

Once the appraisal district has collected data and selected a valuation method, it analyzes the data to determine the value of the property. This analysis may involve using statistical techniques, such as regression analysis, to identify trends in the data.

- Appraisal Report

The appraisal district prepares an appraisal report for each property that it values. The appraisal report includes a description of the property, the data that was used to value the property, and the methods that were employed to analyze the data.

The data and methods that are used in van zandt county appraisal are essential for ensuring that properties are valued fairly and accurately. This ensures that property owners pay their fair share of taxes and that local governments have the resources they need to provide essential services.

5. Laws and Regulations

Laws and regulations play a vital role in van zandt county appraisal, the process of determining the value of real property for the purpose of taxation. These laws and regulations ensure that appraisals are conducted fairly and accurately, and that property owners are treated equitably.

- Property Tax Code

The Texas Property Tax Code establishes the legal framework for van zandt county appraisal. This code sets forth the requirements for appraising property, the procedures for protesting appraisals, and the penalties for non-compliance.

- Uniform Standards of Professional Appraisal Practice (USPAP)

USPAP is a set of ethical and technical standards that govern the conduct of real estate appraisers. These standards ensure that appraisals are conducted in a professional and ethical manner, and that the results are reliable and accurate.

- Texas Administrative Code (TAC)

The TAC contains the rules and regulations adopted by the Texas Comptroller of Public Accounts. These rules and regulations provide detailed guidance on the appraisal process, including the methods that can be used to value property and the procedures for conducting appraisals.

- Local Ordinances

Local governments may adopt ordinances that supplement the state laws and regulations governing van zandt county appraisal. These ordinances may address specific issues, such as the use of local data or the procedures for conducting appraisals in certain areas.

These laws and regulations help to ensure that van zandt county appraisal is conducted fairly and accurately. They protect the rights of property owners and ensure that all property owners are treated equitably.

6. History

The history of van zandt county appraisal is closely intertwined with the development of the county itself. The first appraisals were conducted in the mid-1800s, when the county was still largely rural and agricultural. As the county grew and developed, so too did the appraisal process.

One of the most significant changes to the appraisal process came in 1939, when the Texas Legislature created the first county appraisal districts. These districts were responsible for assessing the value of all real property within their respective counties. The creation of appraisal districts helped to professionalize the appraisal process and ensure that appraisals were conducted fairly and accurately.

Another major change to the appraisal process came in 1979, when the Texas Legislature passed a law requiring all counties to use a computerized mass appraisal system. This system uses a variety of data, including sales data, cost data, and income data, to determine the value of property. The use of a computerized mass appraisal system has made the appraisal process more efficient and accurate.

The history of van zandt county appraisal is a story of constant change and improvement. As the county has grown and developed, so too has the appraisal process. The changes that have been made to the appraisal process have helped to ensure that appraisals are conducted fairly and accurately, and that property owners are treated equitably.

7. Importance

Van Zandt County Appraisal is the process of determining the value of real property for the purpose of taxation. It is an important process because it ensures that property owners pay their fair share of taxes and that local governments have the resources they need to provide essential services.

- Fair Taxation

Accurate appraisals are essential for ensuring that property owners pay their fair share of taxes. If a property is undervalued, the owner will pay less than their fair share of taxes. Conversely, if a property is overvalued, the owner will pay more than their fair share of taxes.

- Local Government Funding

The revenue generated from property taxes is used to fund local government services, such as schools, roads, and libraries. Accurate appraisals are essential for ensuring that local governments have the resources they need to provide these essential services.

- Economic Development

Accurate appraisals can also promote economic development. When businesses know that their property taxes will be fair and predictable, they are more likely to invest in the community. This investment can create jobs and boost the local economy.

- Property Value Stability

Accurate appraisals can also help to stabilize property values. When property values are stable, homeowners are more likely to invest in their properties and communities. This can lead to a more vibrant and prosperous community.

Overall, van zandt county appraisal is an important process that has a number of benefits for property owners, local governments, and the community as a whole.

8. Accuracy

Accuracy is of paramount importance in van zandt county appraisal, the process of determining the value of real property for the purpose of taxation. Accurate appraisals are essential for ensuring that property owners pay their fair share of taxes and that local governments have the resources they need to provide essential services.

There are a number of factors that can affect the accuracy of an appraisal, including the quality of the data used, the methods employed to analyze the data, and the experience and qualifications of the appraiser. It is important to note that no appraisal is perfectly accurate, but there are steps that can be taken to minimize the margin of error.

One of the most important steps that can be taken to ensure the accuracy of an appraisal is to use high-quality data. This data should be accurate, complete, and up-to-date. The appraisal district collects data from a variety of sources, including public records, MLS listings, and property inspections. It is important to verify the accuracy of this data before using it to value a property.

Another important step that can be taken to ensure the accuracy of an appraisal is to use appropriate methods to analyze the data. The appraisal district uses three primary methods to value properties: the sales comparison approach, the cost approach, and the income approach. The sales comparison approach compares the subject property to similar properties that have recently sold. The cost approach estimates the cost of reproducing or replacing the subject property. The income approach estimates the value of the property based on its potential income.

The experience and qualifications of the appraiser is also an important factor that can affect the accuracy of an appraisal. Appraisers must be licensed by the state and must meet certain minimum education and experience requirements. Appraisers should also be familiar with the local real estate market and the appraisal methods that are appropriate for the type of property being appraised.

Accurate appraisals are essential for ensuring that property owners pay their fair share of taxes and that local governments have the resources they need to provide essential services. There are a number of steps that can be taken to ensure the accuracy of an appraisal, including using high-quality data, appropriate methods, and experienced and qualified appraisers.

FAQs on Van Zandt County Appraisal

This section addresses frequently asked questions and aims to provide clear and detailed information regarding van zandt county appraisal. By referring to these FAQs, you can gain a comprehensive understanding of the appraisal process and its implications.

Question 1: What is the purpose of van zandt county appraisal?Van zandt county appraisal is the process of determining the value of real property for the purpose of taxation. Accurate appraisals ensure fair property tax distribution and provide local governments with the necessary resources to fund essential services.

Question 2: How often are properties appraised in van zandt county?In Texas, properties are generally appraised every two years; however, certain circumstances may trigger more frequent appraisals. These include property additions, renovations, or any changes that significantly alter a property's value.

Question 3: What are the different methods used to appraise properties?The primary methods employed in van zandt county appraisal are the sales comparison approach, cost approach, and income approach. Each method utilizes different data and calculations to estimate a property's value, ensuring a well-rounded assessment.

Question 4: How can I contest my property appraisal if I believe it's inaccurate?If you have concerns about the accuracy of your appraisal, you have the right to file a protest. Contact the van zandt county appraisal district within the specified timeframe to initiate the protest process and provide supporting evidence to justify your claim.

Question 5: What happens if I disagree with the outcome of my protest?If you are not satisfied with the resolution of your protest, you may appeal the decision to the van zandt county appraisal review board. The board will review your case and make a final determination regarding your property's value.

Question 6: How can I stay informed about van zandt county appraisal?To stay updated on van zandt county appraisal processes and important deadlines, regularly visit the appraisal district's website or subscribe to their newsletter. Active engagement ensures you are well-informed about matters affecting your property taxes.

Understanding van zandt county appraisal empowers property owners to make informed decisions regarding their tax obligations. By addressing common questions and providing detailed explanations, this FAQ section aims to enhance your knowledge and facilitate a smooth appraisal experience.

Moving forward, let's explore additional aspects of van zandt county appraisal to gain a holistic understanding of the subject matter.

Tips for Van Zandt County Appraisal

To ensure an accurate and successful appraisal experience, consider the following valuable tips:

Tip 1: Maintain Accurate Property RecordsKeep detailed records of any property improvements, repairs, or renovations. These documents provide valuable evidence to support your property's value during the appraisal process.Tip 2: Research Comparable Sales

Gather information about recent sales of similar properties in your neighborhood. This data helps you understand market trends and provides a basis for comparison when assessing your appraisal.Tip 3: Consider Hiring an Appraiser

If you have concerns about the accuracy of your appraisal, consider hiring a qualified appraiser to provide an independent assessment. Their expertise can strengthen your case during a protest.Tip 4: File Your Protest on Time

If you disagree with your appraisal, file a formal protest within the specified timeframe. Failure to meet the deadline may result in losing the opportunity to challenge the valuation.Tip 5: Gather Supporting Evidence

When protesting your appraisal, provide ample documentation to support your claim. This may include comparable sales data, repair invoices, or market analysis reports.Tip 6: Attend the Appraisal Review Board Hearing

If your protest is not resolved informally, you have the right to present your case before the appraisal review board. Prepare your arguments and evidence thoroughly for this hearing.

By following these tips, you can proactively manage the van zandt county appraisal process, ensuring a fair and accurate assessment of your property's value.

Remember, understanding your rights and responsibilities as a property owner is essential for a successful appraisal experience. Stay informed about appraisal procedures, deadlines, and available resources to safeguard your interests.

Conclusion

Van Zandt County Appraisal is a crucial process that determines the value of real property for tax purposes. Accurate appraisals ensure fair distribution of property taxes and provide local governments with the resources to fund essential services. Understanding the appraisal process, including data collection, methodologies, and protest procedures, is essential for property owners.

This article has explored the significance of van Zandt county appraisal, emphasizing its role in ensuring equitable taxation and supporting local government services. By providing comprehensive information and practical tips, we aim to empower property owners to actively engage in the appraisal process and safeguard their interests. Remember, staying informed and exercising your rights as a property owner are key to a successful appraisal experience.

Discover The Who: An Exploration Of The Legendary Members

Who's Quigley Down Under? Meet The Cast Behind The Iconic Outback Adventure

Discover The Ultimate Summer Oasis: Above Ground Pools At Costco

Van Zandt NETRMA

Conway crowned Miss Van Zandt County Fair Van Zandt News

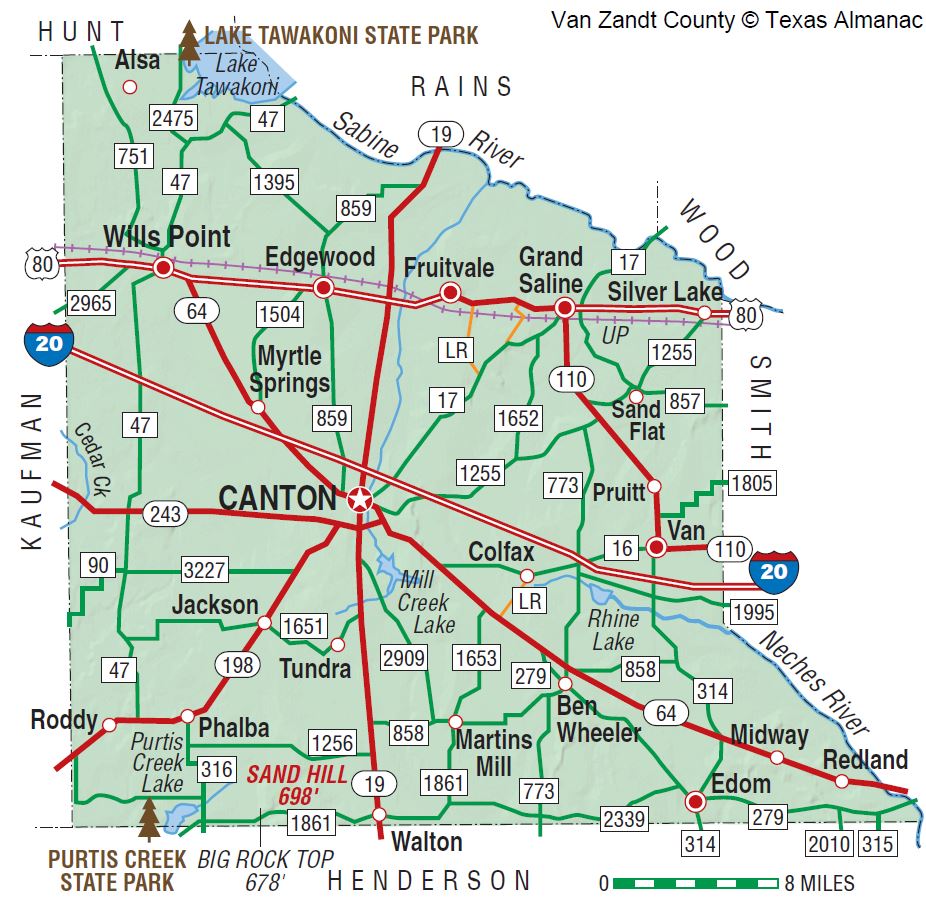

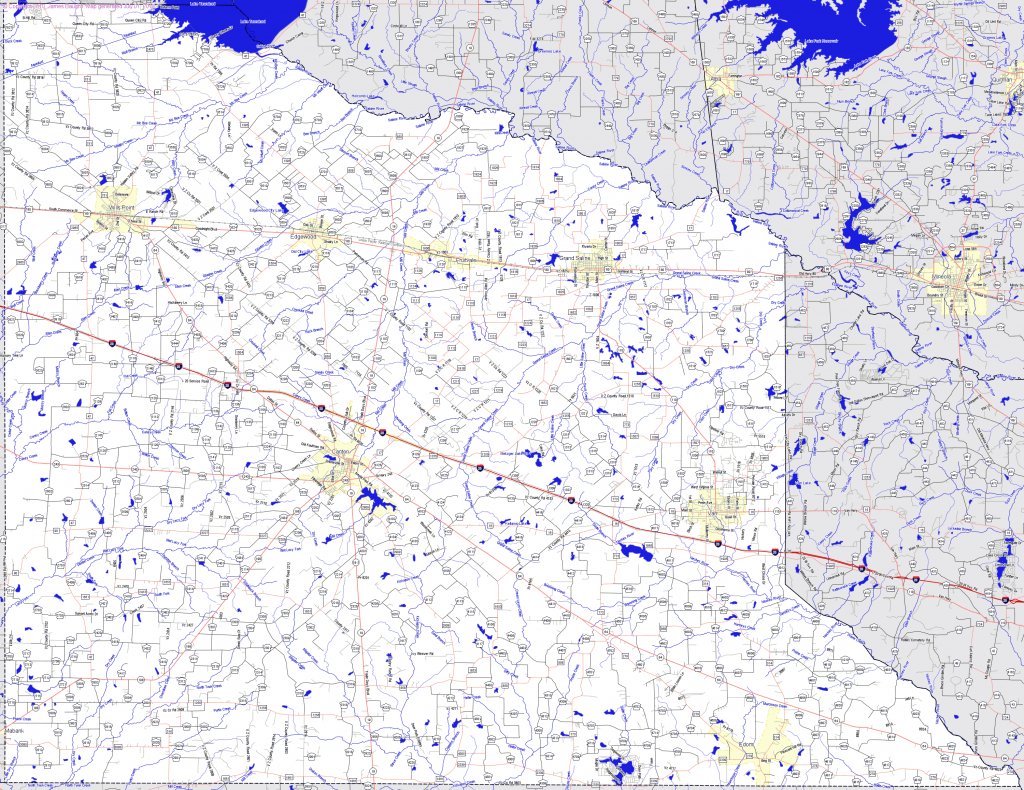

Bridgehunter Van Zandt County, Texas Van Zandt County Texas Map