What Is SPM Net Worth: A Comprehensive Guide To Understanding Its Value

SPM, an acronym often associated with financial or business metrics, has garnered significant attention in recent years due to its potential to influence net worth calculations for individuals and companies alike. But what exactly is SPM net worth, and why does it matter in today's economic landscape? Whether you're an investor, entrepreneur, or simply someone curious about financial terms, understanding the concept of SPM net worth can provide valuable insights into wealth management and growth strategies. This article dives deep into the topic, exploring its origins, significance, and practical applications to help you make informed decisions.

SPM net worth is not just a buzzword; it represents a critical measure of financial health and stability. It often ties into broader discussions about assets, liabilities, and overall financial performance. For businesses, SPM net worth can reflect operational efficiency, while for individuals, it may indicate personal wealth accumulation. Regardless of the context, mastering this concept can empower you to navigate financial challenges and opportunities with confidence.

In this guide, we will break down the intricacies of SPM net worth, answering key questions like "What is SPM net worth?" and "How does it impact financial planning?" By the end of this article, you'll have a comprehensive understanding of SPM net worth, its components, and its relevance in today's dynamic financial world. Let's get started!

Read also:Spiralling Spirit The Locker Room Unveiling The Essence Of Team Dynamics

Table of Contents

- Biography of SPM: A Closer Look at Its Origins

- What is SPM Net Worth? Understanding the Basics

- How Does SPM Net Worth Work in Practice?

- What Factors Influence SPM Net Worth?

- SPM Net Worth vs. Other Financial Metrics: What Sets It Apart?

- Why Does SPM Net Worth Matter for Individuals and Businesses?

- How to Calculate SPM Net Worth: A Step-by-Step Guide

- Frequently Asked Questions About SPM Net Worth

Biography of SPM: A Closer Look at Its Origins

Before we delve into the specifics of SPM net worth, it's essential to understand its origins and evolution. SPM, or Strategic Performance Measurement, emerged as a concept in the late 20th century, gaining traction in corporate settings as a tool for assessing organizational success. Initially, SPM focused on performance metrics, but over time, it expanded to include broader financial indicators like net worth.

Below is a table summarizing key details about SPM and its evolution:

| Attribute | Details |

|---|---|

| Full Form | Strategic Performance Measurement |

| Origin | Late 1980s to early 1990s |

| Primary Use | Assessing organizational and individual performance |

| Key Metric | Net worth, profitability, operational efficiency |

| Industry Application | Finance, technology, manufacturing, and more |

Understanding the biography of SPM provides a foundation for exploring its role in calculating net worth. Its evolution reflects a growing need for comprehensive financial tools that can adapt to changing economic landscapes.

What is SPM Net Worth? Understanding the Basics

At its core, SPM net worth is a measure of financial health derived from the balance between assets and liabilities. It represents the residual value after subtracting liabilities from assets, offering a snapshot of an individual's or organization's wealth. But what makes SPM net worth unique is its integration with strategic performance metrics, allowing for a more nuanced understanding of financial standing.

For businesses, SPM net worth often incorporates factors like operational efficiency, market positioning, and growth potential. For individuals, it may include investments, real estate holdings, and other assets. By combining traditional net worth calculations with performance indicators, SPM net worth provides a holistic view of financial stability.

How Does SPM Net Worth Differ from Traditional Net Worth?

While traditional net worth focuses solely on assets and liabilities, SPM net worth incorporates additional layers of analysis. These include:

Read also:7starhd Your Ultimate Guide To Streaming Highquality Movies And Tv Shows

- Performance metrics like revenue growth and profit margins

- Risk assessment and mitigation strategies

- Market trends and competitive positioning

This multi-dimensional approach ensures a more accurate representation of financial health, making SPM net worth a valuable tool for decision-making.

How Does SPM Net Worth Work in Practice?

Understanding how SPM net worth works in practice requires examining real-world applications. For businesses, SPM net worth is often used to evaluate financial performance during mergers and acquisitions. It helps stakeholders assess the long-term viability of a company by considering both its current assets and future growth potential.

For individuals, SPM net worth can guide investment decisions and retirement planning. By incorporating performance metrics, individuals can identify areas for improvement and optimize their financial strategies.

What Are Some Practical Examples of SPM Net Worth?

Here are a few scenarios where SPM net worth plays a crucial role:

- A startup uses SPM net worth to attract investors by showcasing its growth potential alongside its current financial standing.

- An individual calculates their SPM net worth to determine the feasibility of purchasing a new property while maintaining financial stability.

- A corporation evaluates its SPM net worth during a restructuring phase to ensure sustainable growth.

What Factors Influence SPM Net Worth?

Several factors contribute to the calculation of SPM net worth, ranging from tangible assets to intangible performance indicators. Understanding these factors is essential for accurately assessing financial health.

Key Factors Affecting SPM Net Worth

Below are some of the most significant factors influencing SPM net worth:

- Assets: Including cash, real estate, investments, and intellectual property

- Liabilities: Such as loans, mortgages, and outstanding debts

- Performance Metrics: Revenue growth, profit margins, and operational efficiency

- Market Trends: Industry dynamics and economic conditions

Why Are Market Trends Important for SPM Net Worth?

Market trends play a critical role in determining SPM net worth because they influence asset valuation and growth potential. For instance, a booming real estate market can increase property values, thereby boosting SPM net worth for property owners.

SPM Net Worth vs. Other Financial Metrics: What Sets It Apart?

While SPM net worth shares similarities with other financial metrics like net income and cash flow, it stands out due to its comprehensive approach. Unlike net income, which focuses solely on profitability, or cash flow, which tracks liquidity, SPM net worth provides a broader view of financial health.

How Does SPM Net Worth Compare to Net Income?

Net income measures profitability over a specific period, while SPM net worth considers long-term financial stability. This distinction makes SPM net worth a more reliable indicator of overall financial health.

Why Does SPM Net Worth Matter for Individuals and Businesses?

SPM net worth matters because it serves as a barometer for financial health, guiding decision-making and strategic planning. For businesses, it can influence investor confidence and market valuation. For individuals, it provides a roadmap for achieving financial goals.

What Are the Benefits of Tracking SPM Net Worth?

Tracking SPM net worth offers several advantages:

- Improved financial planning and goal setting

- Enhanced risk management and mitigation

- Greater transparency and accountability

How to Calculate SPM Net Worth: A Step-by-Step Guide

Calculating SPM net worth involves a systematic approach that combines traditional net worth calculations with performance metrics. Follow these steps to determine your SPM net worth:

- List all assets, including cash, investments, and property

- Identify liabilities, such as loans and debts

- Calculate the difference between assets and liabilities

- Incorporate performance metrics like revenue growth and profit margins

What Tools Can Help in Calculating SPM Net Worth?

Several tools and software solutions can streamline the process of calculating SPM net worth, including:

- Financial management software like QuickBooks

- Spreadsheet applications like Microsoft Excel

- Online calculators and financial planning platforms

Frequently Asked Questions About SPM Net Worth

What is SPM Net Worth and Why is it Important?

SPM net worth is a measure of financial health that combines traditional net worth calculations with performance metrics. It is important because it provides a comprehensive view of financial stability, guiding decision-making and strategic planning.

How Often Should I Calculate My SPM Net Worth?

It is advisable to calculate your SPM net worth annually or whenever there are significant changes in your financial situation, such as a major purchase or investment.

Can SPM Net Worth Be Negative?

Yes, SPM net worth can be negative if liabilities exceed assets. This situation often indicates financial distress and requires immediate attention.

Conclusion

Understanding what is SPM net worth is crucial for anyone looking to achieve financial stability and growth. By combining traditional net worth calculations with performance metrics, SPM net worth offers a holistic view of financial health. Whether you're an individual planning for the future or a business striving for success, mastering this concept can provide valuable insights and opportunities.

For further reading on financial metrics and strategies, check out this external resource on net worth.

Katie Johnson Trump: A Comprehensive Guide To Her Life And Influence

Unlocking The Power Of The Salt Under The Tongue Trick: A Comprehensive Guide

Mastering Remote IoT VPC Networks: A Comprehensive Guide

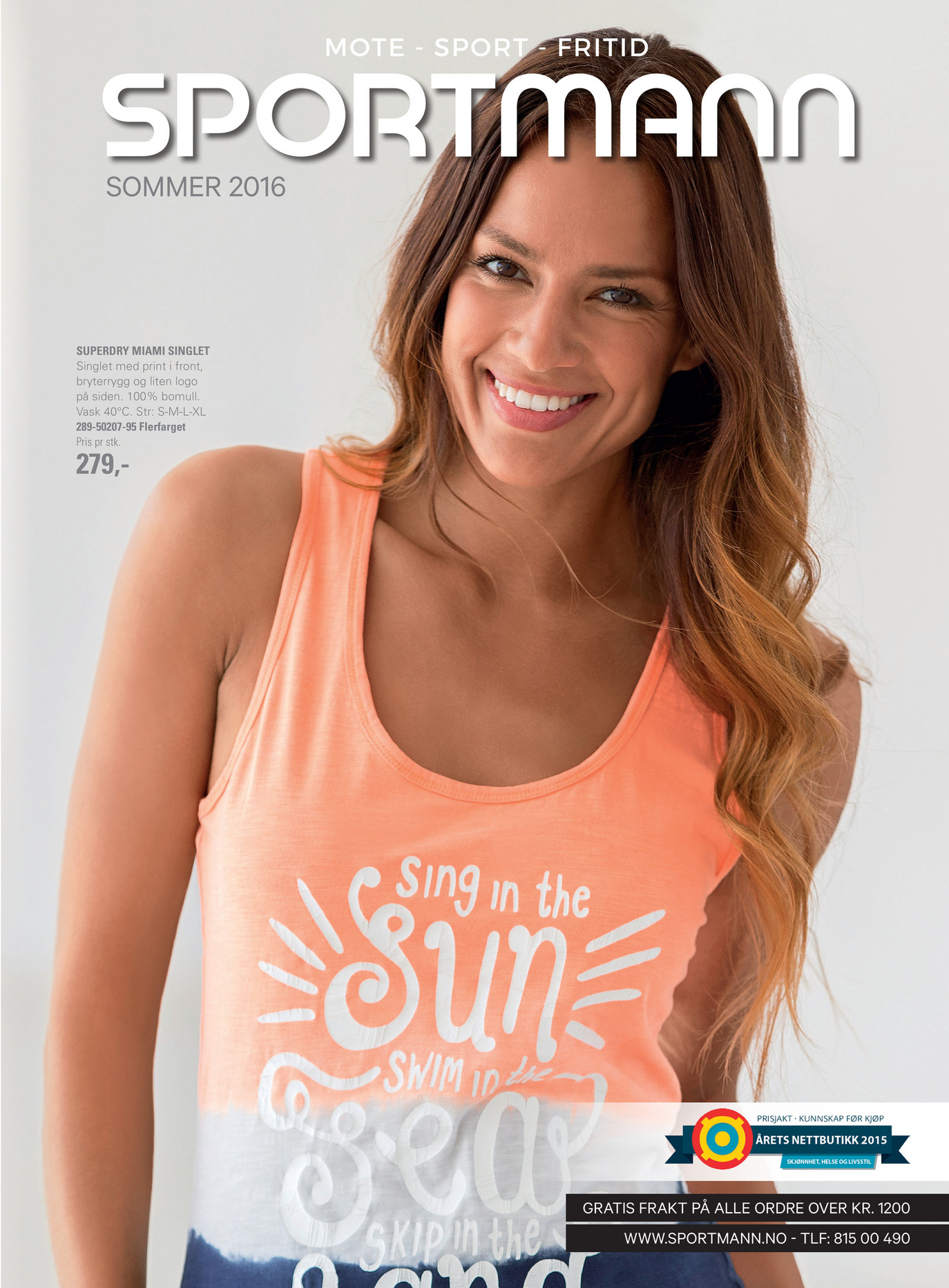

Sportmann AS SPM_Hogsommar_2016 Side 5253

Successful Transformation Managing Change with ServiceNow SPM