Discover The Benefits Of Concordia Plan Services For Your Well-being

Concordia Plan Services is a leading provider of employee benefits and retirement plan services to small and mid-sized businesses.

The company offers a wide range of services, including health insurance, dental insurance, vision insurance, life insurance, disability insurance, and retirement plans. Concordia Plan Services also provides employee assistance programs, wellness programs, and other value-added services.

Concordia Plan Services is committed to providing its clients with high-quality, cost-effective employee benefits and retirement plan services. The company has a team of experienced professionals who are dedicated to helping clients find the right solutions for their needs.

Read also:Fascinating Connection Between Hwang In Yeop And Kimo Hyun Unraveling Their Bond

concordia plan services

Concordia Plan Services is a leading provider of employee benefits and retirement plan services to small and mid-sized businesses.

- Employee benefits

- Retirement plan services

- Health insurance

- Dental insurance

- Vision insurance

- Life insurance

- Disability insurance

- Employee assistance programs

These key aspects of Concordia Plan Services allow them to provide comprehensive employee benefits and retirement plan services to their clients. Concordia Plan Services is committed to providing high-quality, cost-effective services, and their team of experienced professionals is dedicated to helping clients find the right solutions for their needs.

1. Employee benefits

Employee benefits are a key component of Concordia Plan Services' offerings. The company provides a wide range of employee benefits, including health insurance, dental insurance, vision insurance, life insurance, disability insurance, and retirement plans. These benefits are designed to help employees and their families stay healthy, financially secure, and productive.

Employee benefits are an important part of any compensation package. They can help attract and retain employees, and can also improve employee morale and productivity. In addition, employee benefits can help businesses save money on healthcare costs and other expenses.

Concordia Plan Services has a team of experienced professionals who can help businesses find the right employee benefits package for their needs. The company also offers a variety of value-added services, such as employee assistance programs and wellness programs.

2. Retirement plan services

Retirement plan services are an important component of Concordia Plan Services' offerings. The company provides a wide range of retirement plan services, including defined benefit plans, defined contribution plans, and IRAs. These plans are designed to help employees save for retirement and achieve their financial goals.

Read also:Shirley Jones The Beloved Actress Who Captured Hollywoodrsquos Heart

Retirement plan services are an important part of any financial planning strategy. They can help employees save for retirement, reduce their tax liability, and achieve their financial goals. In addition, retirement plan services can help businesses attract and retain employees, and can also improve employee morale and productivity.

Concordia Plan Services has a team of experienced professionals who can help businesses find the right retirement plan services for their needs. The company also offers a variety of value-added services, such as investment advice and financial planning.

3. Health insurance

Concordia Plan Services offers a variety of health insurance plans to meet the needs of businesses and their employees. These plans include:

- Preferred Provider Organizations (PPOs)

PPOs offer a network of doctors and hospitals that provide discounted services to members. Members can choose to see doctors outside of the network, but they will pay a higher cost.

- Health Maintenance Organizations (HMOs)

HMOs offer a network of doctors and hospitals that provide services to members at a fixed cost. Members must choose a primary care physician who will refer them to specialists if necessary.

- Point-of-Service (POS) Plans

POS plans offer a combination of PPO and HMO features. Members can choose to see doctors inside or outside of the network, but they will pay a higher cost for out-of-network services.

- High-Deductible Health Plans (HDHPs)

HDHPs have a higher deductible than traditional health insurance plans, but they also have lower monthly premiums. HDHPs are often paired with a Health Savings Account (HSA), which allows members to save money on healthcare costs.

Concordia Plan Services also offers a variety of value-added services with its health insurance plans, such as:

- Wellness programs

- Disease management programs

- Telemedicine services

- Prescription drug discounts

These value-added services can help members improve their health and save money on healthcare costs. Concordia Plan Services is committed to providing its clients with high-quality, cost-effective health insurance plans and services.

4. Dental insurance

Dental insurance is an important part of Concordia Plan Services' offerings. The company provides a variety of dental insurance plans to meet the needs of businesses and their employees. These plans include:

- Preferred Provider Organizations (PPOs)

PPOs offer a network of dentists that provide discounted services to members. Members can choose to see dentists outside of the network, but they will pay a higher cost.

- Dental Health Maintenance Organizations (DHMOs)

DHMOs offer a network of dentists that provide services to members at a fixed cost. Members must choose a primary care dentist who will refer them to specialists if necessary.

Concordia Plan Services also offers a variety of value-added services with its dental insurance plans, such as:

- Preventive care coverage

- Orthodontic coverage

- Dental implants coverage

These value-added services can help members improve their oral health and save money on dental care costs. Concordia Plan Services is committed to providing its clients with high-quality, cost-effective dental insurance plans and services.

Dental insurance is an important part of any employee benefits package. It can help employees save money on dental care costs, and it can also help prevent serious dental problems. In addition, dental insurance can help businesses attract and retain employees, and it can also improve employee morale and productivity.

Concordia Plan Services has a team of experienced professionals who can help businesses find the right dental insurance plan for their needs. The company also offers a variety of value-added services, such as wellness programs and financial planning.

5. Vision insurance

Vision insurance is an important part of Concordia Plan Services' offerings. The company provides a variety of vision insurance plans to meet the needs of businesses and their employees. These plans include:

- Preferred Provider Organizations (PPOs)

PPOs offer a network of eye doctors and optometrists that provide discounted services to members. Members can choose to see eye doctors and optometrists outside of the network, but they will pay a higher cost.

- Eye Health Maintenance Organizations (EHMOs)

EHMOs offer a network of eye doctors and optometrists that provide services to members at a fixed cost. Members must choose a primary care eye doctor or optometrist who will refer them to specialists if necessary.

Concordia Plan Services also offers a variety of value-added services with its vision insurance plans, such as:

- Preventive care coverage

- Eyeglass and contact lens discounts

- Laser eye surgery discounts

These value-added services can help members improve their eye health and save money on vision care costs. Concordia Plan Services is committed to providing its clients with high-quality, cost-effective vision insurance plans and services.

Vision insurance is an important part of any employee benefits package. It can help employees save money on vision care costs, and it can also help prevent serious eye problems. In addition, vision insurance can help businesses attract and retain employees, and it can also improve employee morale and productivity.

Concordia Plan Services has a team of experienced professionals who can help businesses find the right vision insurance plan for their needs. The company also offers a variety of value-added services, such as wellness programs and financial planning.

6. Life insurance

Life insurance is an important part of Concordia Plan Services' offerings. The company provides a variety of life insurance plans to meet the needs of businesses and their employees. These plans include:

- Term life insurance

Term life insurance provides coverage for a specific period of time, such as 10, 20, or 30 years. If the insured person dies during the coverage period, the beneficiary will receive a death benefit. Term life insurance is typically the most affordable type of life insurance.

- Whole life insurance

Whole life insurance provides coverage for the entire life of the insured person. The policyholder pays a fixed premium each year, and the death benefit is guaranteed as long as the premiums are paid. Whole life insurance is more expensive than term life insurance, but it also provides additional benefits, such as a cash value that can be borrowed against.

- Universal life insurance

Universal life insurance is a type of permanent life insurance that offers flexibility in the amount of coverage and the premiums paid. The policyholder can choose to increase or decrease the coverage amount, and the premiums can be adjusted up or down as needed. Universal life insurance is more expensive than term life insurance, but it offers more flexibility and customization.

- Variable life insurance

Variable life insurance is a type of permanent life insurance that invests the cash value in a variety of investment options. The death benefit and cash value fluctuate based on the performance of the investments. Variable life insurance offers the potential for higher returns than other types of life insurance, but it also comes with more risk.

Concordia Plan Services also offers a variety of value-added services with its life insurance plans, such as:

- Accidental death and dismemberment insurance

- Guaranteed issue life insurance

- Long-term care insurance

These value-added services can help members protect their families and financial futures. Concordia Plan Services is committed to providing its clients with high-quality, cost-effective life insurance plans and services.

7. Disability insurance

Disability insurance is an important part of Concordia Plan Services' offerings. The company provides a variety of disability insurance plans to meet the needs of businesses and their employees. These plans provide income protection in the event that an employee is unable to work due to a disability.

Disability insurance is an important part of any employee benefits package. It can help protect employees from financial hardship in the event that they are unable to work due to a disability. In addition, disability insurance can help businesses attract and retain employees, and it can also improve employee morale and productivity.

Concordia Plan Services has a team of experienced professionals who can help businesses find the right disability insurance plan for their needs. The company also offers a variety of value-added services, such as wellness programs and financial planning.

Here are some real-life examples of how disability insurance has helped people:

- A teacher who was injured in a car accident and was unable to work for several months. Disability insurance provided her with income protection during her recovery.

- A construction worker who was injured on the job and was unable to return to work. Disability insurance provided him with income protection while he retrained for a new career.

- A nurse who was diagnosed with cancer and was unable to work for several months. Disability insurance provided her with income protection during her treatment and recovery.

These are just a few examples of how disability insurance can help people. Concordia Plan Services is committed to providing its clients with high-quality, cost-effective disability insurance plans and services.

8. Employee assistance programs

Employee assistance programs (EAPs) are a key component of Concordia Plan Services' offerings. EAPs provide employees with access to confidential counseling, support, and resources to help them deal with a variety of personal and work-related issues.

- Counseling

EAPs provide employees with access to confidential counseling for a variety of personal and work-related issues, such as stress, anxiety, depression, substance abuse, and family problems. Counseling can help employees identify the root of their problems and develop coping mechanisms. - Support

EAPs provide employees with support through a variety of means, such as support groups, workshops, and online resources. Support can help employees connect with others who are going through similar experiences and learn from their coping mechanisms. - Resources

EAPs provide employees with access to a variety of resources, such as financial planning, legal assistance, and childcare referrals. Resources can help employees address the practical challenges that they may be facing and improve their overall well-being. - Work-life balance

EAPs can help employees achieve a better work-life balance by providing them with resources and support to manage their personal and work lives. EAPs can help employees reduce stress, improve their productivity, and increase their job satisfaction.

EAPs are an important part of any employee benefits package. They can help employees improve their mental and emotional health, cope with stress, and achieve a better work-life balance. Concordia Plan Services is committed to providing its clients with high-quality, cost-effective EAPs.

Concordia Plan Services FAQs

This section provides answers to frequently asked questions about Concordia Plan Services.

Question 1: What is Concordia Plan Services?

Concordia Plan Services is a leading provider of employee benefits and retirement plan services to small and mid-sized businesses.

Question 2: What types of employee benefits does Concordia Plan Services offer?

Concordia Plan Services offers a wide range of employee benefits, including health insurance, dental insurance, vision insurance, life insurance, disability insurance, and retirement plans.

Question 3: What types of retirement plan services does Concordia Plan Services offer?

Concordia Plan Services offers a wide range of retirement plan services, including defined benefit plans, defined contribution plans, and IRAs.

Question 4: What is the difference between a PPO and an HMO?

A PPO (Preferred Provider Organization) offers a network of doctors and hospitals that provide discounted services to members. Members can choose to see doctors outside of the network, but they will pay a higher cost. An HMO (Health Maintenance Organization) offers a network of doctors and hospitals that provide services to members at a fixed cost. Members must choose a primary care physician who will refer them to specialists if necessary.

Question 5: What is the deductible on my health insurance plan?

The deductible is the amount you must pay out-of-pocket before your health insurance plan starts to cover costs. The deductible amount varies depending on the plan you choose.

Question 6: How do I file a claim with Concordia Plan Services?

You can file a claim with Concordia Plan Services online, by mail, or by phone. The claims process varies depending on the type of claim you are filing.

We hope these FAQs have been helpful. If you have any further questions, please contact Concordia Plan Services directly.

Concordia Plan Services is committed to providing its clients with high-quality, cost-effective employee benefits and retirement plan services.

Tips from Concordia Plan Services

Concordia Plan Services is a leading provider of employee benefits and retirement plan services to small and mid-sized businesses. The company offers a wide range of services, including health insurance, dental insurance, vision insurance, life insurance, disability insurance, and retirement plans. Concordia Plan Services also provides employee assistance programs, wellness programs, and other value-added services.

Here are a few tips from Concordia Plan Services to help you get the most out of your employee benefits and retirement plans:

Tip 1: Understand your benefits

It is important to understand the benefits that you are eligible for and how to use them. Concordia Plan Services provides a variety of resources to help you understand your benefits, including online materials, brochures, and seminars.

Tip 2: Use your benefits wisely

Your employee benefits are a valuable part of your compensation package. Use them wisely to improve your health, financial security, and overall well-being.

Tip 3: Save for retirement

Retirement planning is an important part of financial planning. Concordia Plan Services offers a variety of retirement plan services to help you save for your future.

Tip 4: Get help when you need it

Concordia Plan Services provides a variety of resources to help you with your employee benefits and retirement plans. If you have questions or need assistance, please contact Concordia Plan Services.

Summary of key takeaways or benefits:

- Understanding your benefits can help you get the most out of them.

- Using your benefits wisely can improve your health, financial security, and overall well-being.

- Saving for retirement is an important part of financial planning.

- Concordia Plan Services provides a variety of resources to help you with your employee benefits and retirement plans.

Transition to the article's conclusion:

Concordia Plan Services is committed to providing its clients with high-quality, cost-effective employee benefits and retirement plan services. By following these tips, you can get the most out of your benefits and plan for a secure future.

Conclusion

Concordia Plan Services is a leading provider of employee benefits and retirement plan services to small and mid-sized businesses. The company offers a wide range of services, including health insurance, dental insurance, vision insurance, life insurance, disability insurance, and retirement plans. Concordia Plan Services also provides employee assistance programs, wellness programs, and other value-added services.

By partnering with Concordia Plan Services, businesses can provide their employees with a comprehensive and cost-effective employee benefits package. Concordia Plan Services is committed to providing its clients with high-quality, cost-effective employee benefits and retirement plan services. The company has a team of experienced professionals who are dedicated to helping clients find the right solutions for their needs.

Meet The Monsters Of Monster University: A Slug's Perspective

Best Centerville HAC Services - Trusted And Reliable

Uncover The Enigmatic "They Call Me Magic F": Exploring The Origins Of The Legendary Magician

Concordia Plan Services CSS Design Awards

CONCORDIA PLAN SERVICES BUSINESS INTELLIGENCE / DATA WAREHOUSE

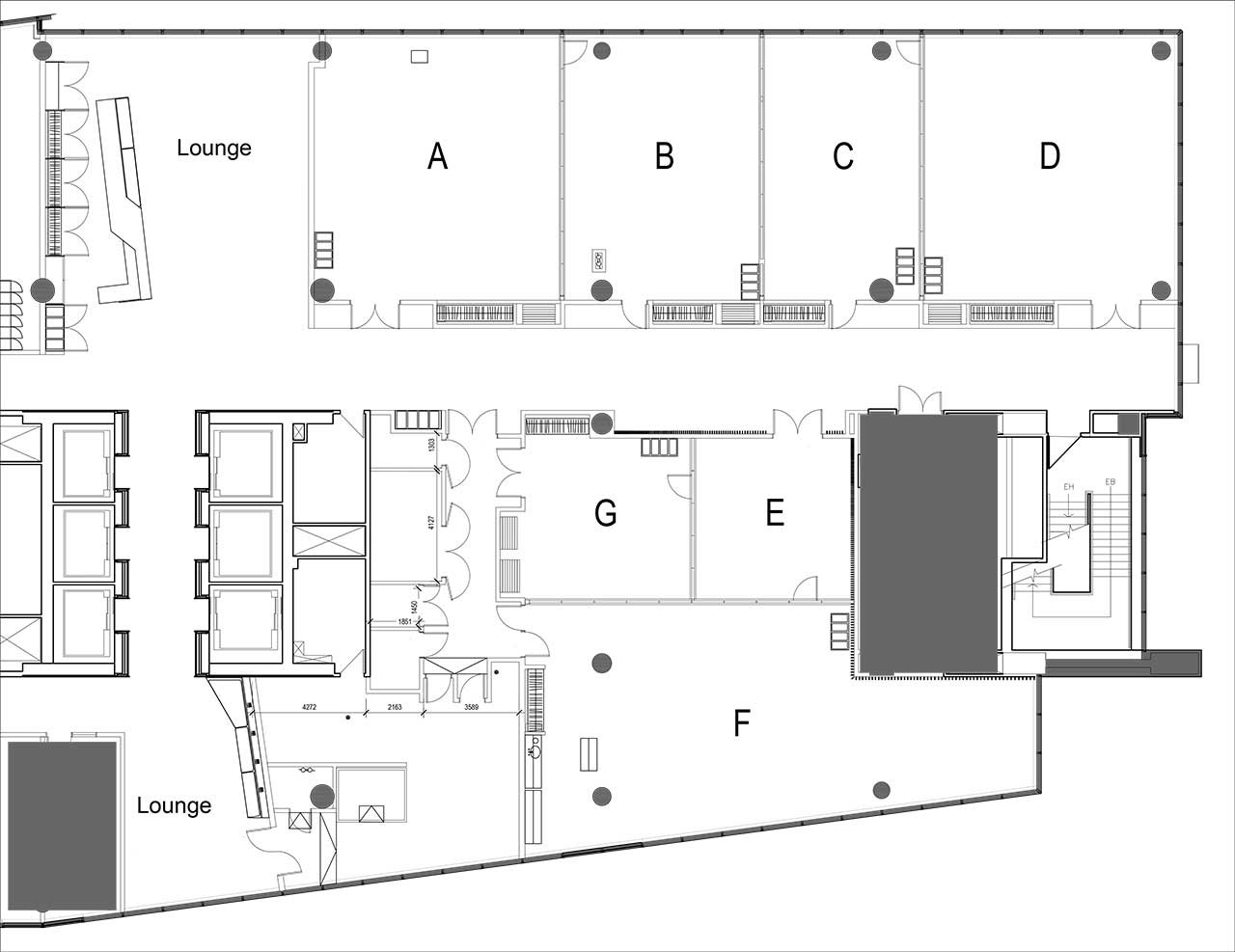

Floor plan and seating capacity Concordia University